Volta SPAC Presentation Deck

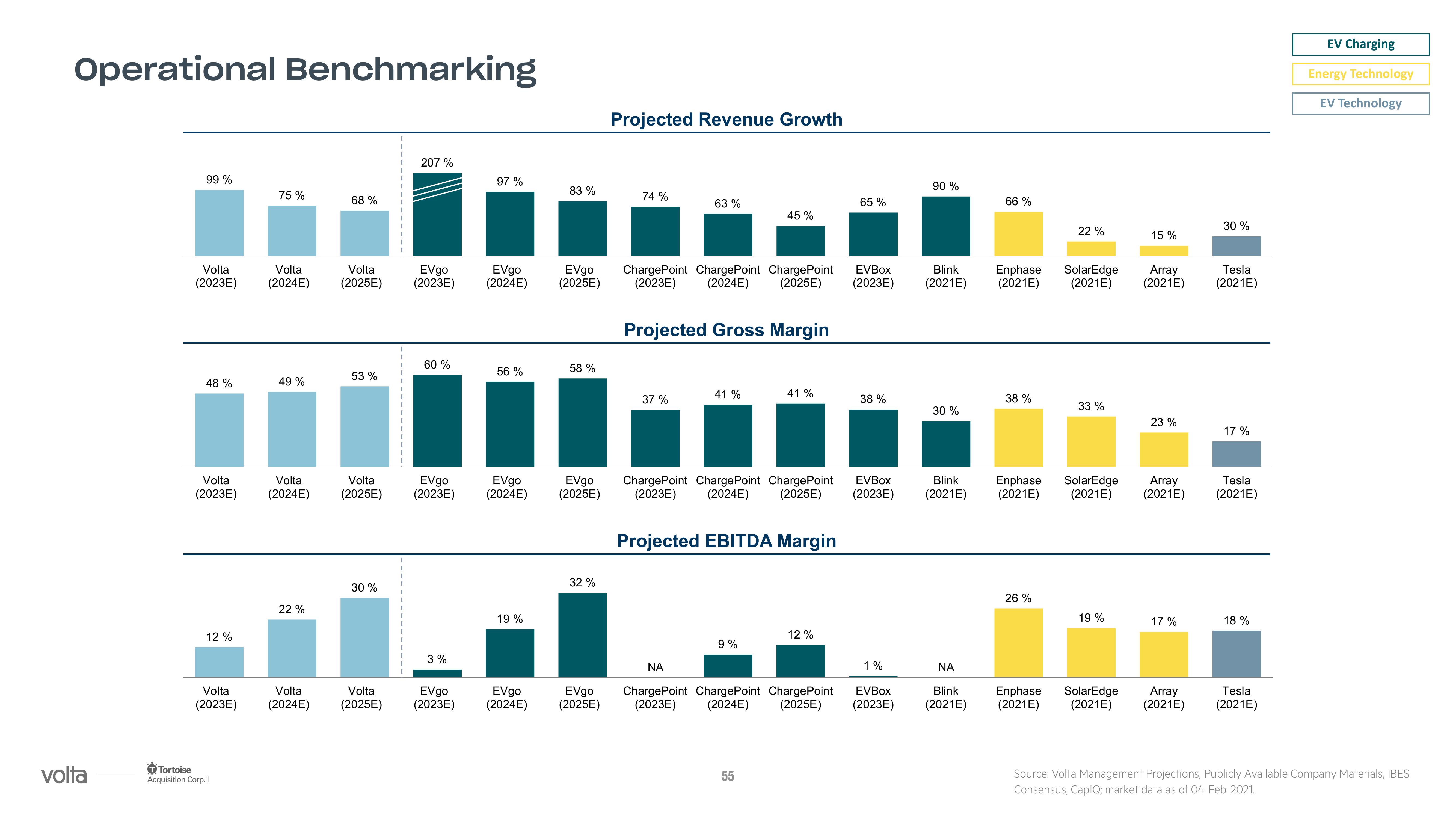

Operational Benchmarking

volta

99 %

Volta

(2023E)

48 %

Volta

(2023E)

12%

Volta

(2023E)

Tortoise

Acquisition Corp.ll

75%

Volta

Volta

(2024E) (2025E)

49%

Volta

(2024E)

68 %

22%

53 %

207 %

30 %

EVgo

(2023E)

60 %

97%

3%

EVgo

(2024E)

Volta

EVgo

EVgo

(2025E) (2023E) (2024E)

56%

19%

Volta

Volta

EVgo

EVgo

(2024E) (2025E) (2023E) (2024E)

83 %

EVgo

(2025E)

58 %

EVgo

(2025E)

32%

EVgo

(2025E)

Projected Revenue Growth

74%

63%

37%

ChargePoint ChargePoint ChargePoint

(2023E) (2024E) (2025E)

Projected Gross Margin

41%

45 %

ChargePoint ChargePoint ChargePoint

(2023E) (2024E) (2025E)

9%

41%

Projected EBITDA Margin

55

12%

ΝΑ

ChargePoint ChargePoint ChargePoint

(2023E) (2024E) (2025E)

65 %

EVBOX

(2023E)

38%

90 %

1%

Blink

(2021E)

30%

EVBox

Blink

(2023E) (2021E)

ΝΑ

EVBox

Blink

(2023E) (2021E)

66%

Enphase SolarEdge

(2021E) (2021E)

38 %

Enphase

(2021E)

22%

26%

33 %

SolarEdge

(2021E)

19%

15%

Array

(2021E)

23 %

30 %

17%

Tesla

(2021E)

17%

Array

Tesla

(2021E) (2021E)

18 %

Tesla

Enphase

SolarEdge Array

(2021E) (2021E) (2021E) (2021E)

EV Charging

Energy Technology

EV Technology

Source: Volta Management Projections, Publicly Available Company Materials, IBES

Consensus, CapIQ; market data as of 04-Feb-2021.View entire presentation