Rhode Island Employees’ Retirement System

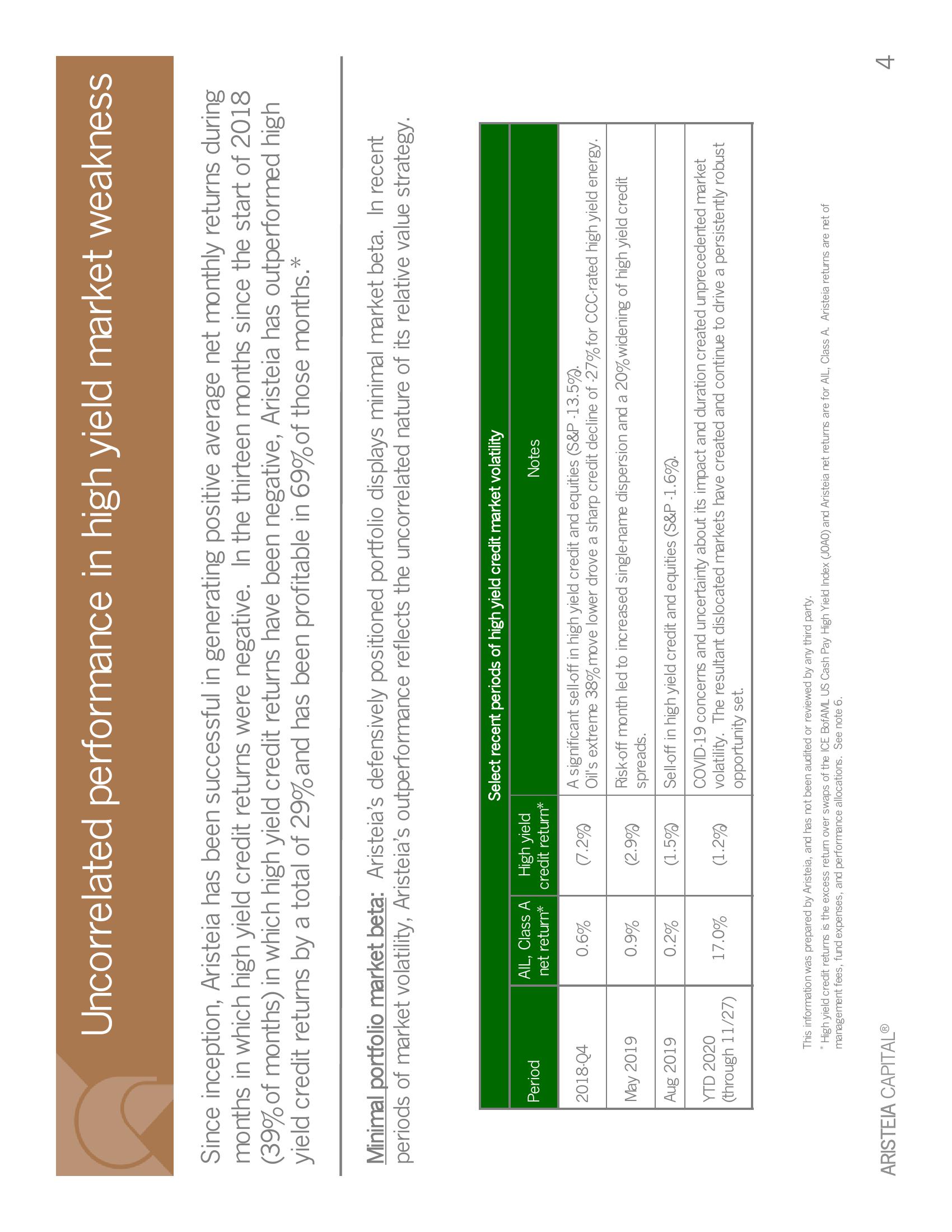

Since inception, Aristeia has been successful in generating positive average net monthly returns during

months in which high yield credit returns were negative. In the thirteen months since the start of 2018

(39% of months) in which high yield credit returns have been negative, Aristeia has outperformed high

yield credit returns by a total of 29% and has been profitable in 69% of those months.*

Minimal portfolio market beta: Aristeia's defensively positioned portfolio displays minimal market beta. In recent

periods of market volatility, Aristeia's outperformance reflects the uncorrelated nature of its relative value strategy.

Period

Uncorrelated performance in high yield market weakness

2018-Q4

May 2019

Aug 2019

YTD 2020

(through 11/27)

AIL, Class A

net return*

ARISTEIA CAPITAL®

0.6%

0.9%

0.2%

17.09

High yield

credit return*

(7.2%)

(2.9%)

(1.5%)

(1.2%)

Select recent periods of high yield credit market volatility

Notes

A significant sell-off in high yield credit and equities (S&P-13.5%.

Oil's extreme 38% move lower drove a sharp credit decline of -27% for CCC-rated high yield energy.

Risk-off month led to increased single-name dispersion and a 20% widening of high yield credit

spreads.

Sell-off in high yield credit and equities (S&P-1.6%).

COVID-19 concerns and uncertainty about its impact and duration created unprecedented market

volatility. The resultant dislocated markets have created and continue to drive a persistently robust

opportunity set.

This information was prepared by Aristeia, and has not been audited or reviewed by any third party.

*High yield credit returns is the excess return over swaps of the ICE BofAML US Cash Pay High Yield Index (JOAO) and Aristeia net returns are for AIL, Class A. Aristeia returns are net of

management fees, fund expenses, and performance allocations. See note 6.

4View entire presentation