Vroom Investor Day Presentation Deck

non-gaap reconciliations-adjusted ebitda

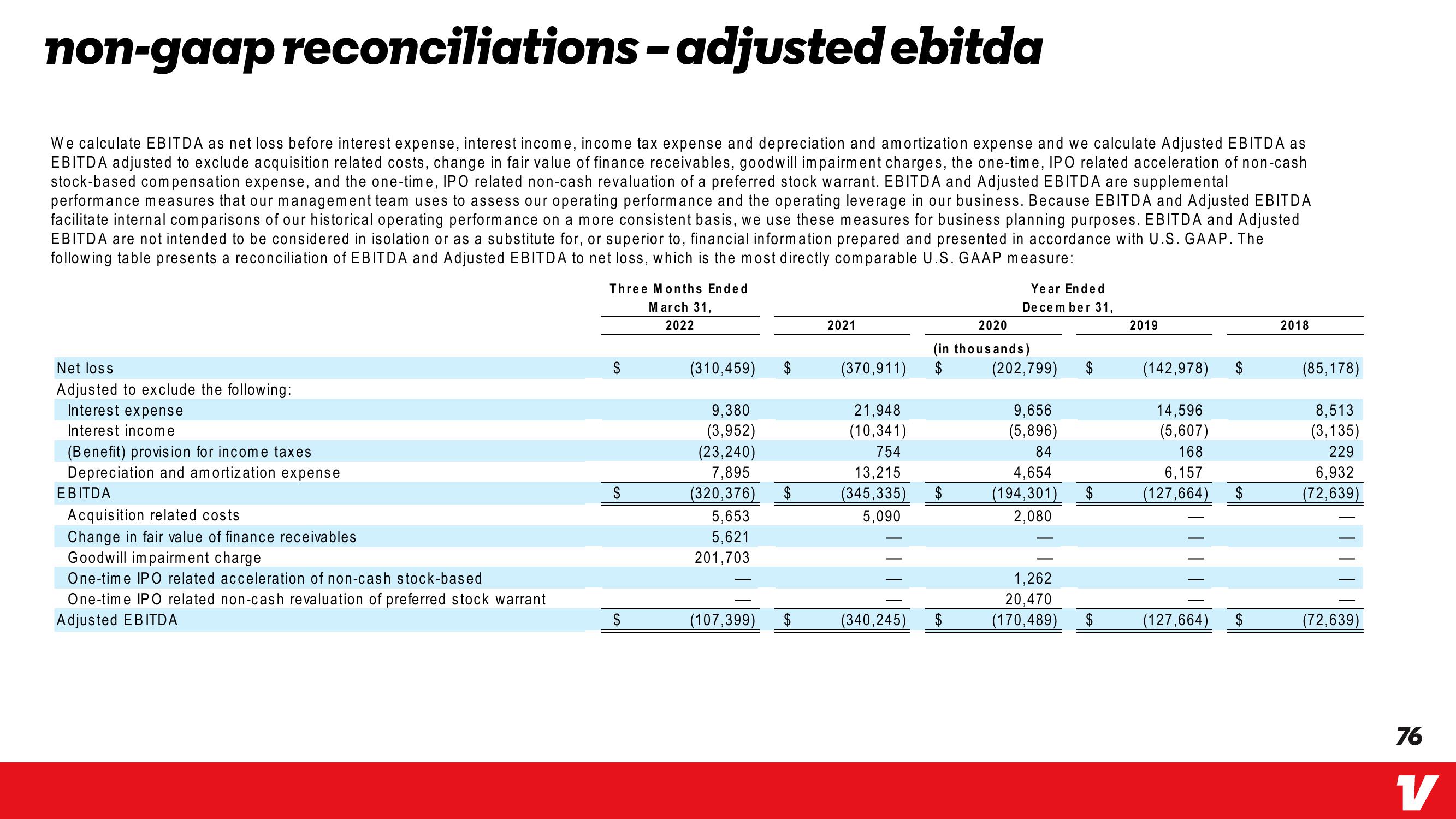

We calculate EBITDA as net loss before interest expense, interest income, income tax expense and depreciation and amortization expense and we calculate Adjusted EBITDA as

EBITDA adjusted to exclude acquisition related costs, change in fair value of finance receivables, goodwill impairment charges, the one-time, IPO related acceleration of non-cash

stock-based compensation expense, and the one-time, IPO related non-cash revaluation of a preferred stock warrant. EBITDA and Adjusted EBITDA are supplemental

performance measures that our management team uses to assess our operating performance and the operating leverage in our business. Because EBITDA and Adjusted EBITDA

facilitate internal comparisons of our historical operating performance on a more consistent basis, we use these measures for business planning purposes. EBITDA and Adjusted

EBITDA are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with U.S. GAAP. The

following table presents a reconciliation of EBITDA and Adjusted EBITDA to net loss, which is the most directly comparable U.S. GAAP measure:

Net loss

Adjusted to exclude the following:

Interest expense

Interest income

(Benefit) provision for income taxes

Depreciation and amortization expense

EBITDA

Acquisition related costs

Change in fair value of finance receivables

Goodwill impairment charge

One-time IPO related acceleration of non-cash stock-based

One-time IPO related non-cash revaluation of preferred stock warrant

Adjusted EBITDA

Three Months Ended

March 31,

2022

$

$

(310,459)

9,380

(3,952)

(23,240)

7,895

(320,376)

5,653

5,621

201,703

$

(107,399) $

2021

(370,911)

21,948

(10,341)

754

13,215

(345,335)

5,090

2020

(in thousands)

$

$

Year Ended

December 31,

(340,245) $

(202,799) $

9,656

(5,896)

84

4,654

(194,301)

2,080

1,262

20,470

(170,489)

$

$

2019

(142,978)

14,596

(5,607)

168

6,157

(127,664)

$

(127,664) $

2018

(85,178)

8,513

(3,135)

229

6,932

(72,639)

(72,639)

76

VView entire presentation