Inovalon Results Presentation Deck

Reconciliation

Non-GAAP Net Income

of Forward-Looking Guidance

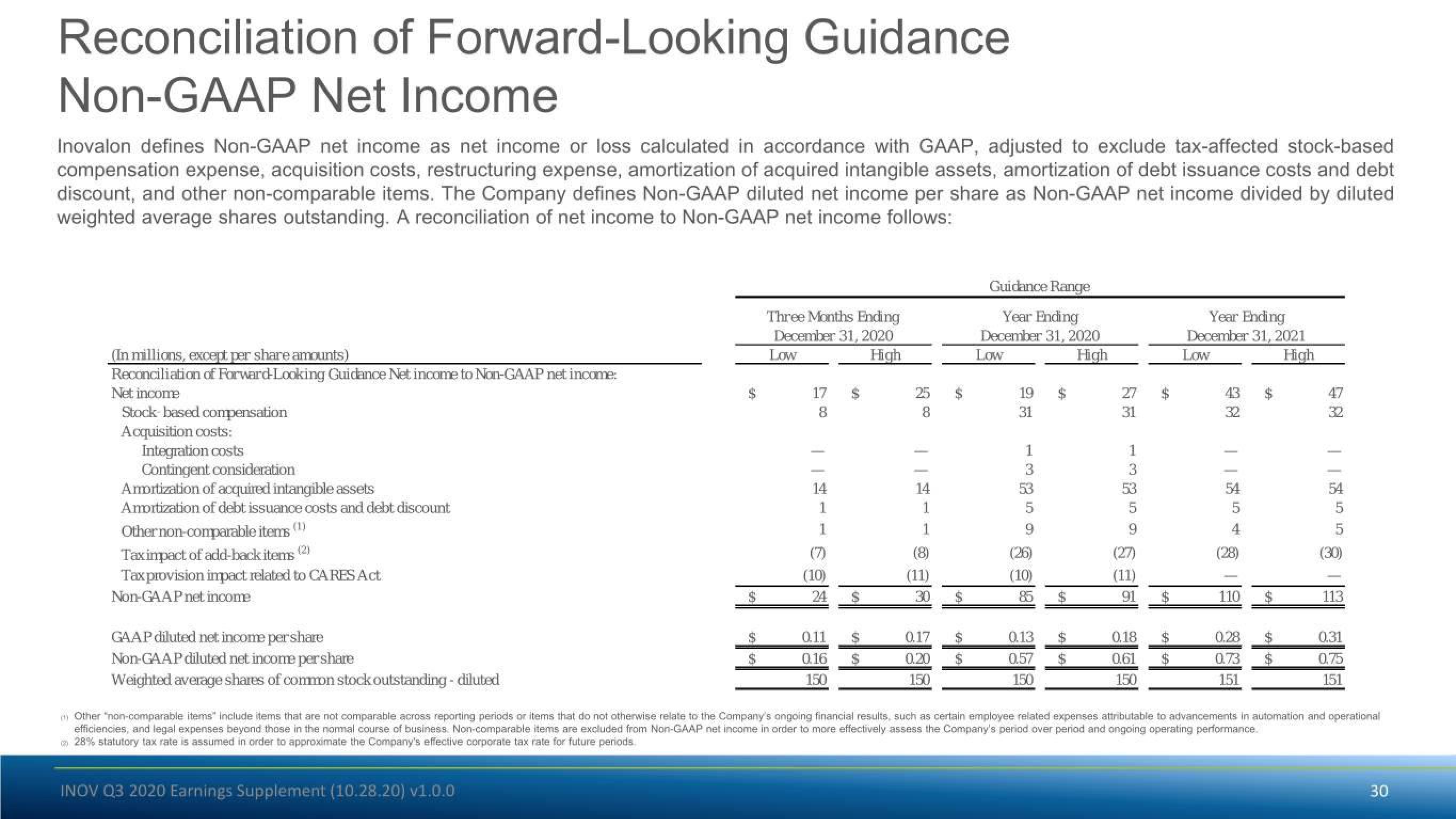

Inovalon defines Non-GAAP net income as net income or loss calculated in accordance with GAAP, adjusted to exclude tax-affected stock-based

compensation expense, acquisition costs, restructuring expense, amortization of acquired intangible assets, amortization of debt issuance costs and debt

discount, and other non-comparable items. The Company defines Non-GAAP diluted net income per share as Non-GAAP net income divided by diluted

weighted average shares outstanding. A reconciliation of net income to Non-GAAP net income follows:

(In millions, except per share amounts)

Reconciliation of Forward-Looking Guidance Net income to Non-GAAP net income:

Net income

Stock-based compensation

Acquisition costs:

Integration costs

Contingent consideration

Amortization of acquired intangible assets

Amortization of debt issuance costs and debt discount

Other non-comparable items (1)

Taximpact of add-back items (2)

Tax provision impact related to CARES Act

Non-GAAP net income

GAAP diluted net income per share

Non-GAAP diluted net income per share

Weighted average shares of common stock outstanding-diluted

60

INOV Q3 2020 Earnings Supplement (10.28.20) v1.0.0

S

Three Months Ending

December 31, 2020

Low

High

17

8

14

(10)

24

0.11

0.16

150

14

1

(8)

(11)

30

0.17

0.20

150

$

Guidance Range

Year Ending

December 31, 2020

Low

High

19

31

ABRE

3

5

9

(26)

(10)

85

0.13

0.57

150

27

31

13259

(27)

(11)

91

0.18

0.61

150

+A

Year Ending

December 31, 2021

Low

High

32

54

ㄒㄒ

110

0.28

0.73

151

32

54

5

5

(30)

113

0.31

0.75

151

Other *non-comparable items include items that are not comparable across reporting periods or items that do not otherwise relate to the Company's ongoing financial results, such as certain employee related expenses attributable to advancements in automation and operational

efficiencies, and legal expenses beyond those in the normal course of business. Non-comparable items are excluded from Non-GAAP net income in order to more effectively assess the Company's period over period and ongoing operating performance.

28% statutory tax rate is assumed in order to approximate the Company's effective corporate tax rate for future periods

30View entire presentation