Klaviyo IPO Presentation Deck

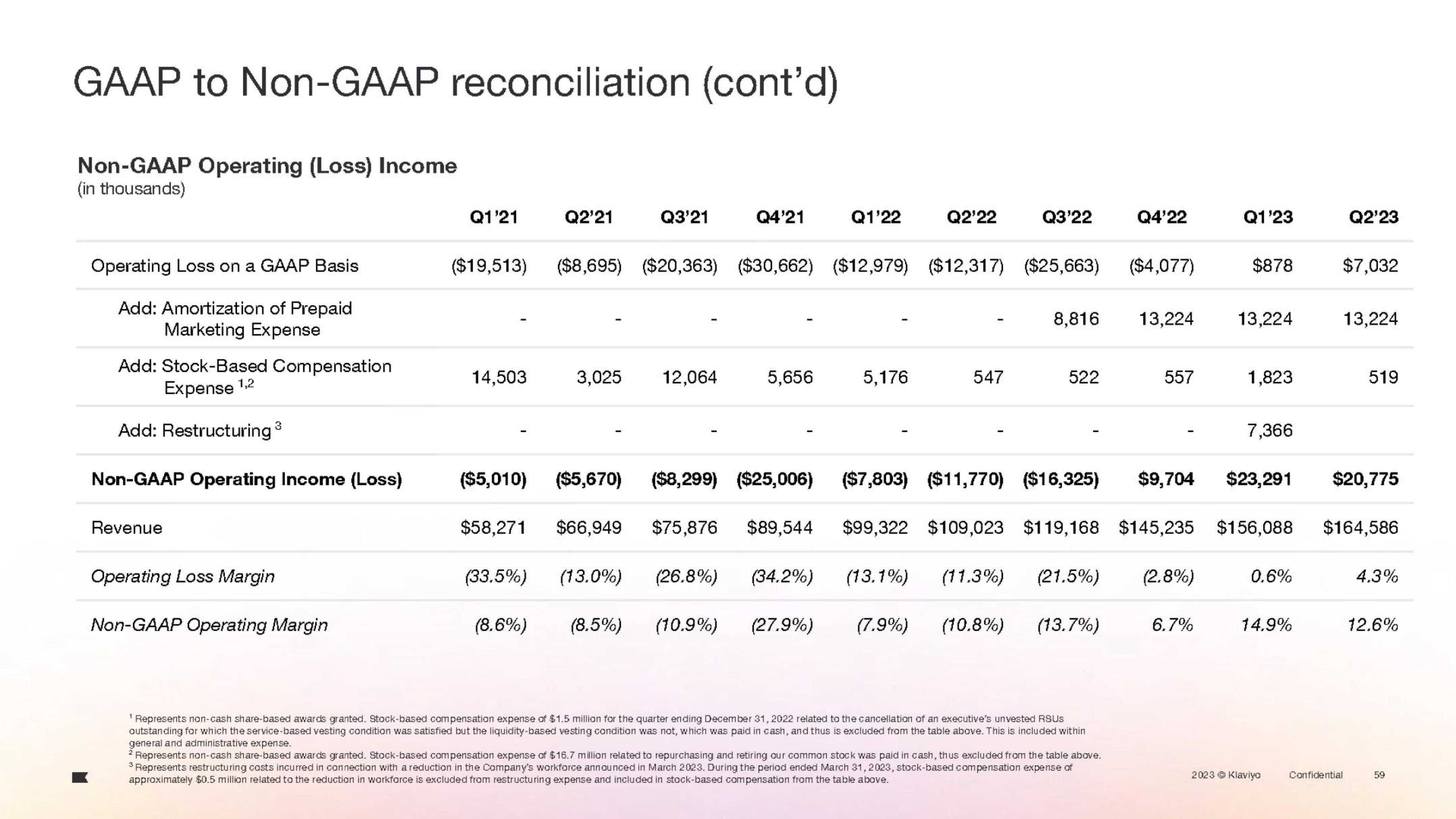

GAAP to Non-GAAP reconciliation (cont'd)

Non-GAAP Operating (Loss) Income

(in thousands)

Operating Loss on a GAAP Basis

Add: Amortization of Prepaid

Marketing Expense

Add: Stock-Based Compensation

Expense 1,2

Add: Restructuring ³

3

Non-GAAP Operating Income (Loss)

Revenue

Operating Loss Margin

Non-GAAP Operating Margin

Q1'21

14,503

Q2'21

(33.5%)

Q3'21

3,025 12,064

($19,513) ($8,695) ($20,363) ($30,662) ($12,979) ($12,317) ($25,663)

(13.0%)

(8.6%) (8.5%)

Q4'21

(26.8%)

(10.9%)

5,656

Q1'22

(34.2%)

(27.9%)

Q2'22

5,176

Q3'22

547

8,816

522

¹ Represents non-cash share-based awards granted. Stock-based compensation expense of $1.5 million for the quarter ending December 31, 2022 related to the cancellation of an executive's unvested RSUS

outstanding for which the service-based vesting condition was satisfied but the liquidity-based vesting condition was not, which was paid in cash, and thus is excluded from the table above. This is included within

general and administrative expense.

Q4'22

2 Represents non-cash share-based awards granted. Stock-based compensation expense of $16.7 million related to repurchasing and retiring our common stock was paid in cash, thus excluded from the table above.

3 Represents restructuring costs incurred in connection with a reduction in the Company's workforce announced in March 2023. During the period ended March 31, 2023, stock-based compensation expense of

approximately $0.5 million related to the reduction in workforce is excluded from restructuring expense and included in stock-based compensation from the table above.

($4,077)

557

$20,775

($5,010) ($5,670) ($8,299) ($25,006) ($7,803) ($11,770) ($16,325) $9,704 $23,291

$99,322 $109,023 $119,168 $145,235 $156,088 $164,586

$58,271 $66,949 $75,876 $89,544

(13.1%) (11.3%) (21.5%) (2.8%)

(7.9%) (10.8%) (13.7%)

Q1'23

13,224 13,224

$878

6.7%

1,823

7,366

0.6%

14.9%

2023 Ⓒ Klaviyo

Q2'23

$7,032

Confidential

13,224

519

4.3%

12.6%

59View entire presentation