Inovalon Results Presentation Deck

Full Year 2016 Revised Revenue Guidance

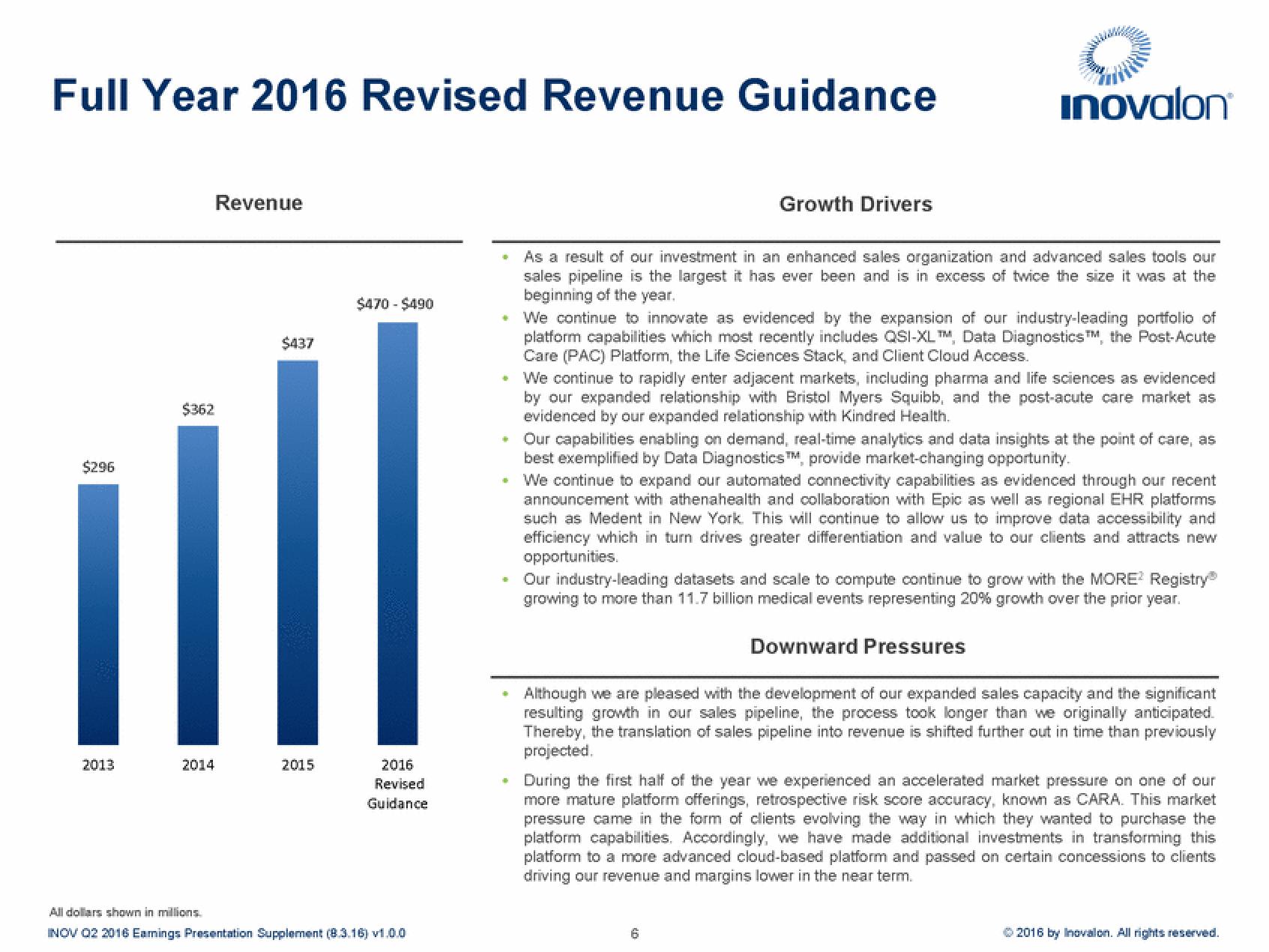

$296

2013

$362

2014

Revenue

$437

2015

$470 - $490

2016

Revised

Guidance

All dollars shown in millions.

INOV 02 2016 Eamings Presentation Supplement (8.3.16) v1.0.0

•

+

@

Growth Drivers

inovalon

As a result of our investment in an enhanced sales organization and advanced sales tools our

sales pipeline is the largest it has ever been and is in excess of twice the size it was at the

beginning of the year.

We continue to innovate as evidenced by the expansion of our industry-leading portfolio of

platform capabilities which most recently includes QSI-XLTM, Data DiagnosticsTM, the Post-Acute

Care (PAC) Platform, the Life Sciences Stack, and Client Cloud Access.

We continue to rapidly enter adjacent markets, including pharma and life sciences as evidenced

by our expanded relationship with Bristol Myers Squibb, and the post-acute care market as

evidenced by our expanded relationship with Kindred Health.

Our capabilities enabling on demand, real-time analytics and data insights at the point of care, as

best exemplified by Data Diagnostics™, provide market-changing opportunity.

We continue to expand our automated connectivity capabilities as evidenced through our recent

announcement with athenahealth and collaboration with Epic as well as regional EHR platforms

such as Medent in New York. This will continue to allow us to improve data accessibility and

efficiency which in turn drives greater differentiation and value to our clients and attracts new

opportunities.

Our industry-leading datasets and scale to compute continue to grow with the MORE? Registry

growing to more than 11.7 billion medical events representing 20% growth over the prior year.

Downward Pressures

Although we are pleased with the development of our expanded sales capacity and the significant

resulting growth in our sales pipeline, the process took longer than we originally anticipated.

Thereby, the translation of sales pipeline into revenue is shifted further out in time than previously

projected.

6

During the first half of the year we experienced an accelerated market pressure on one of our

more mature platform offerings, retrospective risk score accuracy, known as CARA. This market

pressure came in the form of clients evolving the way in which they wanted to purchase the

platform capabilities. Accordingly, we have made additional investments in transforming this

platform to a more advanced cloud-based platform and passed on certain concessions to clients

driving our revenue and margins lower in the near term.

© 2016 by Inovalon. All rights reserved.View entire presentation