Freightos SPAC Presentation Deck

Transaction Summary

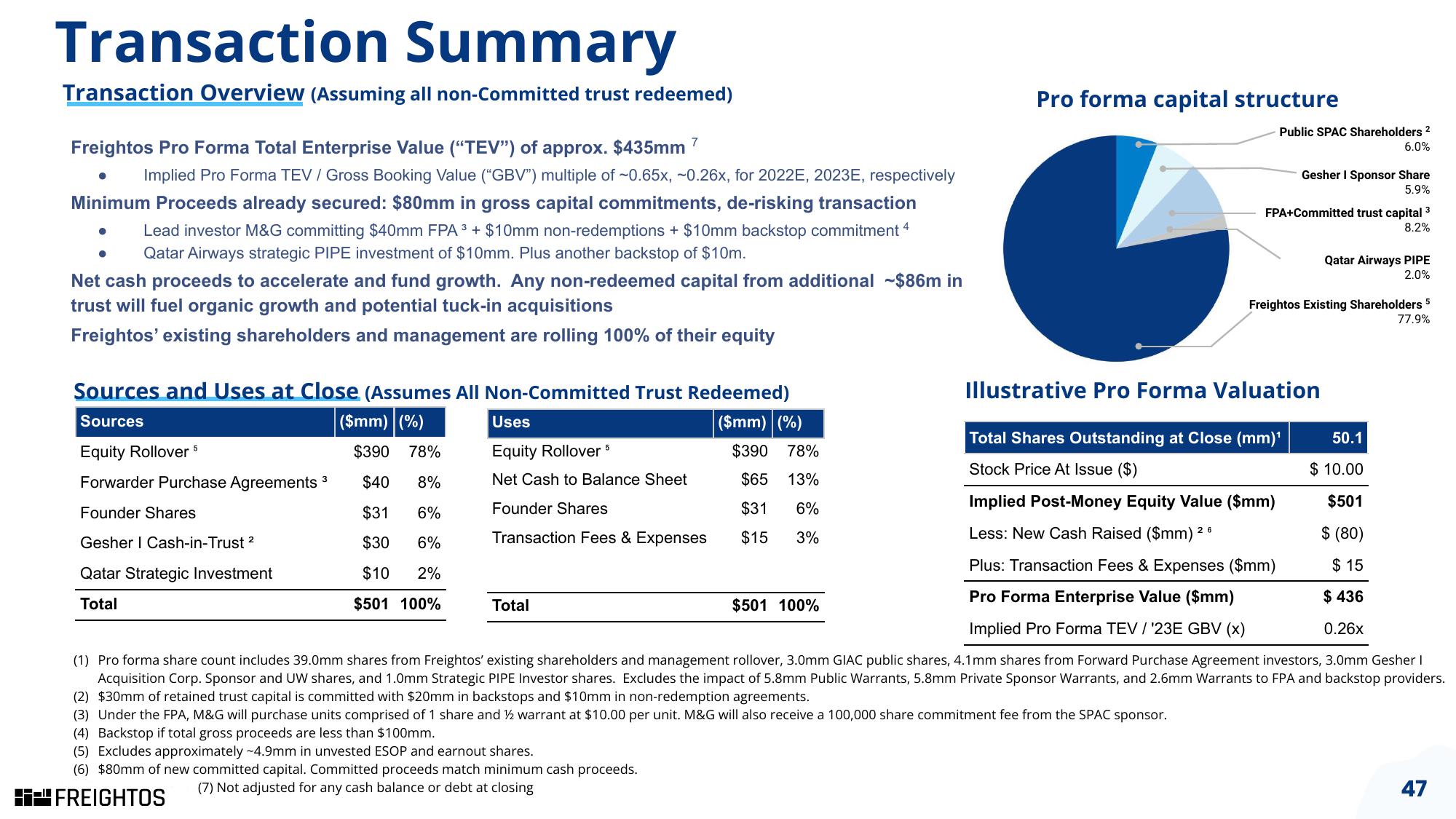

Transaction Overview (Assuming all non-Committed trust redeemed)

Freightos Pro Forma Total Enterprise Value ("TEV") of approx. $435mm

Implied Pro Forma TEV / Gross Booking Value ("GBV") multiple of ~0.65x, -0.26x, for 2022E, 2023E, respectively

Minimum Proceeds already secured: $80mm in gross capital commitments, de-risking transaction

Lead investor M&G committing $40mm FPA ³ + $10mm non-redemptions + $10mm backstop commitment 4

Qatar Airways strategic PIPE investment of $10mm. Plus another backstop of $10m.

Net cash proceeds to accelerate and fund growth. Any non-redeemed capital from additional -$86m in

trust will fuel organic growth and potential tuck-in acquisitions

Freightos' existing shareholders and management are rolling 100% of their equity

7

Sources and Uses at Close (Assumes All Non-Committed Trust Redeemed)

Sources

($mm) (%)

($mm) (%)

Equity Rollover 5

Forwarder Purchase Agreements

Founder Shares

Gesher I Cash-in-Trust ²

Qatar Strategic Investment

Total

$390 78%

$40

8%

$31

6%

$30 6%

$10 2%

$501 100%

Uses

Equity Rollover 5

Net Cash to Balance Sheet

Founder Shares

Transaction Fees & Expenses

Total

$390 78%

$65 13%

$31 6%

$15 3%

Pro forma capital structure

6

$501 100%

Public SPAC Shareholders 2

6.0%

Gesher I Sponsor Share

5.9%

50.1

Implied Post-Money Equity Value ($mm)

Less: New Cash Raised ($mm) 20

$ 10.00

$501

$ (80)

26

$15

Plus: Transaction Fees & Expenses ($mm)

Pro Forma Enterprise Value ($mm)

Implied Pro Forma TEV / '23E GBV (x)

$ 436

0.26x

(1) Pro forma share count includes 39.0mm shares from Freightos' existing shareholders and management rollover, 3.0mm GIAC public shares, 4.1mm shares from Forward Purchase Agreement investors, 3.0mm Gesher I

Acquisition Corp. Sponsor and UW shares, and 1.0mm Strategic PIPE Investor shares. Excludes the impact of 5.8mm Public Warrants, 5.8mm Private Sponsor Warrants, and 2.6mm Warrants to FPA and backstop providers.

(2) $30mm of retained trust capital is committed with $20mm in backstops and $10mm in non-redemption agreements.

(3) Under the FPA, M&G will purchase units comprised of 1 share and ½ warrant at $10.00 per unit. M&G will also receive a 100,000 share commitment fee from the SPAC sponsor.

(4) Backstop if total gross proceeds are less than $100mm.

(5) Excludes approximately -4.9mm in unvested ESOP and earnout shares.

(6) $80mm of new committed capital. Committed proceeds match minimum cash proceeds.

(7) Not adjusted for any cash balance or debt at closing

FREIGHTOS

FPA+Committed trust capital ³

8.2%

Qatar Airways PIPE

2.0%

Freightos Existing Shareholders 5

77.9%

Illustrative Pro Forma Valuation

Total Shares Outstanding at Close (mm)¹

Stock Price At Issue ($)

47View entire presentation