Kinnevik Results Presentation Deck

OUR FINANCIAL POSITION ALLOWS US TO MAINTAIN OUR INVESTMENT MOMENTUM,

AND WE AIM TO ALLOCATE CAPITAL IN A DISCIPLINED BUT FLEXIBLE FASHION

■

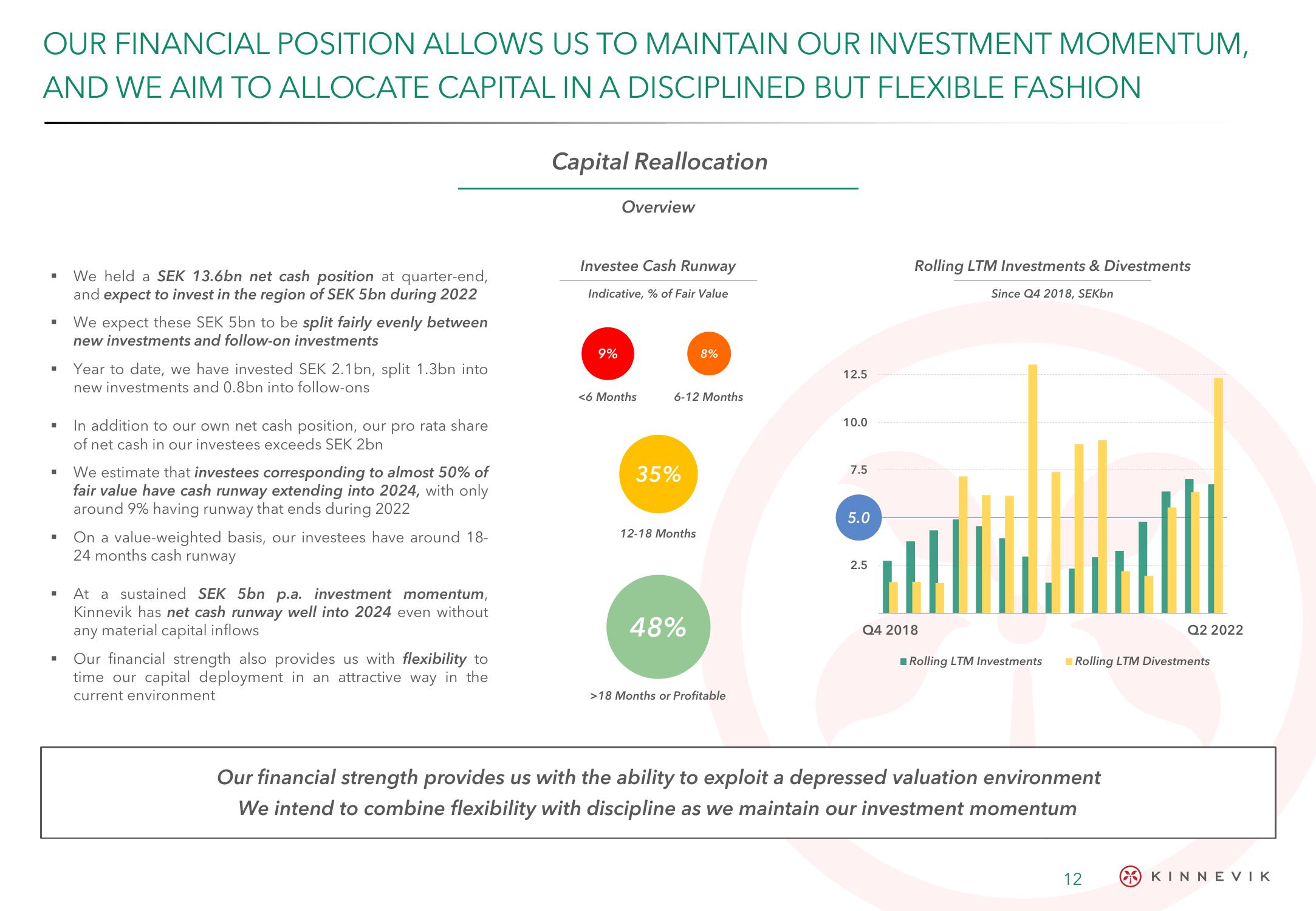

We held a SEK 13.6bn net cash position at quarter-end,

and expect to invest in the region of SEK 5bn during 2022

We expect these SEK 5bn to be split fairly evenly between

new investments and follow-on investments

Year to date, we have invested SEK 2.1bn, split 1.3bn into

new investments and 0.8bn into follow-ons

In addition to our own net cash position, our pro rata share

of net cash in our investees exceeds SEK 2bn

We estimate that investees corresponding to almost 50% of

fair value have cash runway extending into 2024, with only

around 9% having runway that ends during 2022

On a value-weighted basis, our investees have around 18-

24 months cash runway

At a sustained SEK 5bn p.a. investment momentum,

Kinnevik has net cash runway well into 2024 even without

any material capital inflows

Our financial strength also provides us with flexibility to

time our capital deployment in an attractive way in the

current environment

Capital Reallocation

Overview

Investee Cash Runway

Indicative, % of Fair Value

9%

<6 Months

6-12 Months

35%

12-18 Months

8%

48%

>18 Months or Profitable

12.5

10.0

7.5

5.0

2.5

Rolling LTM Investments & Divestments

Since Q4 2018, SEKbn

Q4 2018

Rolling LTM Investments Rolling LTM Divestments

Our financial strength provides us with the ability to exploit a depressed valuation environment

We intend to combine flexibility with discipline as we maintain our investment momentum

Q2 2022

12

KINNEVIKView entire presentation