Evercore Investment Banking Pitch Book

Preliminary Valuation Detail - SIRE Financial Projections

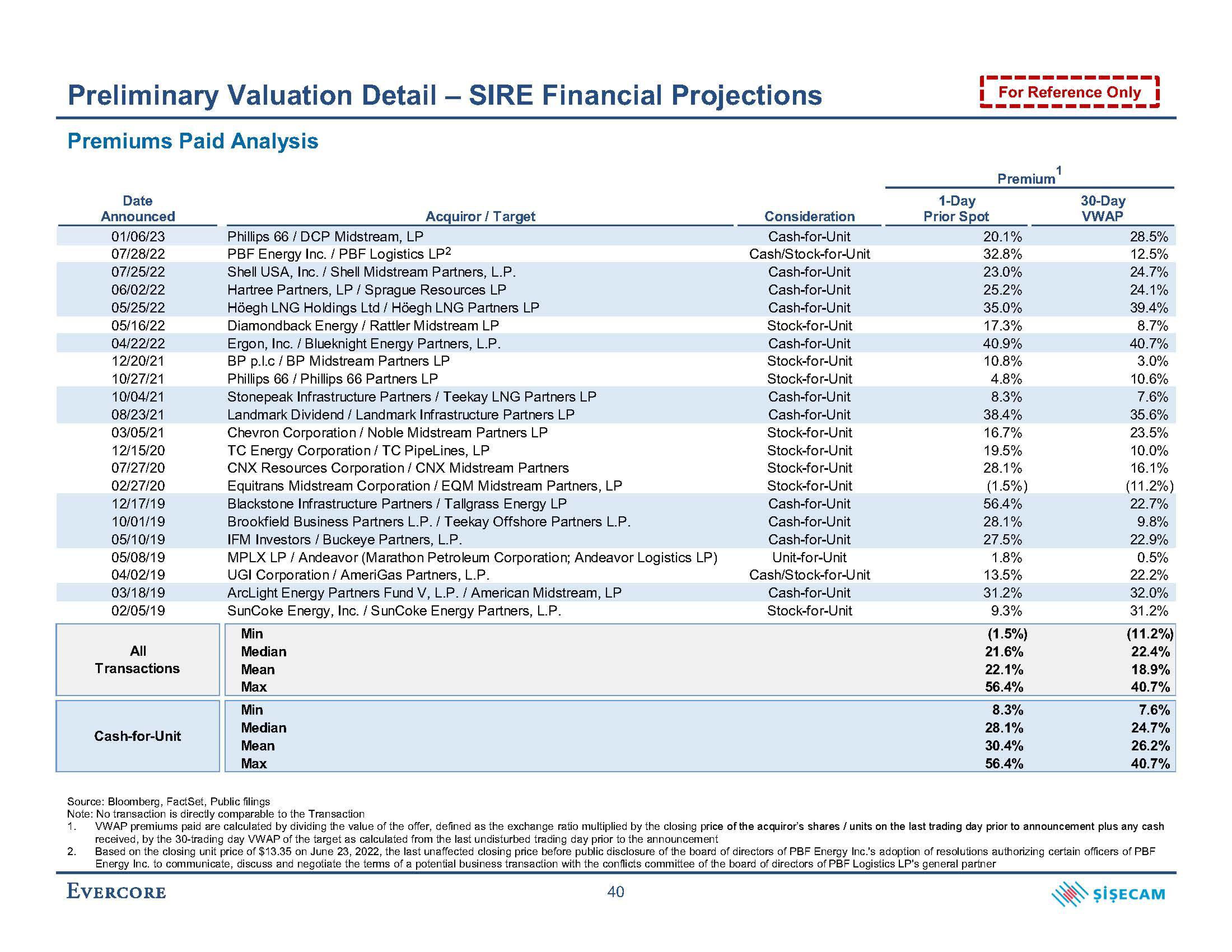

Premiums Paid Analysis

Date

Announced

2.

01/06/23

07/28/22

07/25/22

06/02/22

05/25/22

05/16/22

04/22/22

12/20/21

10/27/21

10/04/21

08/23/21

03/05/21

12/15/20

07/27/20

02/27/20

12/17/19

10/01/19

05/10/19

05/08/19

04/02/19

03/18/19

02/05/19

All

Transactions

Cash-for-Unit

Acquiror / Target

Phillips 66 / DCP Midstream, LP

PBF Energy Inc. / PBF Logistics LP2

Shell USA, Inc. / Shell Midstream Partners, L.P.

Hartree Partners, LP / Sprague Resources LP

Höegh LNG Holdings Ltd / Höegh LNG Partners LP

Diamondback Energy / Rattler Midstream LP

Ergon, Inc. / Blueknight Energy Partners, L.P.

BP p.l.c/ BP Midstream Partners LP

Phillips 66 / Phillips 66 Partners LP

Stonepeak Infrastructure Partners / Teekay LNG Partners LP

Landmark Dividend / Landmark Infrastructure Partners LP

Chevron Corporation / Noble Midstream Partners LP

TC Energy Corporation / TC PipeLines, LP

CNX Resources Corporation / CNX Midstream Partners

Equitrans Midstream Corporation / EQM Midstream Partners, LP

Blackstone Infrastructure Partners / Tallgrass Energy LP

Brookfield Business Partners L.P./ Teekay Offshore Partners L.P.

IFM Investors / Buckeye Partners, L.P.

MPLX LP / Andeavor (Marathon Petroleum Corporation; Andeavor Logistics LP)

UGI Corporation / AmeriGas Partners, L.P.

ArcLight Energy Partners Fund V, L.P. / American Midstream, LP

SunCoke Energy, Inc. / SunCoke Energy Partners, L.P.

Min

Median

Mean

Max

Min

Median

Mean

Max

Consideration

Cash-for-Unit

Cash/Stock-for-Unit

Cash-for-Unit

Cash-for-Unit

Cash-for-Unit

Stock-for-Unit

Cash-for-Unit

Stock-for-Unit

Stock-for-Unit

Cash-for-Unit

Cash-for-Unit

Stock-for-Unit

Stock-for-Unit

Stock-for-Unit

Stock-for-Unit

Cash-for-Unit

Cash-for-Unit

Cash-for-Unit

Unit-for-Unit

Cash/Stock-for-Unit

Cash-for-Unit

Stock-for-Unit

1-Day

Prior Spot

For Reference Only

Premium¹

20.1%

32.8%

23.0%

25.2%

35.0%

17.3%

40.9%

10.8%

4.8%

8.3%

38.4%

16.7%

19.5%

28.1%

(1.5%)

56.4%

28.1%

27.5%

1.8%

13.5%

31.2%

9.3%

(1.5%)

21.6%

22.1%

56.4%

8.3%

28.1%

30.4%

56.4%

30-Day

VWAP

28.5%

12.5%

24.7%

24.1%

39.4%

8.7%

40.7%

3.0%

10.6%

7.6%

35.6%

23.5%

10.0%

16.1%

(11.2%)

22.7%

9.8%

22.9%

0.5%

22.2%

32.0%

31.2%

(11.2%)

22.4%

18.9%

40.7%

7.6%

24.7%

26.2%

40.7%

Source: Bloomberg, FactSet, Public filings

Note: No transaction is directly comparable to the Transaction

1. VWAP premiums paid are calculated by dividing the value of the offer, defined as the exchange ratio multiplied by the closing price of the acquiror's shares / units on the last trading day prior to announcement plus any cash

received, by the 30-trading day VWAP of the target as calculated from the last undisturbed trading day prior to the announcement

Based on the closing unit price of $13.35 on June 23, 2022, the last unaffected closing price before public disclosure of the board of directors of PBF Energy Inc.'s adoption of resolutions authorizing certain officers of PBF

Energy Inc. to communicate, discuss and negotiate the terms of a potential business transaction with the conflicts committee of the board of directors of PBF Logistics LP's general partner

EVERCORE

40

ŞİŞECAMView entire presentation