Truist Financial Corp Results Presentation Deck

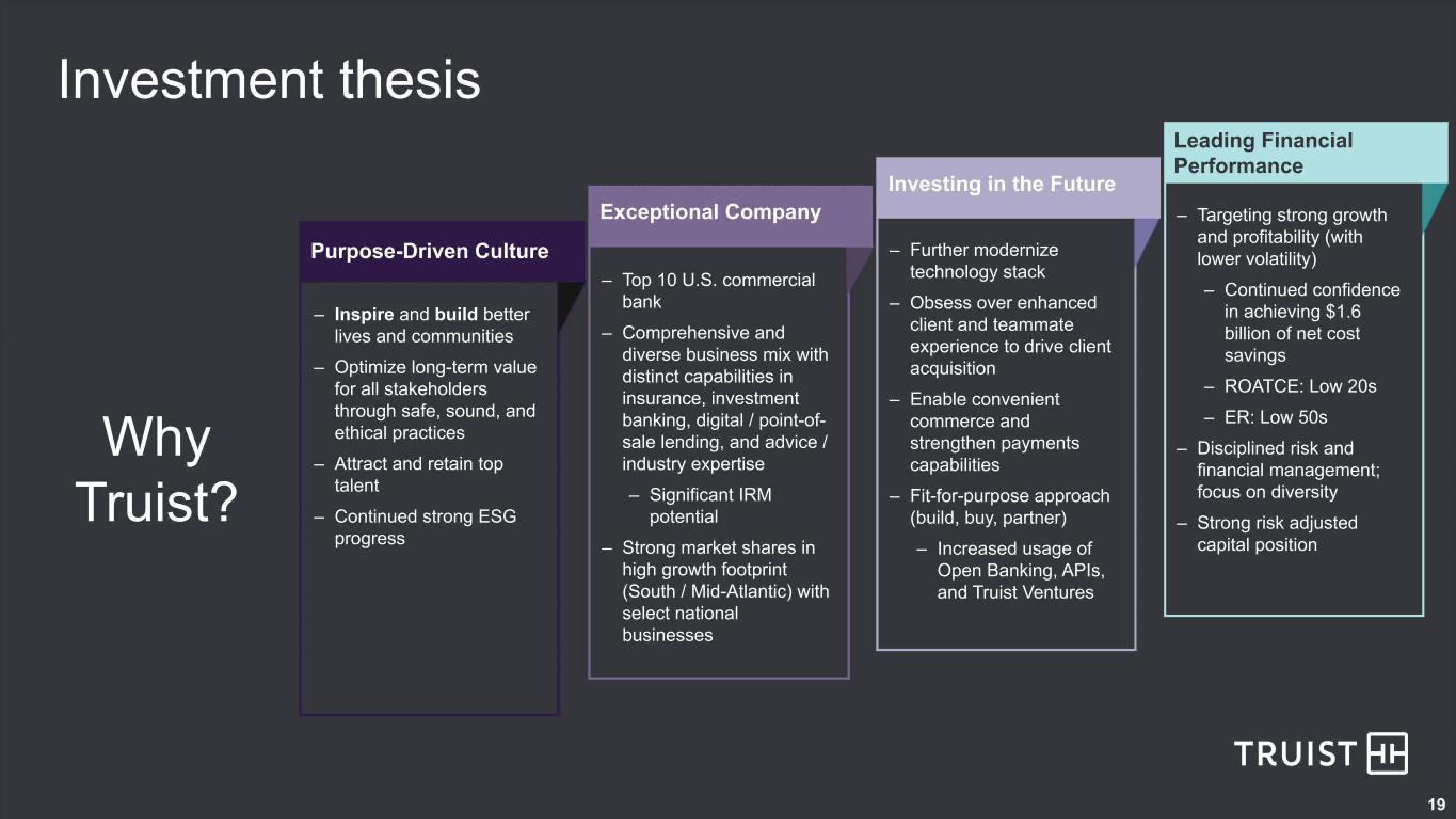

Investment thesis

Why

Truist?

Purpose-Driven Culture

- Inspire and build better

lives and communities

- Optimize long-term value

for all stakeholders

through safe, sound, and

ethical practices

Attract and retain top

talent

- Continued strong ESG

progress

Exceptional Company

-

Top 10 U.S. commercial

bank

Comprehensive and

diverse business mix with

distinct capabilities in

insurance, investment

banking, digital / point-of-

sale lending, and advice /

industry expertise

Significant IRM

potential

Strong market shares in

high growth footprint

(South / Mid-Atlantic) with

select national

businesses

Investing in the Future

-

-

-

Further modernize

technology stack

Obsess over enhanced

client and teammate

experience to drive client

acquisition

Enable convenient

commerce and

strengthen payments

capabilities

Fit-for-purpose approach

(build, buy, partner)

-

Increased usage of

Open Banking, APIs,

and Truist Ventures

Leading Financial

Performance

Targeting strong growth

and profitability (with

lower volatility)

-

-

Continued confidence

in achieving $1.6

billion of net cost

savings

ROATCE: Low 20s

-

ER: Low 50s

Disciplined risk and

financial management;

focus on diversity

Strong risk adjusted

capital position

TRUIST HH

19View entire presentation