Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

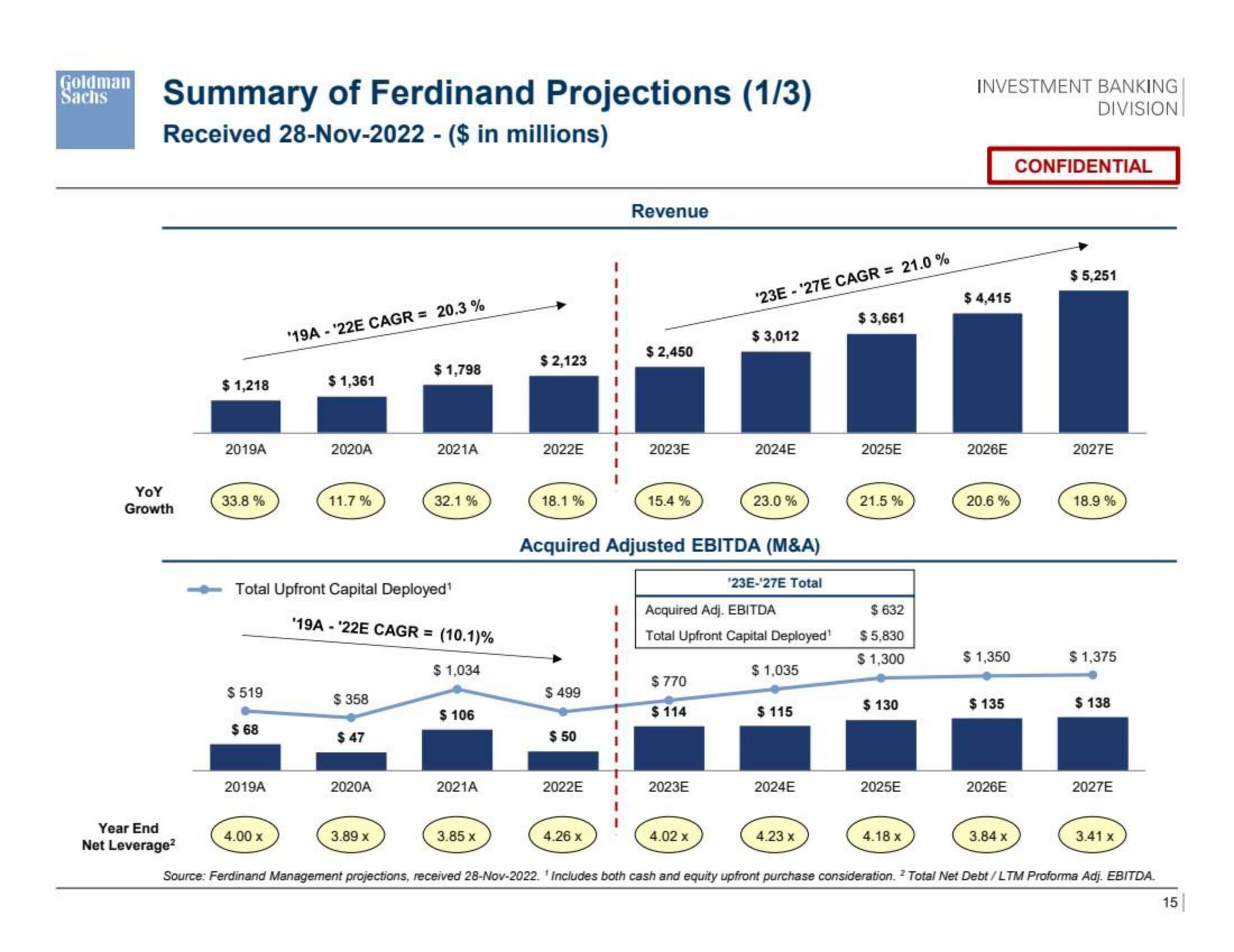

Summary of Ferdinand Projections (1/3)

Received 28-Nov-2022 - ($ in millions)

YOY

Growth

Year End

Net Leverage²

$ 1,218

2019A

33.8 %

$519

$ 68

2019A

'19A -'22E CAGR = 20.3 %

4.00 x

$ 1,361

2020A

11.7%

Total Upfront Capital Deployed¹

$ 358

$ 47

$1,798

'19A-'22E CAGR = (10.1)%

$ 1,034

2020A

2021A

3.89 x

32.1%

$ 106

2021A

3.85 x

$ 2,123

2022E

18.1%

$ 499

$50

2022E

Revenue

4.26 x

$ 2,450

2023E

15.4%

Acquired Adjusted EBITDA (M&A)

$770

$114

'23E-'27E CAGR = 21.0 %

2023E

$ 3,012

4.02 x

2024E

¹23E-¹27E Total

Acquired Adj. EBITDA

Total Upfront Capital Deployed¹

$ 1,035

23.0%

$115

2024E

4.23 x

$3,661

2025E

21.5%

$632

$5,830

$ 1,300

$130

2025E

4.18 x

INVESTMENT BANKING

DIVISION

$ 4,415

2026E

20.6 %

$ 1,350

$ 135

2026E

3.84 x

CONFIDENTIAL

$ 5,251

2027E

18.9%

$ 1,375

$ 138

2027E

3.41 x

Source: Ferdinand Management projections, received 28-Nov-2022. Includes both cash and equity upfront purchase consideration. 2 Total Net Debt/LTM Proforma Adj. EBITDA.

15View entire presentation