Investor Presentation

Our Strategy

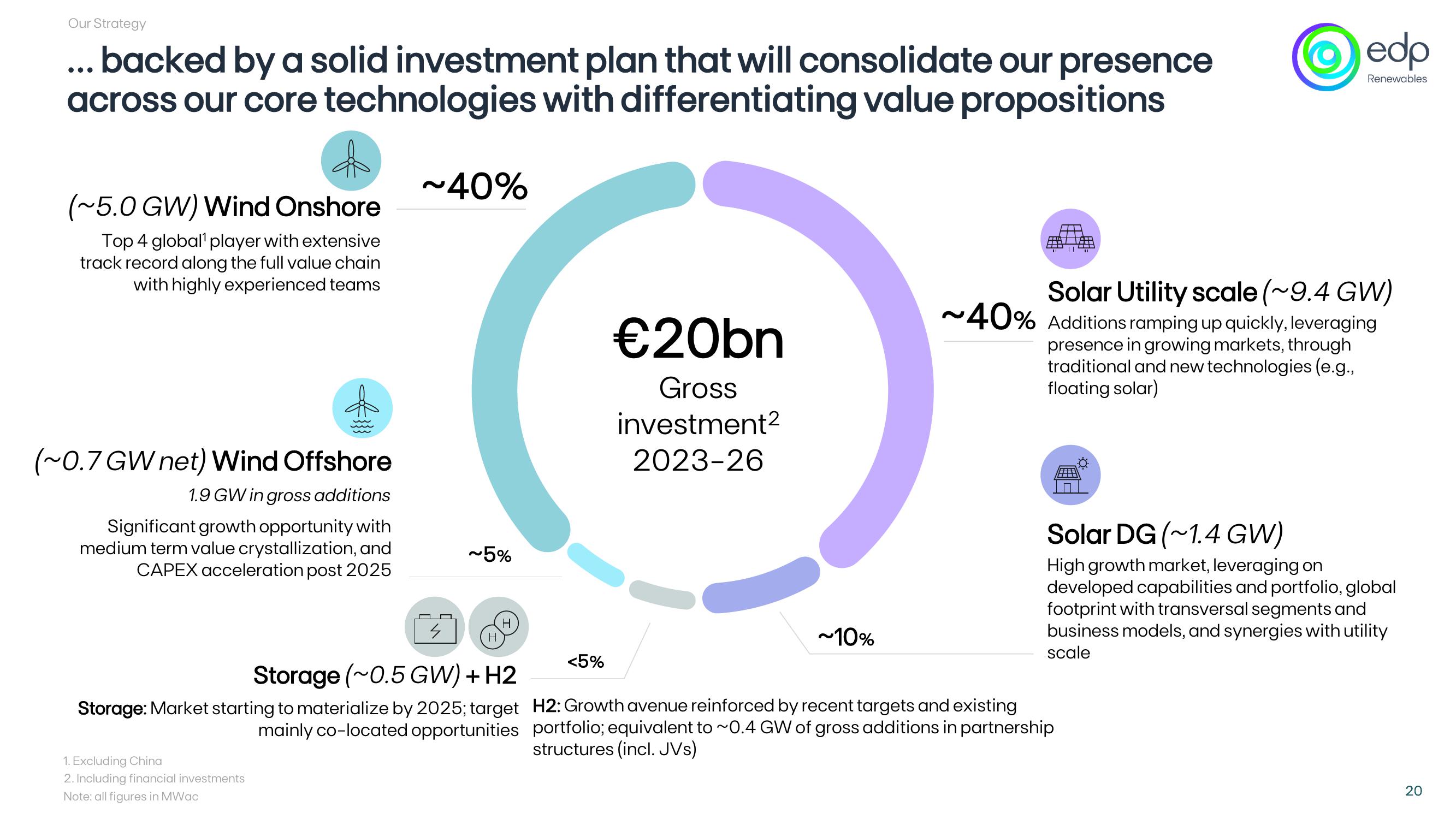

... backed by a solid investment plan that will consolidate our presence

across our core technologies with differentiating value propositions

की

(~5.0 GW) Wind Onshore

Top 4 global player with extensive

track record along the full value chain

with highly experienced teams

~40%

edp

Renewables

(~0.7 GW net) Wind Offshore.

1.9 GW in gross additions

Significant growth opportunity with

€20bn

Gross

investment2

2023-26

Solar Utility scale (~9.4 GW)

~40% Additions ramping up quickly, leveraging

presence in growing markets, through

traditional and new technologies (e.g.,

floating solar)

medium term value crystallization, and

CAPEX acceleration post 2025

~5%

S

H

H

Storage (~0.5 GW) + H2

Storage: Market starting to materialize by 2025; target

mainly co-located opportunities

1. Excluding China

2. Including financial investments

Note: all figures in MWac

<5%

~10%

Solar DG (~1.4 GW)

High growth market, leveraging on

developed capabilities and portfolio, global

footprint with transversal segments and

business models, and synergies with utility

scale

H2: Growth avenue reinforced by recent targets and existing

portfolio; equivalent to ~0.4 GW of gross additions in partnership

structures (incl. JVs)

20

20View entire presentation