Antero Midstream Partners Investor Presentation Deck

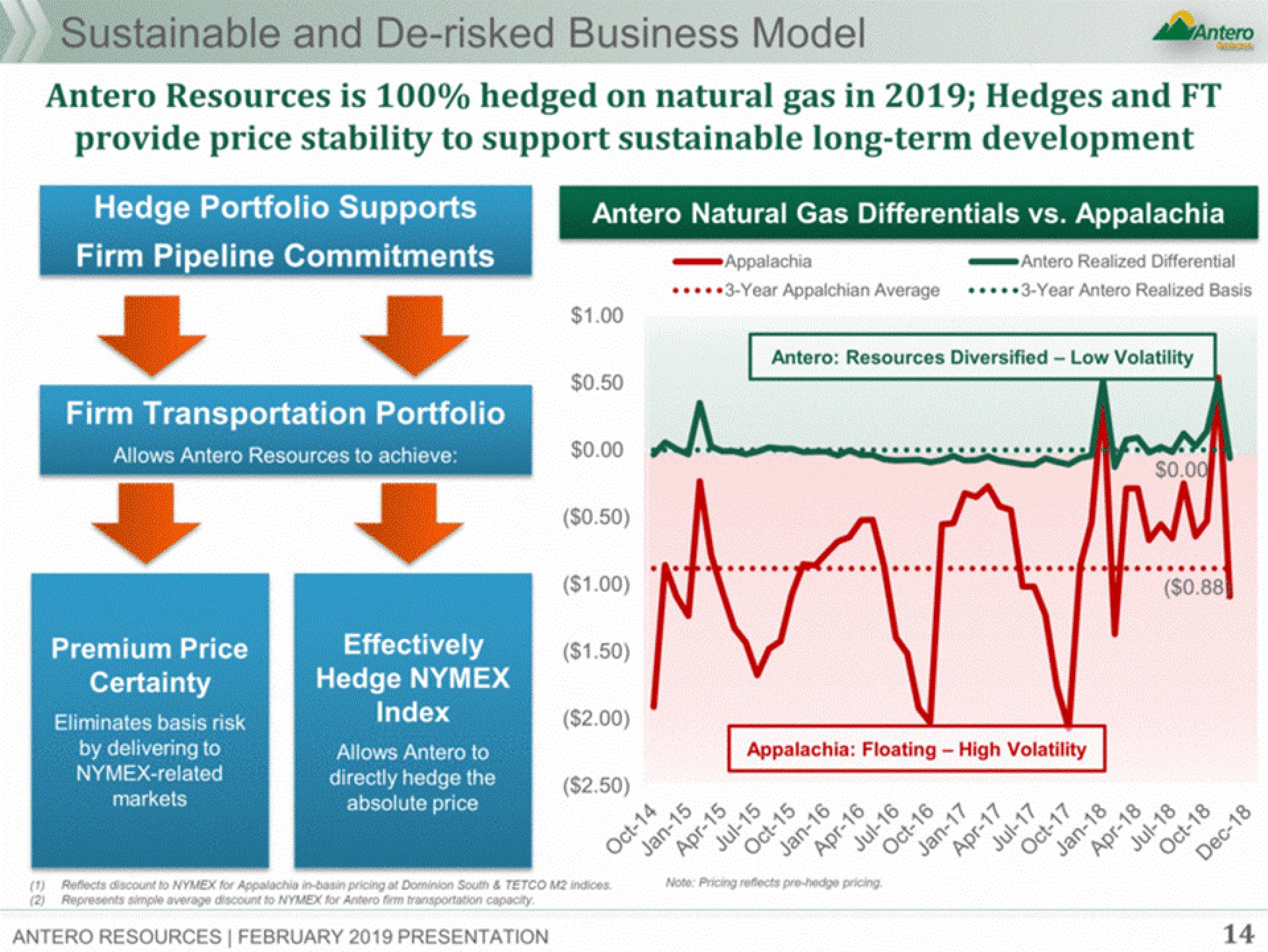

Sustainable and De-risked Business Model

Antero Resources is 100% hedged on natural gas in 2019; Hedges and FT

provide price stability to support sustainable long-term development

Hedge Portfolio Supports

Firm Pipeline Commitments

Firm Transportation Portfolio

Allows Antero Resources to achieve:

Premium Price

Certainty

Eliminates basis risk

by delivering to

NYMEX-related

markets

Effectively

Hedge NYMEX

Index

Allows Antero to

directly hedge the

absolute price

Antero Natural Gas Differentials vs. Appalachia

Appalachia

Antero Realized Differential

* *3-Year Appalchian Average *****3-Year Antero Realized Basis

$1.00

$0.50

$0.00

($0.50)

($1.00)

($1.50)

($2.00)

($2.50)

Oct-14

(1) Reflects discount to NYMEX for Appalachia in-basin pricing at Dominion South & TETCO M2 indices

(2) Represents simple average discount to NYMEX for Antero firm transportation capacity.

ANTERO RESOURCES | FEBRUARY 2019 PRESENTATION

nte

M

Jan-15

Apr-15

Antero: Resources Diversified - Low Volatility

Appalachia: Floating - High Volatility

Jul-15

Oct-15

Jan-16

Apr-16

Note: Pricing reflects pre-hedge pricing.

Jul-16

Oct-16

Jan-17

Apr-17

Jul-17

Oct-17

Antero

CAMERA

Jan-18

$0.00

W

Apr-18

($0.88)

Jul-18

Oct-18

Dec-18

14View entire presentation