THOR Industries Results Presentation Deck

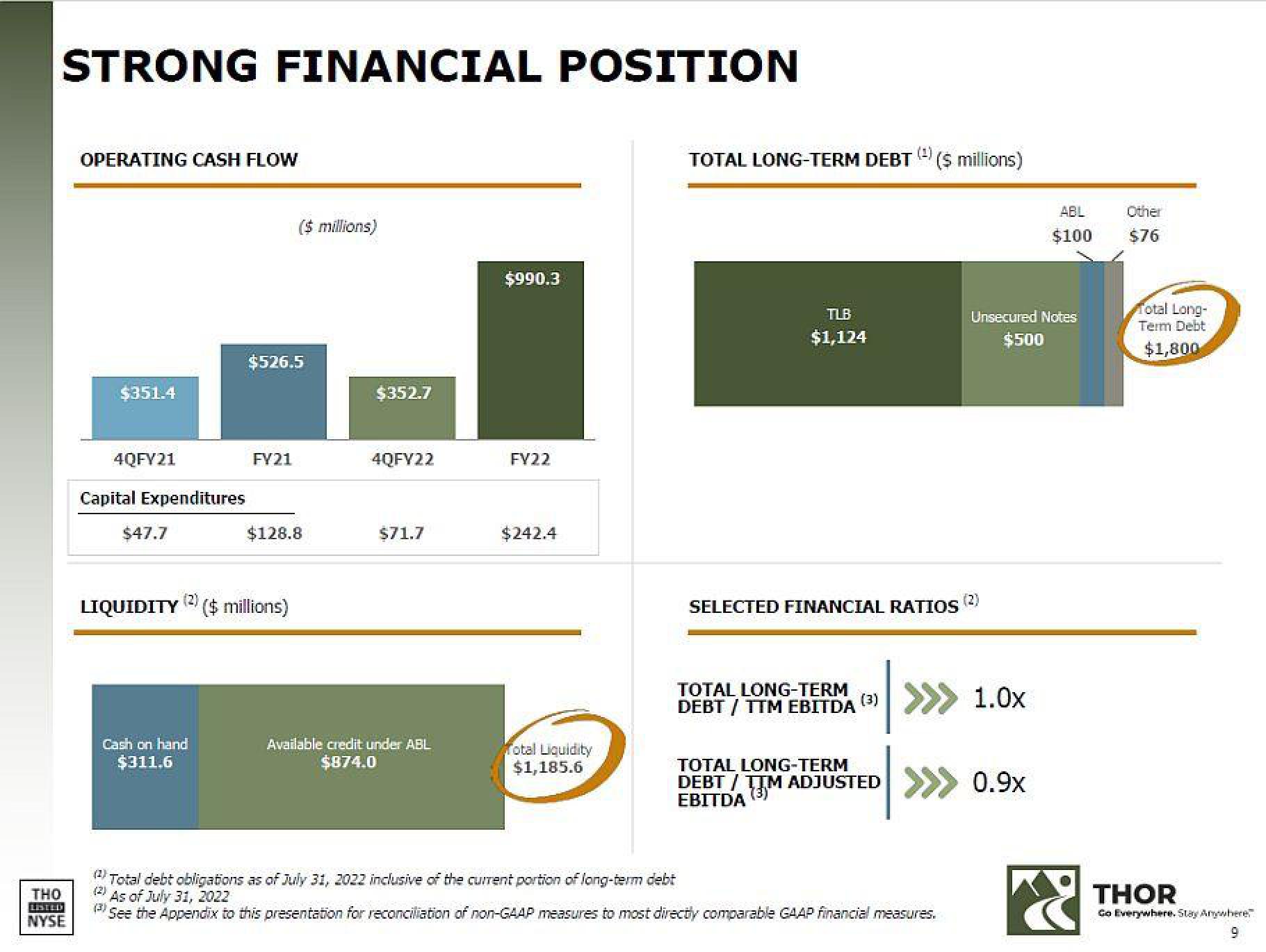

STRONG FINANCIAL POSITION

THO

(BILD

NYSE

OPERATING CASH FLOW

$351.4

4QFY21

Capital Expenditures

$47.7

Cash on hand

$311.6

$526.5

FY21

($ millions)

LIQUIDITY($ millions)

$128.8

$352.7

4QFY22

$71.7

Available credit under ABL

$874.0

$990.3

FY22

$242.4

Total Liquidity

$1,185.6

TOTAL LONG-TERM DEBT($ millions)

TLB

$1,124

SELECTED FINANCIAL RATIOS

TOTAL LONG-TERM

DEBT / TTM EBITDA

TOTAL LONG-TERM

DEBT / TTM ADJUSTED

EBITDA (3)

(3) >>> 1.0x

Total debt obligations as of July 31, 2022 inclusive of the current portion of long-term debt

(2)

As of July 31, 2022

(3)

See the Appendix to this presentation for reconciliation of non-GAAP measures to most directly comparable GAAP financial measures.

Unsecured Notes

$500

(2)

ABL

$100

0.9x

Other

$76

Total Long-

Term Debt

$1,800

THOR

Go Everywhere. Stay Anywhere

9View entire presentation