Evercore Investment Banking Pitch Book

Appendix

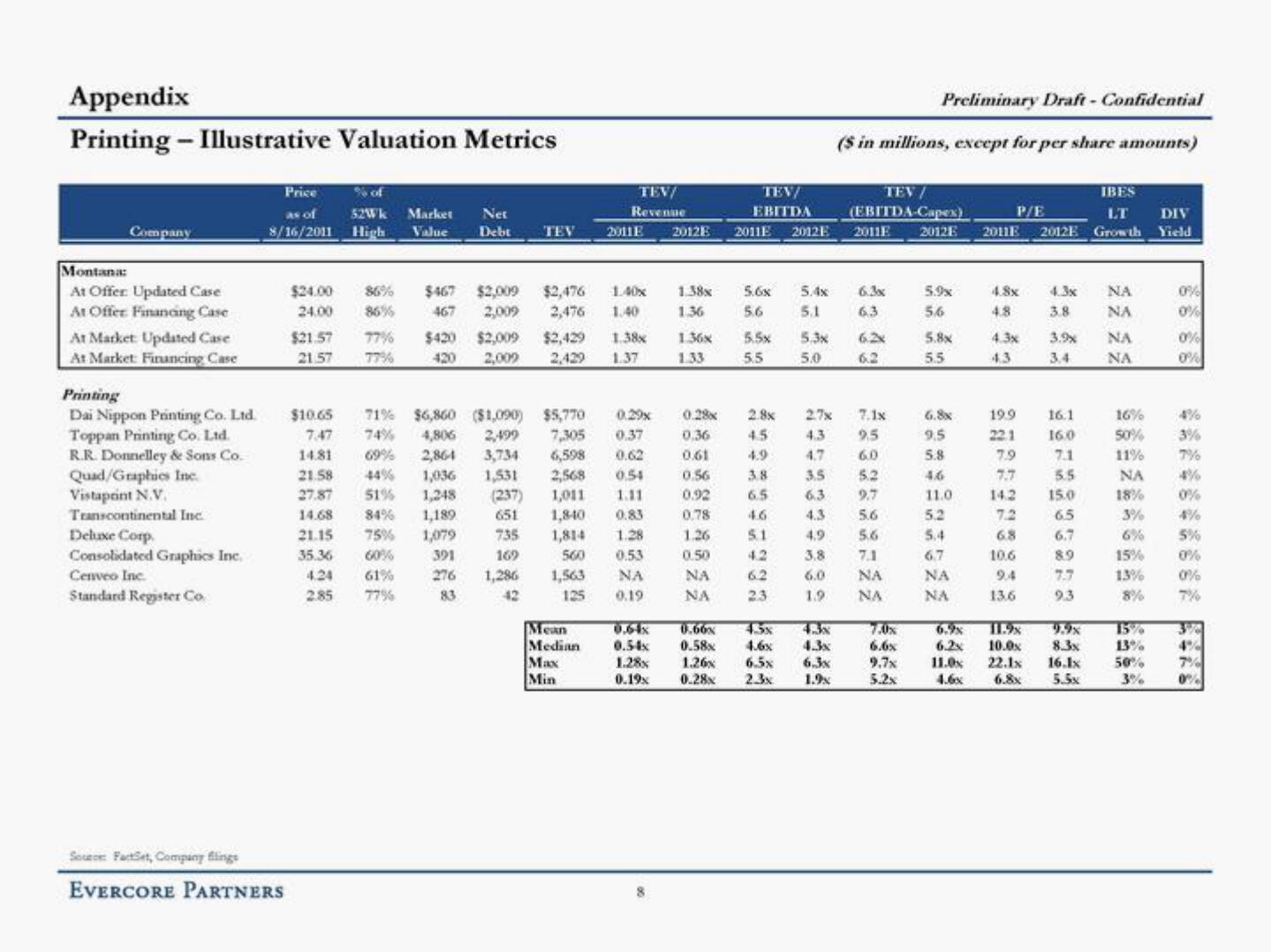

Printing - Illustrative Valuation Metrics

Company

Montana:

At Offer: Updated Case

At Offer Financing Case

At Market Updated Case

At Market Financing Case

Printing

Dai Nippon Printing Co. Ltd.

Toppan Printing Co. Ltd.

R.R. Donnelley & Sons Co.

Quad/Graphics Inc.

Vistaprint N.V.

Transcontinental Inc.

Deluxe Corp.

Consolidated Graphics Inc.

Cenveo Inc.

Standard Register Co.

Price

as of

8/16/2011

Source FactSet, Company filings

EVERCORE PARTNERS

52Wk Market Net

High Value

Debt

$24.00

24.00

$21.57

21.57 77%

$10.65

7.47

14.81

86% $467

86%

35.36

4.24

2.85

$2,009

467 2,009

77% $420 $2,009

2,009

TEV

$2,476

2,476

TEV/

Revenue

2011E

Mean

Median

Max

Min

1.40x

1.40

$2,429

2,429 1.37

71% $6,860 ($1,090)

$5,770

0.29x

74%

4,806

0.37

2,499

7,305

3,734 6,598 0.62

69% 2,864

21.58 44% 1,036 1,531 2,568 0.54

27.87 51% 1,248 (237) 1,011 1.11

651 1,840 0.83

14.68

84% 1,189

21.15

75%

1,079

735 1,814 1.28

60%

391

0.53

169

560

276 1,286 1,563

61%

NA

77%

83

42

125

0.19

1.38x 1.36x

1.33

2012E 2011E 2012 E

1.38x

1.36

TEV/

EBITDA

0.28x

0.36

0.61

0.56

0.92

0.78

1.26

0.50

NA

NA

5.6x

5.6

5.5x

5.5

5.4x

5.1

2.8x 2.7x

4.5

4.9

3.8

6.5

46

5.1

4.2

62

23

Preliminary Draft - Confidential

($ in millions, except for per share amounts)

TEV /

(EBITDA-Capex)

4.3x

0.64x 0.66% 458 488

0.54x 0.58x 4.6x

1.28x 1.26% 6.5x

0.19x 0.28% 2.3x

6.3x

1.9%

2011E

5.3x 6.2x

5.0

6.2

6.3x

63

7.1x

4.3 9.5

6.0

3.5

52

6.3 9,7

4.3

5.6

4.9

5.6

3.8 7.1

6.0

NA

1.9 NA

7.0%

6.6x

9.7x

5.2x

2012E

5.9x

56

5.8x

5.5

6.8x

9.5

5.8

46

11.0

5.2

5.4

6.7

NA

NA

IBES

LT

2011E 2012E Growth

P/E

4.8x

4.8

4.3x

43

19.9

221

7.9

142

7.2

6.8

10.6

9.4

13.6

6.9%

6.2x 10.0x

4.3x ΝΑ

3.8

NA

3.4

16.1

16.0

7.1

5.5

15.0

6.5

6.7

8.9

9.3

8.3x

11.0x 22.1x 16.1x

4.6x

6.8x

5.5x

NA

NA

16%

50%

11%

NA

18%

3%

6%

15%

13%

8%

15%

13%

50%

3%

DIV

Yield

0%

0%

0%

0%

3%

7%

0%

4%

5%

0%

0%

7%

90

4%

7%

0%View entire presentation