Xos SPAC Presentation Deck

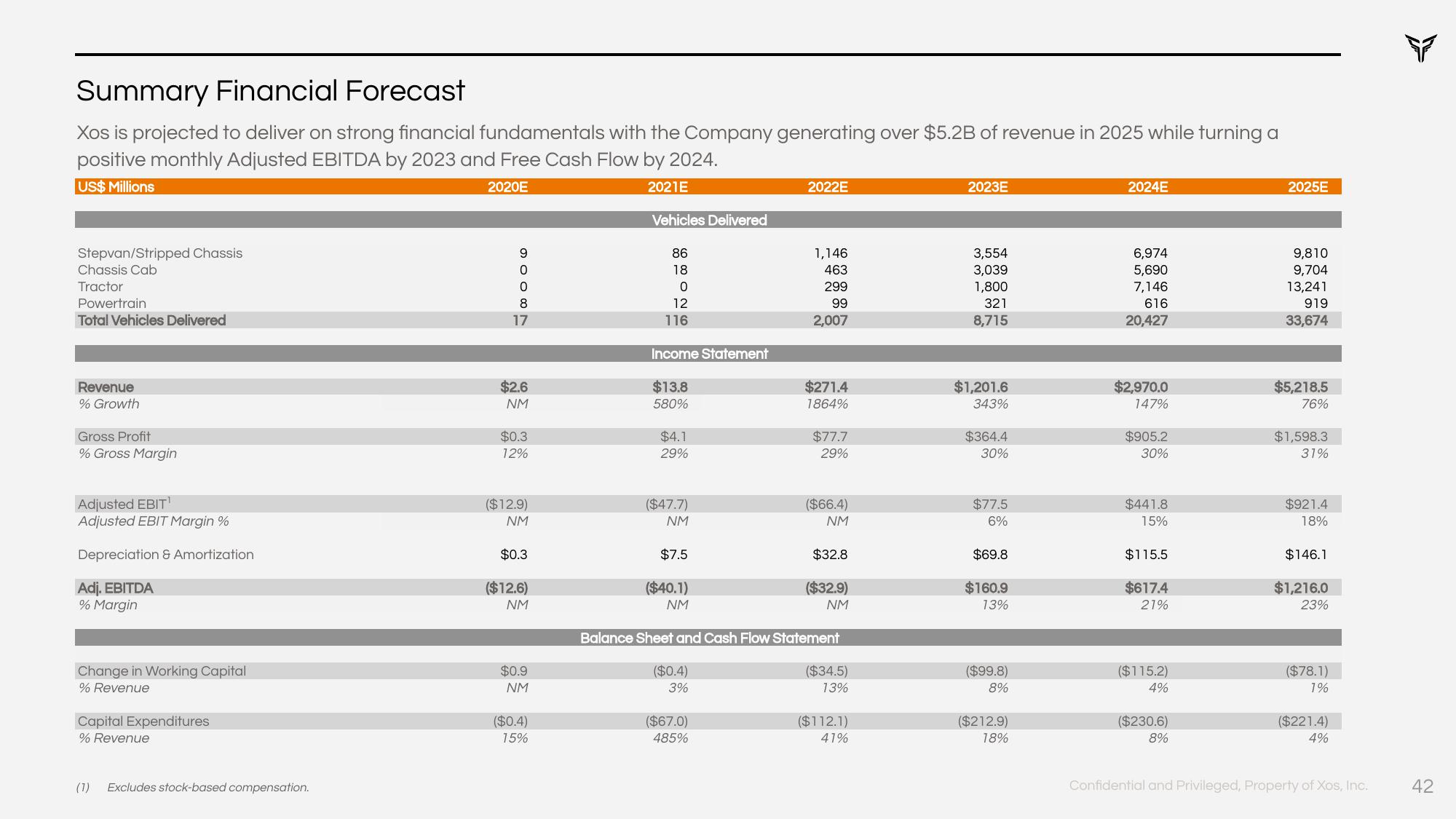

Summary Financial Forecast

Xos is projected to deliver on strong financial fundamentals with the Company generating over $5.2B of revenue in 2025 while turning a

positive monthly Adjusted EBITDA by 2023 and Free Cash Flow by 2024.

US$ Millions

2020E

2021E

Stepvan/Stripped Chassis

Chassis Cab

Tractor

Powertrain

Total Vehicles Delivered

Revenue

% Growth

Gross Profit

% Gross Margin

Adjusted EBIT

Adjusted EBIT Margin %

Depreciation & Amortization

Adj. EBITDA

% Margin

Change in Working Capital

% Revenue

Capital Expenditures

% Revenue

(1) Excludes stock-based compensation.

H8006

17

$2.6

NM

$0.3

12%

($12.9)

NM

$0.3

($12.6)

NM

$0.9

NM

($0.4)

15%

Vehicles Delivered

86

18

0

12

116

Income Statement

$13.8

580%

$4.1

29%

($47.7)

NM

$7.5

($40.1)

NM

($0.4)

3%

2022E

($67.0)

485%

1,146

463

299

99

2,007

$271.4

1864%

$77.7

29%

($66.4)

NM

$32.8

Balance Sheet and Cash Flow Statement

($32.9)

NM

($34.5)

13%

($112.1)

41%

2023E

3,554

3,039

1,800

321

8,715

$1,201.6

343%

$364.4

30%

$77.5

6%

$69.8

$160.9

13%

($99.8)

8%

($212.9)

18%

2024E

6,974

5,690

7,146

616

20,427

$2,970.0

147%

$905.2

30%

$441.8

15%

$115.5

$617.4

21%

($115.2)

4%

($230.6)

8%

2025E

9,810

9,704

13,241

919

33,674

$5,218.5

76%

$1,598.3

31%

$921.4

18%

$146.1

$1,216.0

23%

($78.1)

1%

($221.4)

4%

Confidential and Privileged, Property of Xos, Inc.

F

42View entire presentation