Deutsche Bank Results Presentation Deck

Commercial Real Estate (CRE) 1/2

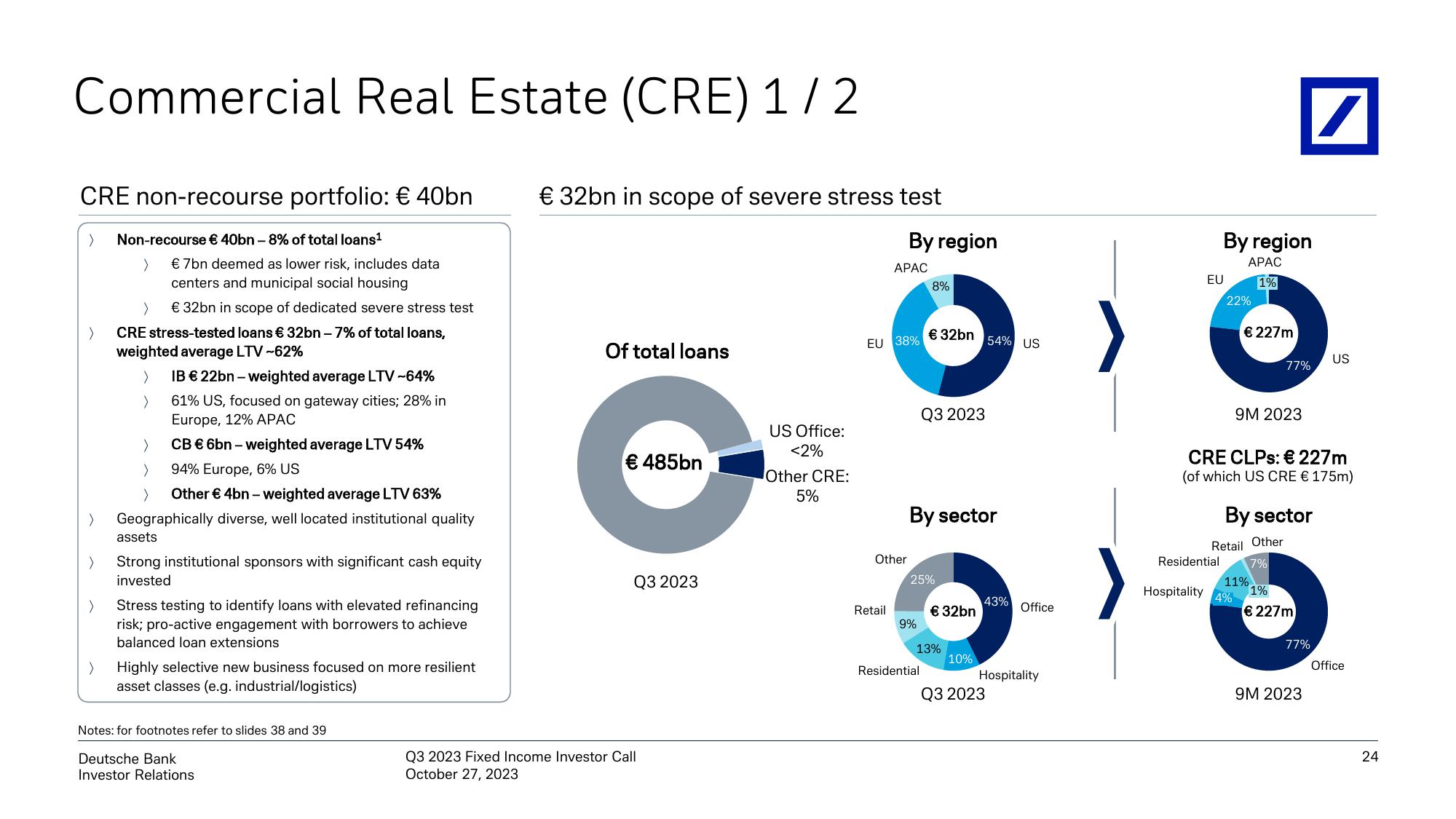

CRE non-recourse portfolio: € 40bn

> Non-recourse € 40bn - 8% of total loans¹

>

>

>

>

>

>

€ 32bn in scope of dedicated severe stress test

CRE stress-tested loans € 32bn - 7% of total loans,

weighted average LTV -62%

€ 7bn deemed as lower risk, includes data

centers and municipal social housing

IB € 22bn - weighted average LTV -64%

61% US, focused on gateway cities; 28% in

Europe, 12% APAC

CB € 6bn-weighted average LTV 54%

94% Europe, 6% US

>

Other € 4bn - weighted average LTV 63%

Geographically diverse, well located institutional quality

assets

Strong institutional sponsors with significant cash equity

invested

>

>

Stress testing to identify loans with elevated refinancing

risk; pro-active engagement with borrowers to achieve

balanced loan extensions

Highly selective new business focused on more resilient

asset classes (e.g. industrial/logistics)

Notes: for footnotes refer to slides 38 and 39

Deutsche Bank

Investor Relations

€ 32bn in scope of severe stress test

Of total loans

€ 485bn

Q3 2023

Q3 2023 Fixed Income Investor Call

October 27, 2023

US Office:

<2%

Other CRE:

5%

By region

APAC

EU 38%

Other

Retail

8%

9%

€ 32bn

Q3 2023

By sector

25%

Residential

€ 32bn

13%

10%

54% US

43% Office

Hospitality

Q3 2023

)

EU

By region

APAC

1%

22%

Residential

€ 227m

77%

9M 2023

Hospitality 4%

CRE CLPs: € 227m

(of which US CRE € 175m)

Retail Other

7%

1%

€227m

11%

By sector

/

77%

9M 2023

US

Office

24View entire presentation