AES Panama Investor Presentation

Diversified and Reliable USD-linked Sources of Revenue

Key Highlights

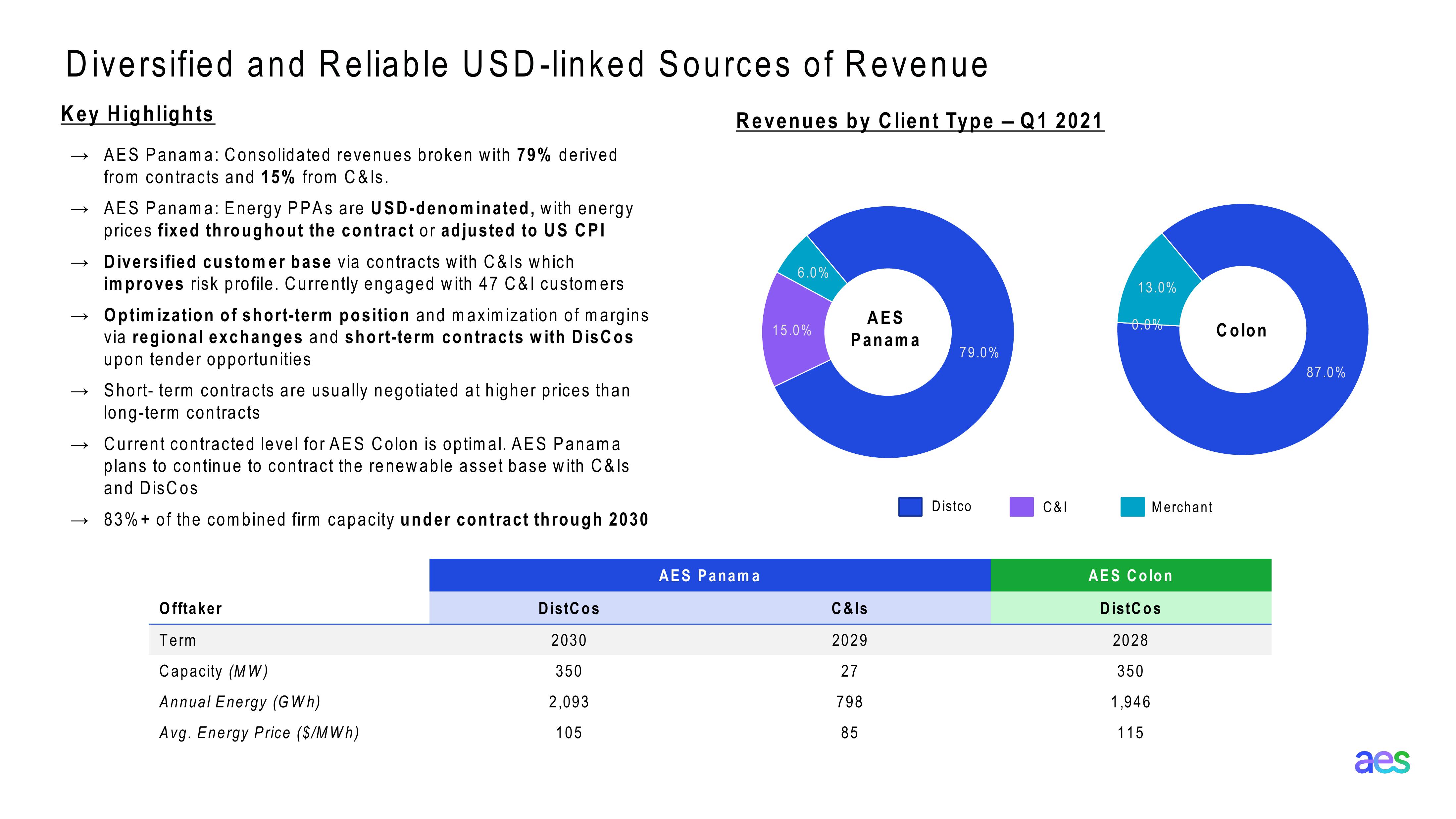

→> AES Panama: Consolidated revenues broken with 79% derived

from contracts and 15% from C&Is.

→>>

→>

->

→>>

AES Panama: Energy PPAs are USD-denominated, with energy

prices fixed throughout the contract or adjusted to US CPI

Diversified customer base via contracts with C&Is which

improves risk profile. Currently engaged with 47 C&I customers

Optimization of short-term position and maximization of margins

via regional exchanges and short-term contracts with DisCos

upon tender opportunities

Short-term contracts are usually negotiated at higher prices than

long-term contracts

→ Current contracted level for AES Colon is optimal. AES Panama

plans to continue to contract the renewable asset base with C&Is

and DisCos

→ 83% of the combined firm capacity under contract through 2030

Revenues by Client Type – Q1 2021

6.0%

13.0%

15.0%

AES

Panama

0.0%

Colon

79.0%

87.0%

Distco

C&I

Merchant

AES Panama

AES Colon

Offtaker

DistCos

C & Is

DistCos

Term

2030

2029

Capacity (MW)

350

27

Annual Energy (GWh)

2,093

798

2028

350

1,946

Avg. Energy Price ($/MWh)

105

85

115

aesView entire presentation