Tudor, Pickering, Holt & Co Investment Banking

Transaction Assumptions | Pre-Unitholder Tax

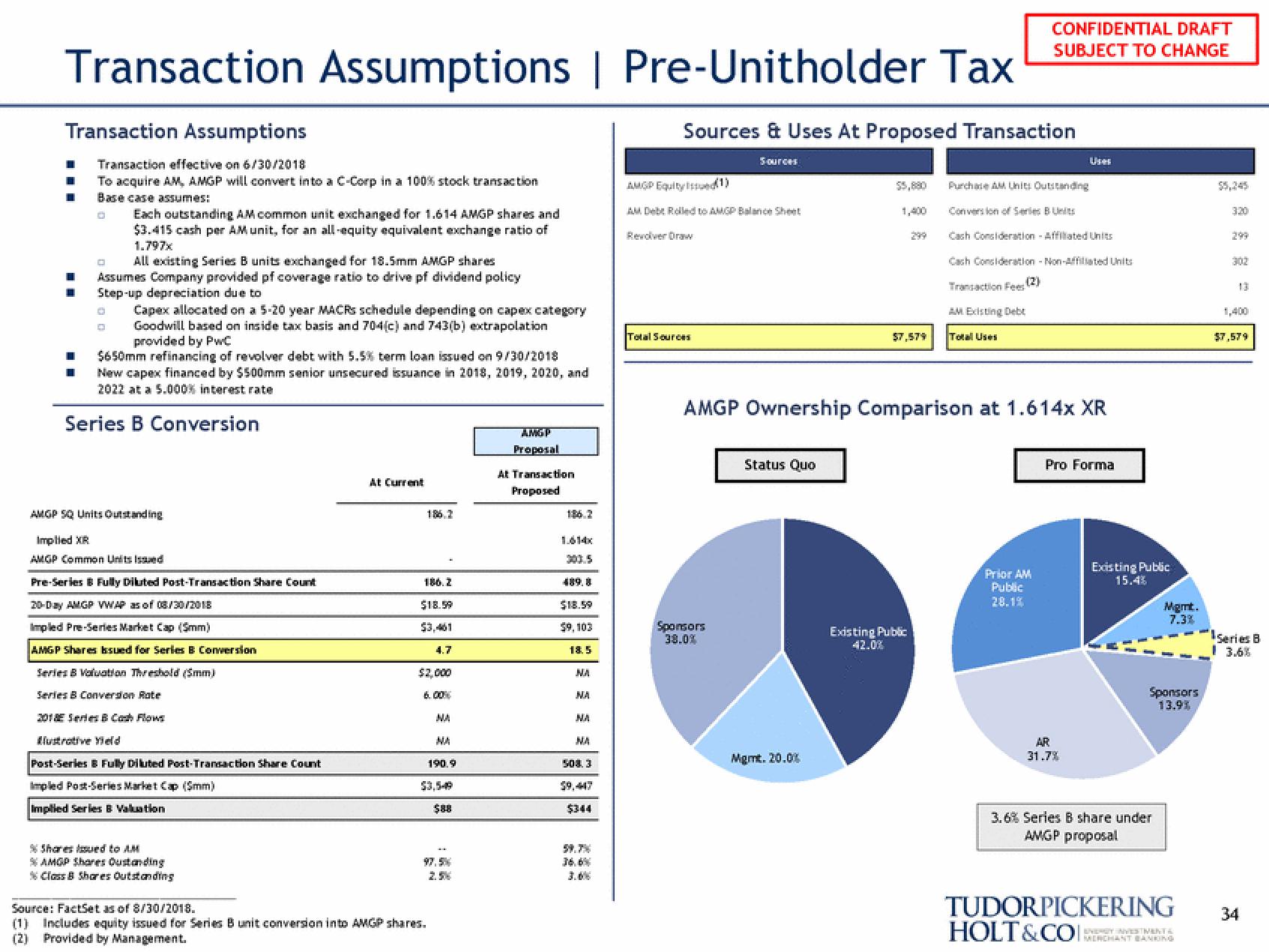

Sources & Uses At Proposed Transaction

Sources

Transaction Assumptions

Transaction effective on 6/30/2018

To acquire AM, AMGP will convert into a C-Corp in a 100% stock transaction

Base case assumes:

□

"

■

■

O

All existing Series B units exchanged for 18.5mm AMGP shares

Assumes Company provided pf coverage ratio to drive pf dividend policy

Step-up depreciation due to

Each outstanding AM common unit exchanged for 1.614 AMGP shares and

$3.415 cash per AM unit, for an all-equity equivalent exchange ratio of

1.797x

13

Capex allocated on a 5-20 year MACRS schedule depending on capex category

Goodwill based on inside tax basis and 704(c) and 743(b) extrapolation

provided by PwC

$650mm refinancing of revolver debt with 5.5% term loan issued on 9/30/2018

New capex financed by $500mm senior unsecured issuance in 2018, 2019, 2020, and

2022 at a 5.000% interest rate

Series B Conversion

AMGP SQ Units Outstanding

Implied XR

AMGP Common Units issued

Pre-Series & Fully Diluted Post-Transaction Share Count

20-Day AMGP VWAP as of 08/30/2018

Impled Pre-Series Market Cap (Smm)

AMGP Shares Issued for Series B Conversion

Series & Valuation Threshold (mm)

Series B Conversion Rate

201 Serie B Cash Flows

Elustrative Yield

Post-Series & Fully Diluted Post-Transaction Share Count

Impled Post-Series Market Cap (Smm)

Implied Series & Valuation

% Shares Issued to AM

% AMGP Shares Oustanding

* Class 8 Shares Outstanding

At Current

186.2

186.2

$18.99

$3,461

4.7

$2,000

6.00%

Source: FactSet as of 8/30/2018.

(1) Includes equity issued for Series B unit conversion into AMGP shares.

(2) Provided by Management.

MA

MA

190.9

$3,5-9

$88

Proposal

At Transaction

Proposed

$18.99

59,103

18.5

MA

NA

NA

NA

508.3

$344

AMGP Equity Issued (1)

AM Debe Rolled to AMGP Balance Sheet

Revolver Draw

Total Sources

Sponsors

38.0%

Status Quo

$7,579

Mgmt. 20.0%

Existing Public

42.0%

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

Purchase AM Units Outstanding

Conversion of Series Units

AMGP Ownership Comparison at 1.614x XR

Cash Consideration - Affiliated Units

AM Existing Debt

Total Uses

Cash Consideration-Non-Affiliated Units

(2)

Transaction Fees

Uses

Prior AM

Public

28.1%

Pro Forma

AR

31.7%

Existing Public

15.4%

Mgmt.

7.3%

Sponsors

13.9%

3.6% Series B share under

AMGP proposal

TUDORPICKERING

HOLT&COI:

VERY NYESTMENT &

MERCHANT BANKING

302

13

$7,579

Series B

I 3.6%

34View entire presentation