Evotec ESG Presentation Deck

STI target value

Y1

evotec

PAGE 26

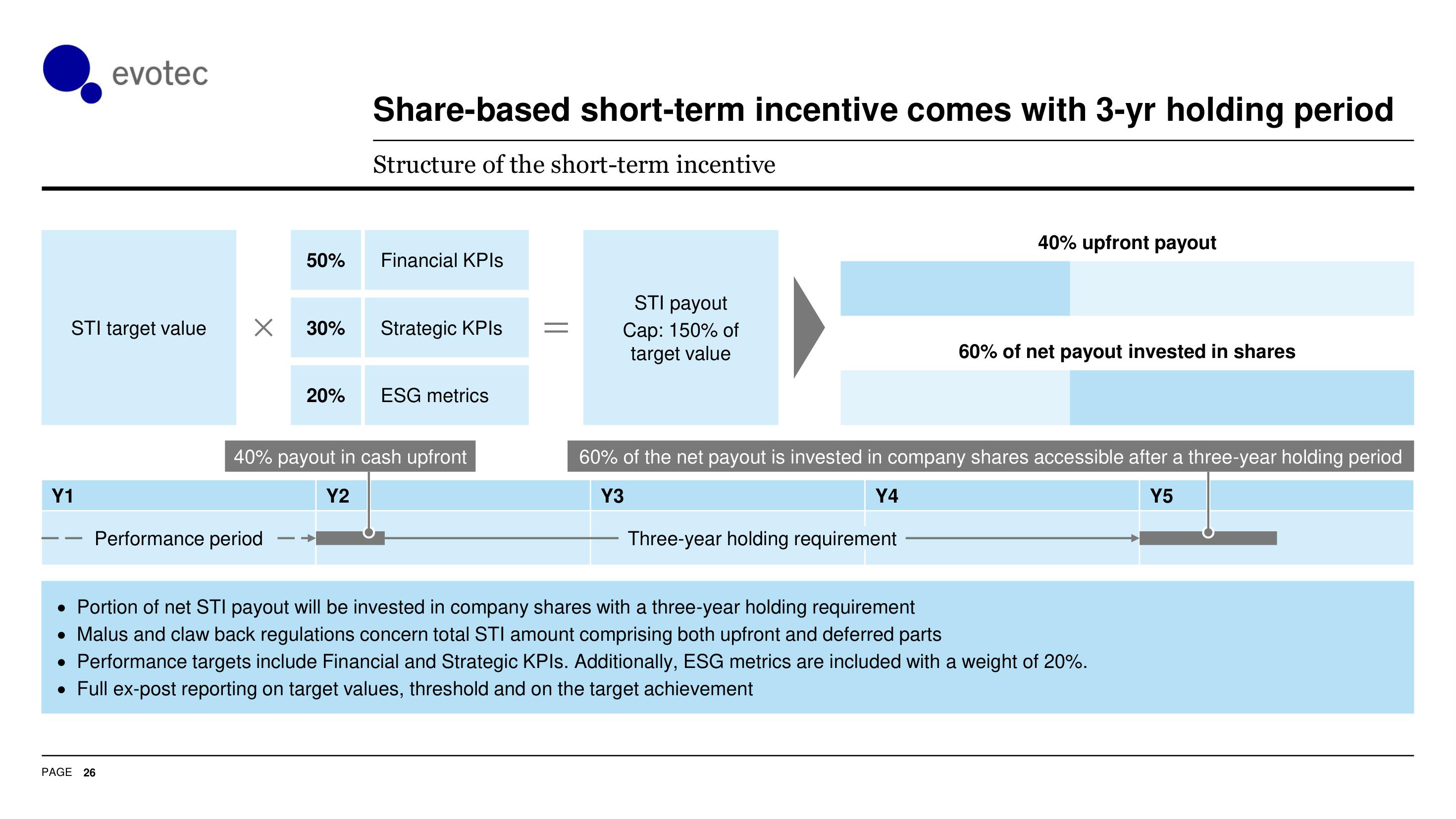

50%

X 30%

Performance period

20%

Share-based short-term incentive comes with 3-yr holding period

Structure of the short-term incentive

Financial KPIs

Strategic KPIs

ESG metrics

40% payout in cash upfront

Y2

=

STI payout

Cap: 150% of

target value

40% upfront payout

Three-year holding requirement

60% of net payout invested in shares

60% of the net payout is invested in company shares accessible after a three-year holding period

Y3

Y4

Y5

• Portion of net STI payout will be invested in company shares with a three-year holding requirement

• Malus and claw back regulations concern total STI amount comprising both upfront and deferred parts

• Performance targets include Financial and Strategic KPIs. Additionally, ESG metrics are included with a weight of 20%.

• Full ex-post reporting on target values, threshold and on the target achievementView entire presentation