Comcast Results Presentation Deck

Cable Communications 1st Quarter 2022 Overview

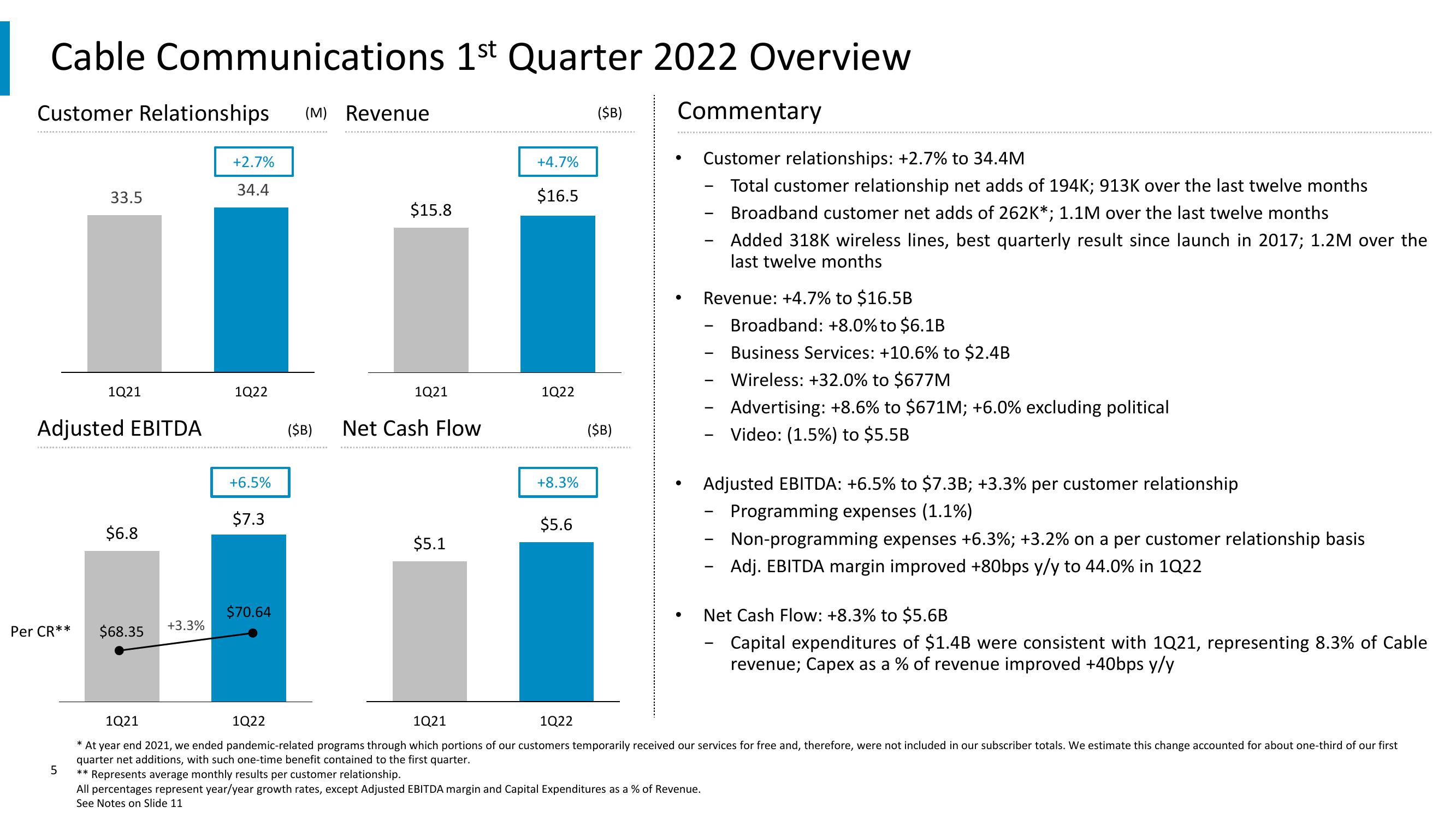

Customer Relationships (M) Revenue

Per CR**

33.5

Adjusted EBITDA

5

1Q21

$6.8

$68.35

+3.3%

+2.7%

34.4

1Q22

+6.5%

$7.3

$70.64

$15.8

1Q22

1Q21

($B) Net Cash Flow

$5.1

+4.7%

$16.5

1Q22

+8.3%

$5.6

($B)

($B)

Commentary

Customer relationships: +2.7% to 34.4M

Total customer relationship net adds of 194K; 913K over the last twelve months

Broadband customer net adds of 262K*; 1.1M over the last twelve months

●

●

** Represents average monthly results per customer relationship.

All percentages represent year/year growth rates, except Adjusted EBITDA margin and Capital Expenditures as a % of Revenue.

See Notes on Slide 11

Revenue: +4.7% to $16.5B

-

Added 318K wireless lines, best quarterly result since launch in 2017; 1.2M over the

last twelve months

-

Broadband: +8.0% to $6.1B

Business Services: +10.6% to $2.4B

Wireless: +32.0% to $677M

Advertising: +8.6% to $671M; +6.0% excluding political

Video: (1.5%) to $5.5B

Adjusted EBITDA: +6.5% to $7.3B; +3.3% per customer relationship

Programming expenses (1.1%)

Non-programming expenses +6.3%; +3.2% on a per customer relationship basis

Adj. EBITDA margin improved +80bps y/y to 44.0% in 1Q22

1Q21

1Q21

1Q22

* At year end 2021, we ended pandemic-related programs through which portions of our customers temporarily received our services for free and, therefore, were not included in our subscriber totals. We estimate this change accounted for about one-third of our first

quarter net additions, with such one-time benefit contained to the first quarter.

Net Cash Flow: +8.3% to $5.6B

Capital expenditures of $1.4B were consistent with 1Q21, representing 8.3% of Cable

revenue; Capex as a % of revenue improved +40bps y/yView entire presentation