J.P.Morgan Shareholder Engagement Presentation Deck

B Executive Compensation

The CMDC determined 2022 pay, referencing the Firm's annual and long-term

operating performance and ROTCE, including over the recent pandemic cycle

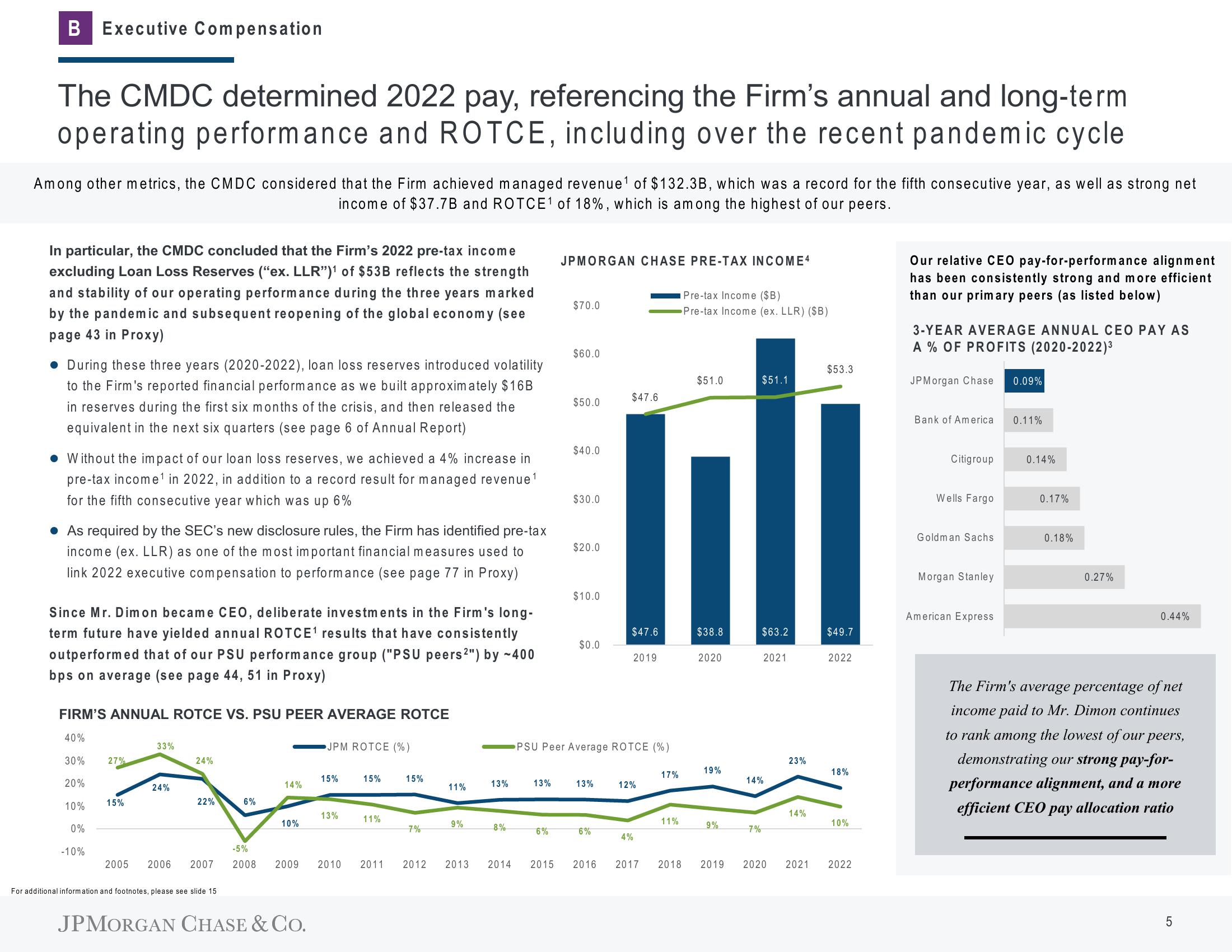

Among other metrics, the CMDC considered that the Firm achieved managed revenue¹ of $132.3B, which was a record for the fifth consecutive year, as well as strong net

income of $37.7B and ROTCE1 of 18%, which is among the highest of our peers.

In particular, the CMDC concluded that the Firm's 2022 pre-tax income

excluding Loan Loss Reserves ("ex. LLR")¹ of $53B reflects the strength

and stability of our operating performance during the three years marked

by the pandemic and subsequent reopening of the global economy (see

page 43 in Proxy)

During these three years (2020-2022), loan loss reserves introduced volatility

to the Firm's reported financial performance as we built approximately $16B

in reserves during the first six months of the crisis, and then released the

equivalent in the next six quarters (see page 6 of Annual Report)

Without the impact of our loan loss reserves, we achieved a 4% increase in

pre-tax income¹ in 2022, in addition to a record result for managed revenue ¹

for the fifth consecutive year which was up 6%

• As required by the SEC's new disclosure rules, the Firm has identified pre-tax

income (ex. LLR) as one of the most important financial measures used to

link 2022 executive compensation to performance (see page 77 in Proxy)

Since Mr. Dimon became CEO, deliberate investments in the Firm's long-

term future have yielded annual ROTCE¹ results that have consistently

outperformed that of our PSU performance group ("PSU peers 2") by ~400

bps on average (see page 44, 51 in Proxy)

FIRM'S ANNUAL ROTCE VS. PSU PEER AVERAGE ROTCE

40%

30%

20%

10%

0%

-10%

33%

24%

24%

A

15%

22%

27%

6%

-5%

2005 2006 2007 2008

For additional information and footnotes, please see slide 15

14%

10%

JPM ROTCE (%)

JPMORGAN CHASE & CO.

15%

13%

2009 2010

15%

11%

15%

7%

2011 2012

11%

9%

2013

13%

8%

2014

13%

JPMORGAN CHASE PRE-TAX INCOME4

6%

$70.0

$60.0

$50.0

$40.0

$30.0

$20.0

$10.0

$0.0

PSU Peer Average ROTCE (%)

13%

$47.6

6%

$47.6

2019

12%

4%

2015 2016 2017

17%

11%

2018

Pre-tax Income ($B)

Pre-tax Income (ex. LLR) ($B)

$51.0

$38.8

2020

19%

9%

$51.1

7%

$63.2

2021

14%

23%

14%

$53.3

$49.7

2022

18%

10%

2019 2020 2021 2022

Our relative CEO pay-for-performance alignment

has been consistently strong and more efficient

than our primary peers (as listed below)

3-YEAR AVERAGE ANNUAL CEO PAY AS

A % OF PROFITS (2020-2022)³

JPMorgan Chase

Bank of America

Citigroup

Wells Fargo

Goldman Sachs

Morgan Stanley

American Express

0.09%

0.11%

0.14%

0.17%

0.18%

0.27%

0.44%

The Firm's average percentage of net

income paid to Mr. Dimon continues

to rank among the lowest of our peers,

demonstrating our strong pay-for-

performance alignment, and a more

efficient CEO pay allocation ratio

LO

5View entire presentation