Lakeland Bancorp Investor Conference Presentation Deck

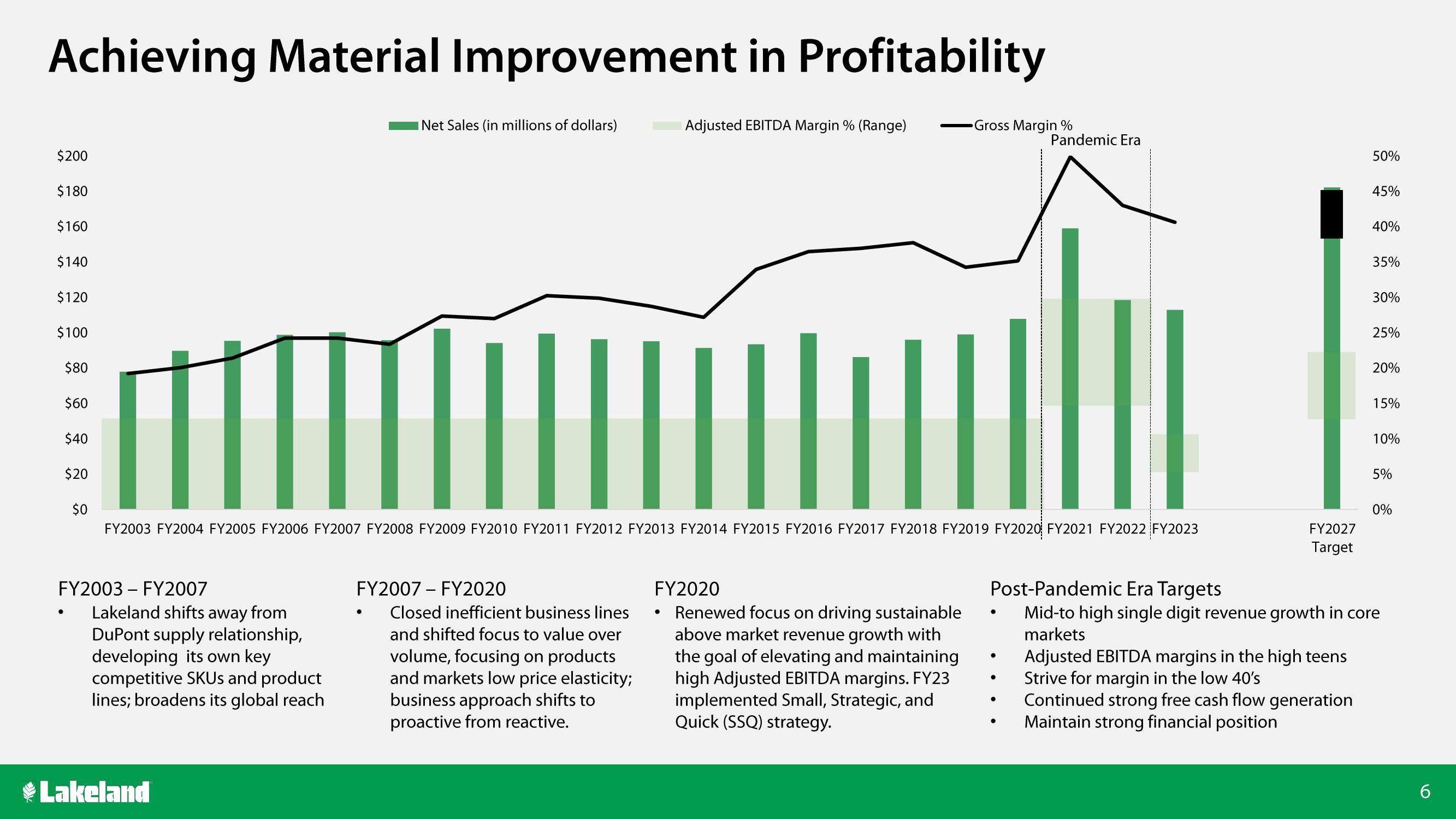

Achieving Material Improvement in Profitability

$200

$180

$160

$140

$120

$100

$80

$60

$40

$20

$0

FY2003- FY2007

●

Lakeland shifts away from

DuPont supply relationship,

developing its own key

competitive SKUs and product

lines; broadens its global reach

Net Sales (in millions of dollars)

Lakeland

|||

FY2003 FY2004 FY2005 FY2006 FY2007 FY2008 FY2009 FY2010 FY2011 FY2012 FY2013 FY2014 FY2015 FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 FY2022 FY2023

FY2007 - FY2020

Closed inefficient business lines

and shifted focus to value over

volume, focusing on products

and markets low price elasticity;

business approach shifts to

proactive from reactive.

Adjusted EBITDA Margin % (Range)

FY2020

Renewed focus on driving sustainable

above market revenue growth with

the goal of elevating and maintaining

high Adjusted EBITDA margins. FY23

implemented Small, Strategic, and

Quick (SSQ) strategy.

●

Gross Margin %

●

●

●

Pandemic Era

●

●

FY2027

Target

50%

Adjusted EBITDA margins in the high teens

Strive for margin in the low 40's

Continued strong free cash flow generation

Maintain strong financial position

45%

40%

35%

30%

25%

Post-Pandemic Era Targets

Mid-to high single digit revenue growth in core

markets

20%

15%

10%

5%

0%

6View entire presentation