Evercore Investment Banking Pitch Book

SIRE Situation Analysis

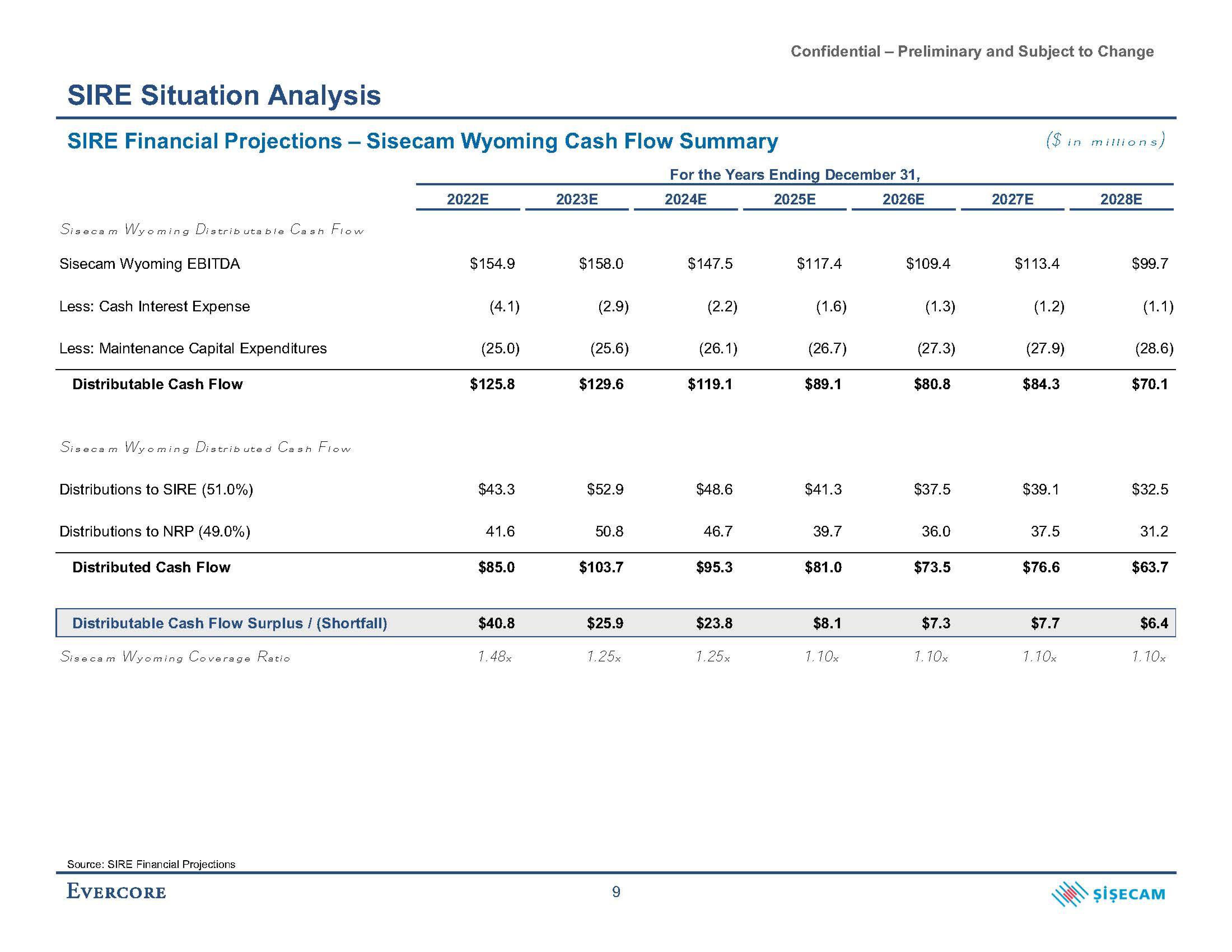

SIRE Financial Projections - Sisecam Wyoming Cash Flow Summary

Sisecam Wyoming Distributable Cash Flow

Sisecam Wyoming EBITDA

Less: Cash Interest Expense

Less: Maintenance Capital Expenditures

Distributable Cash Flow

Sisecam Wyoming Distributed Cash Flow

Distributions to SIRE (51.0%)

Distributions to NRP (49.0%)

Distributed Cash Flow

Distributable Cash Flow Surplus / (Shortfall)

Sisecam Wyoming Coverage Ratio

Source: SIRE Financial Projections

EVERCORE

2022E

$154.9

(4.1)

(25.0)

$125.8

$43.3

41.6

$85.0

$40.8

1.48x

2023E

$158.0

(2.9)

(25.6)

$129.6

$52.9

50.8

$103.7

$25.9

1.25x

9

For the Years Ending December 31,

2024E

2025E

2026E

$147.5

(2.2)

(26.1)

$119.1

$48.6

46.7

$95.3

$23.8

Confidential - Preliminary and Subject to Change

1.25x

$117.4

(1.6)

(26.7)

$89.1

$41.3

39.7

$81.0

$8.1

1.10x

$109.4

(1.3)

(27.3)

$80.8

$37.5

36.0

$73.5

$7.3

1.10x

2027E

($

$113.4

(1.2)

(27.9)

$84.3

$39.1

37.5

$76.6

$7.7

1.10x

millions)

in m

2028E

$99.7

(1.1)

(28.6)

$70.1

$32.5

31.2

$63.7

$6.4

1.10x

ŞİŞECAMView entire presentation