Mondee Investor Presentation Deck

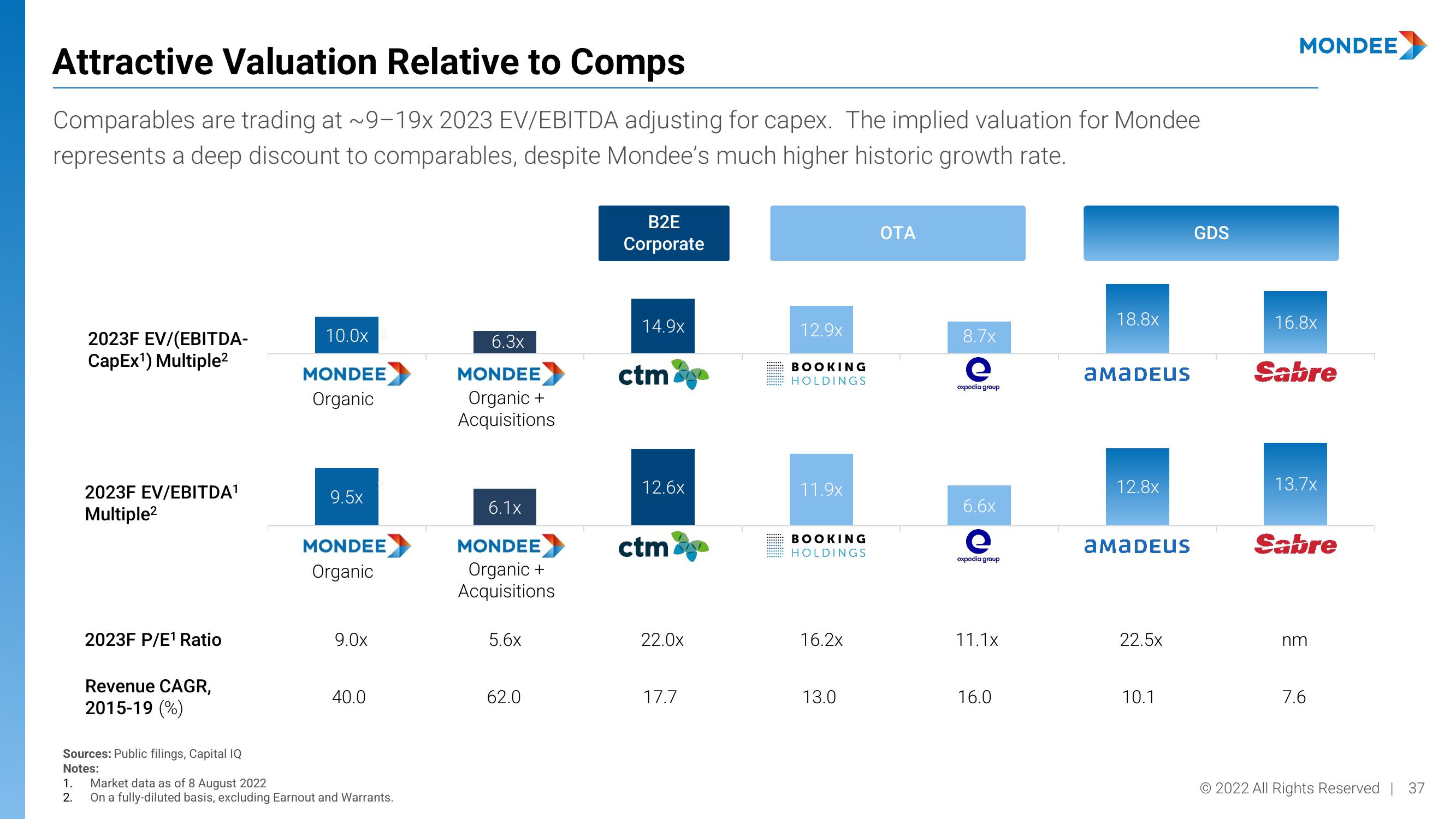

Attractive Valuation Relative to Comps

Comparables are trading at ~9-19x 2023 EV/EBITDA adjusting for capex. The implied valuation for Mondee

represents a deep discount to comparables, despite Mondee's much higher historic growth rate.

2023F EV/(EBITDA-

CapEx¹) Multiple²

2023F EV/EBITDA¹

Multiple²

2023F P/E¹ Ratio

Revenue CAGR,

2015-19 (%)

Sources: Public filings, Capital IQ

Notes:

10.0x

MONDEE

Organic

9.5x

MONDEE

Organic

9.0x

40.0

1. Market data as of 8 August 2022

2. On a fully-diluted basis, excluding Earnout and Warrants.

6.3x

MONDEE

Organic +

Acquisitions

6.1x

MONDEE

Organic +

Acquisitions

5.6x

62.0

B2E

Corporate

14.9x

ctm

12.6x

ctm

22.0x

17.7

12.9x

BOOKING

HOLDINGS

11.9x

BOOKING

HOLDINGS

16.2x

13.0

OTA

8.7x

e

expedia group

6.6x

e

expedia group

11.1x

16.0

18.8x

AMADEUS

12.8x

AMADEUS

22.5×

10.1

GDS

MONDEE

16.8x

Sabre

13.7x

Sabre

nm

7.6

Ⓒ2022 All Rights Reserved | 37View entire presentation