2nd Quarter 2021 Investor Presentation

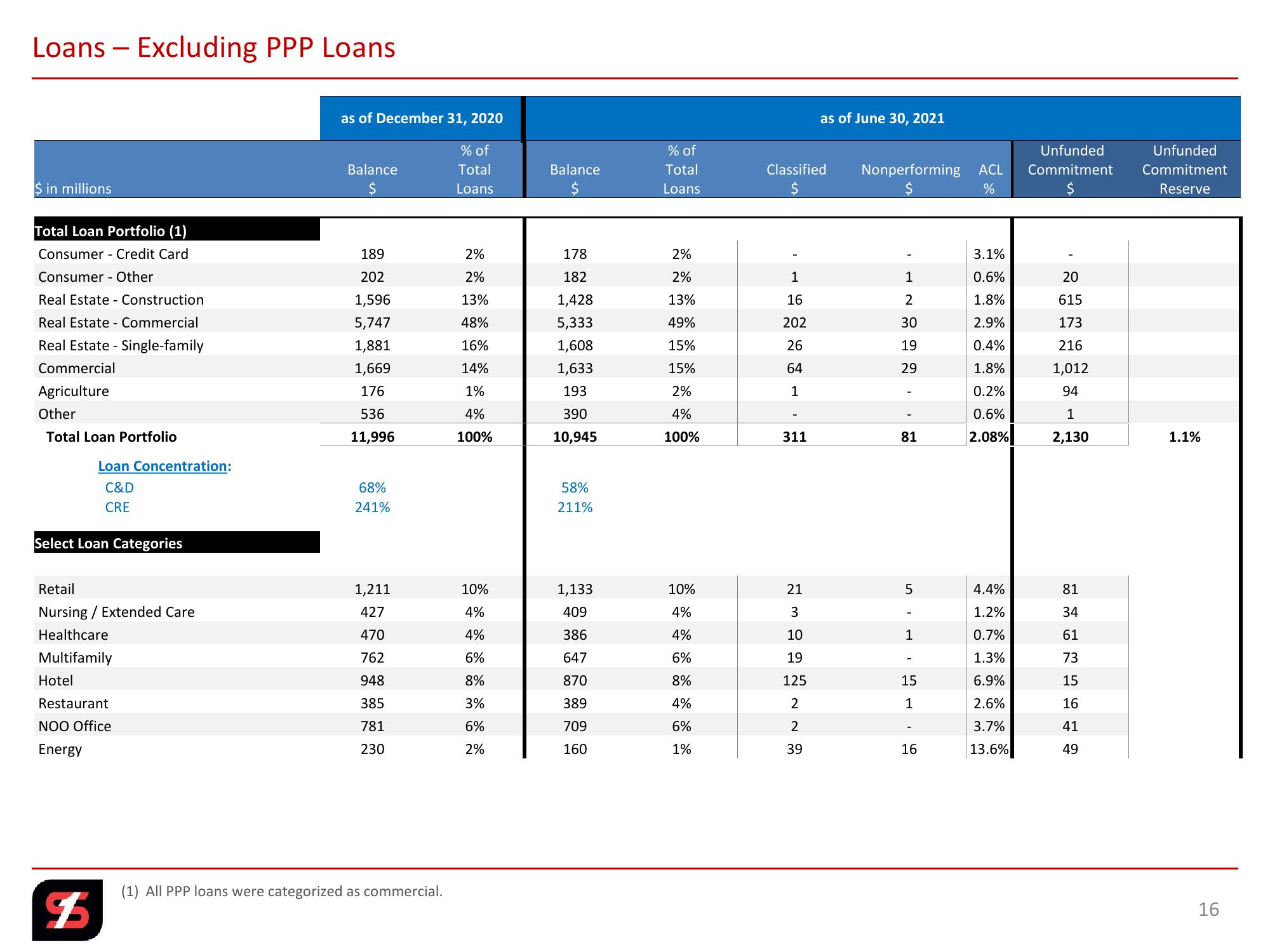

Loans - Excluding PPP Loans

as of December 31, 2020

as of June 30, 2021

% of

% of

$ in millions

Balance

$

Total

Balance

Total

Classified

Loans

$

Loans

$

$

%

Unfunded

Unfunded

Nonperforming ACL Commitment Commitment

$

Reserve

Total Loan Portfolio (1)

Consumer Credit Card

189

2%

178

2%

3.1%

Consumer Other

202

2%

182

2%

1

1

0.6%

20

Real Estate Construction

1,596

13%

1,428

13%

16

2

1.8%

615

Real Estate Commercial

5,747

48%

5,333

49%

202

30

2.9%

173

Real Estate - Single-family

1,881

16%

1,608

15%

26

19

0.4%

216

Commercial

1,669

14%

1,633

15%

64

29

1.8%

1,012

Agriculture

176

1%

193

2%

1

0.2%

94

Other

536

4%

390

4%

-

0.6%

1

Total Loan Portfolio

11,996

100%

10,945

100%

311

81

2.08%

2,130

1.1%

Loan Concentration:

C&D

CRE

68%

241%

58%

211%

Select Loan Categories

Retail

1,211

Nursing/Extended Care

427

Healthcare

470

Multifamily

762

Hotel

Restaurant

NOO Office

Energy

$

948

385

781

230

(1) All PPP loans were categorized as commercial.

សំ ៖ ៖ ៖ ៖ ៖ ៖ ៖

10%

1,133

10%

21

409

4%

4%

386

4%

10

647

6%

19

870

8%

125

389

4%

709

160

6%

die de de

1%

39

23222222

5

4.4%

81

-

1.2%

34

1

0.7%

61

1.3%

73

15

6.9%

15

1

2.6%

16

3.7%

41

16

13.6%

49

16View entire presentation