SoftBank Results Presentation Deck

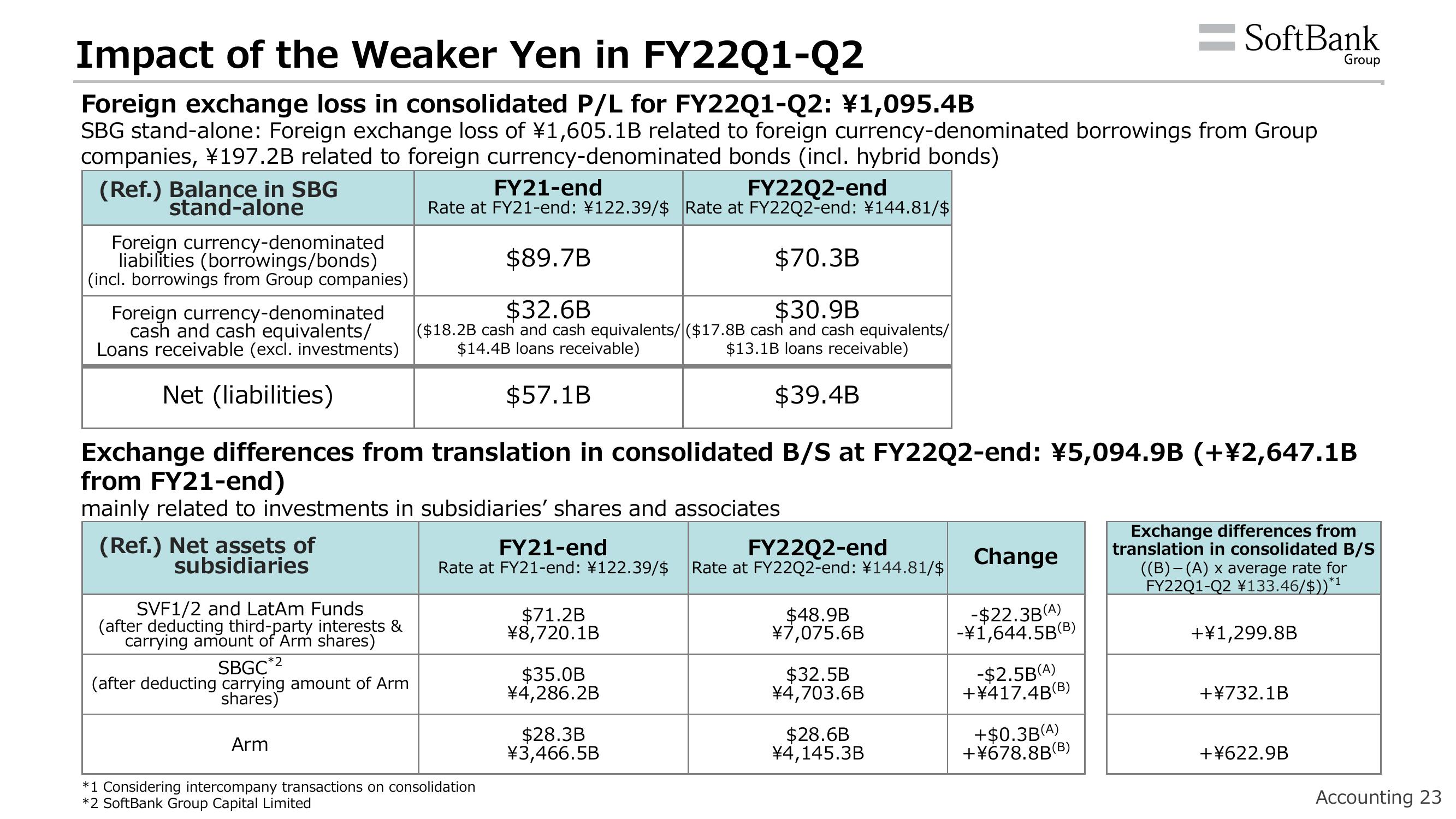

Impact of the Weaker Yen in FY22Q1-Q2

Foreign exchange loss in consolidated P/L for FY22Q1-Q2: ¥1,095.4B

SBG stand-alone: Foreign exchange loss of ¥1,605.1B related to foreign currency-denominated borrowings from Group

companies, ¥197.2B related to foreign currency-denominated bonds (incl. hybrid bonds)

(Ref.) Balance in SBG

stand-alone

Foreign currency-denominated

liabilities (borrowings/bonds)

(incl. borrowings from Group companies)

Foreign currency-denominated

cash and cash equivalents/

Loans receivable (excl. investments)

Net (liabilities)

(Ref.) Net assets of

subsidiaries

SVF1/2 and LatAm Funds

(after deducting third-party interests &

carrying amount of Arm shares)

SBGC*2

(after deducting carrying amount of Arm

shares)

FY21-end

FY22Q2-end

Rate at FY21-end: ¥122.39/$ Rate at FY22Q2-end: ¥144.81/$

Arm

$89.7B

$70.3B

$32.6B

$30.9B

($18.2B cash and cash equivalents/ ($17.8B cash and cash equivalents/

$14.4B loans receivable)

$13.1B loans receivable)

$57.1B

$39.4B

Exchange differences from translation in consolidated B/S at FY22Q2-end: ¥5,094.9B (+¥2,647.1B

from FY21-end)

mainly related to investments in subsidiaries' shares and associates

FY21-end

FY22Q2-end

Rate at FY21-end: ¥122.39/$ Rate at FY22Q2-end: ¥144.81/$

*1 Considering intercompany transactions on consolidation

*2 SoftBank Group Capital Limited

$71.2B

¥8,720.1B

$35.0B

¥4,286.2B

$28.3B

¥3,466.5B

$48.9B

¥7,075.6B

$32.5B

¥4,703.6B

$28.6B

¥4,145.3B

Change

-$22.3B(A)

-¥1,644.5B(B)

SoftBank

-$2.5B(A)

+¥417.4B(B)

+$0.3B(A)

+¥678.8B(B)

Exchange differences from

translation in consolidated B/S

((B)-(A) x average rate for

FY22Q1-Q2 ¥133.46/$))*¹

+¥1,299.8B

Group

+¥732.1B

+¥622.9B

Accounting 23View entire presentation