Verint SPAC Presentation Deck

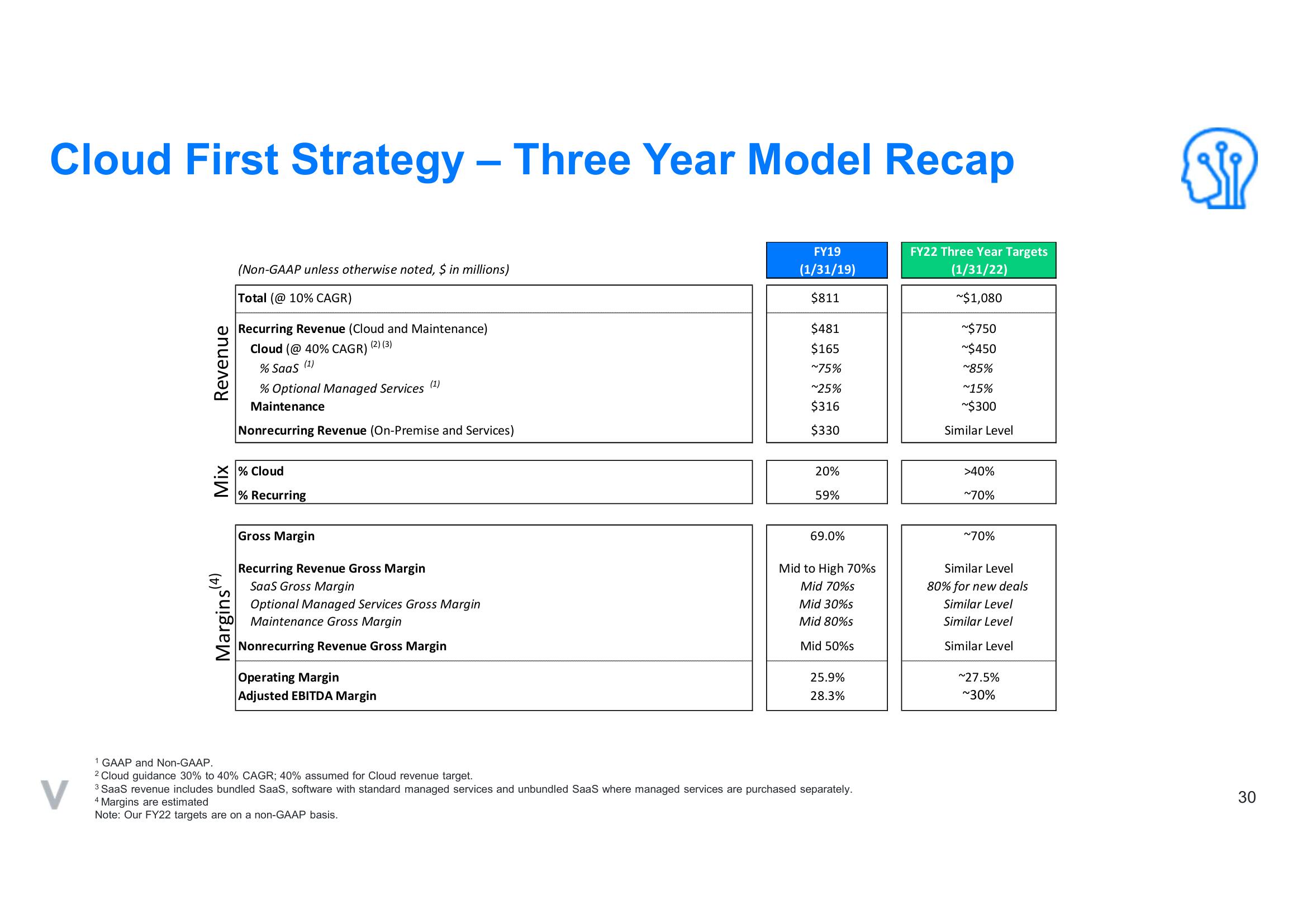

Cloud First Strategy - Three Year Model Recap

Revenue

Mix

Margins (4)

(Non-GAAP unless otherwise noted, $ in millions)

Total (@ 10% CAGR)

Recurring Revenue (Cloud and Maintenance)

(2)(3)

Cloud (@ 40% CAGR)

(1)

% SaaS

% Optional Managed Services (¹)

Maintenance

Nonrecurring Revenue (On-Premise and Services)

% Cloud

% Recurring

Gross Margin

Recurring Revenue Gross Margin

SaaS Gross Margin

Optional Managed Services Gross Margin

Maintenance Gross Margin

Nonrecurring Revenue Gross Margin

Operating Margin

Adjusted EBITDA Margin

FY19

(1/31/19)

$811

$481

$165

~75%

~25%

$316

$330

20%

59%

69.0%

Mid to High 70%s

Mid 70%s

Mid 30%s

Mid 80%s

Mid 50%s

25.9%

28.3%

1 GAAP and Non-GAAP.

2 Cloud guidance 30% to 40% CAGR; 40% assumed for Cloud revenue target.

3 SaaS revenue includes bundled SaaS, software with standard managed services and unbundled SaaS where managed services are purchased separately.

4 Margins are estimated

Note: Our FY22 targets are on a non-GAAP basis.

FY22 Three Year Targets

(1/31/22)

~$1,080

~$750

~$450

~85%

~15%

~$300

Similar Level

>40%

~70%

~70%

Similar Level

80% for new deals

Similar Level

Similar Level

Similar Level

~27.5%

~30%

30View entire presentation