Allwyn Investor Conference Presentation Deck

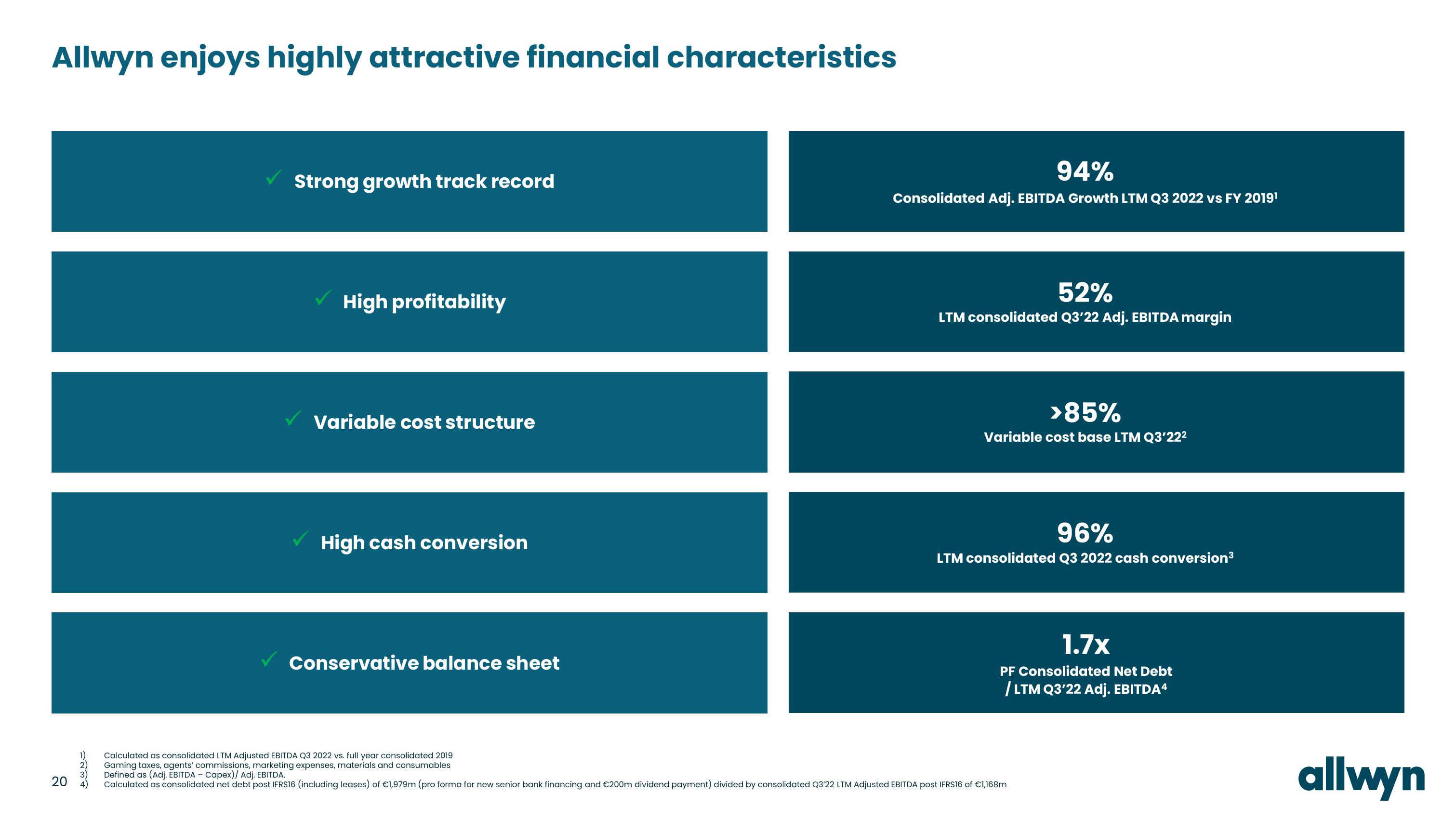

Allwyn enjoys highly attractive financial characteristics

20

1)

3

Strong growth track record

High profitability

Variable cost structure

High cash conversion

Conservative balance sheet

94%

Consolidated Adj. EBITDA Growth LTM Q3 2022 vs FY 2019¹

52%

LTM consolidated Q3'22 Adj. EBITDA margin

>85%

Variable cost base LTM Q3'22²

96%

LTM consolidated Q3 2022 cash conversion³

1.7x

PF Consolidated Net Debt

/ LTM Q3'22 Adj. EBITDA4

Calculated as consolidated LTM Adjusted EBITDA Q3 2022 vs. full year consolidated 2019

Gaming taxes, agents' commissions, marketing expenses, materials and consumables

Defined as (Adj. EBITDA - Capex)/ Adj. EBITDA.

Calculated as consolidated net debt post IFRS16 (including leases) of €1,979m (pro forma for new senior bank financing and €200m dividend payment) divided by consolidated Q3'22 LTM Adjusted EBITDA post IFRS16 of €1,168m

allwynView entire presentation