First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

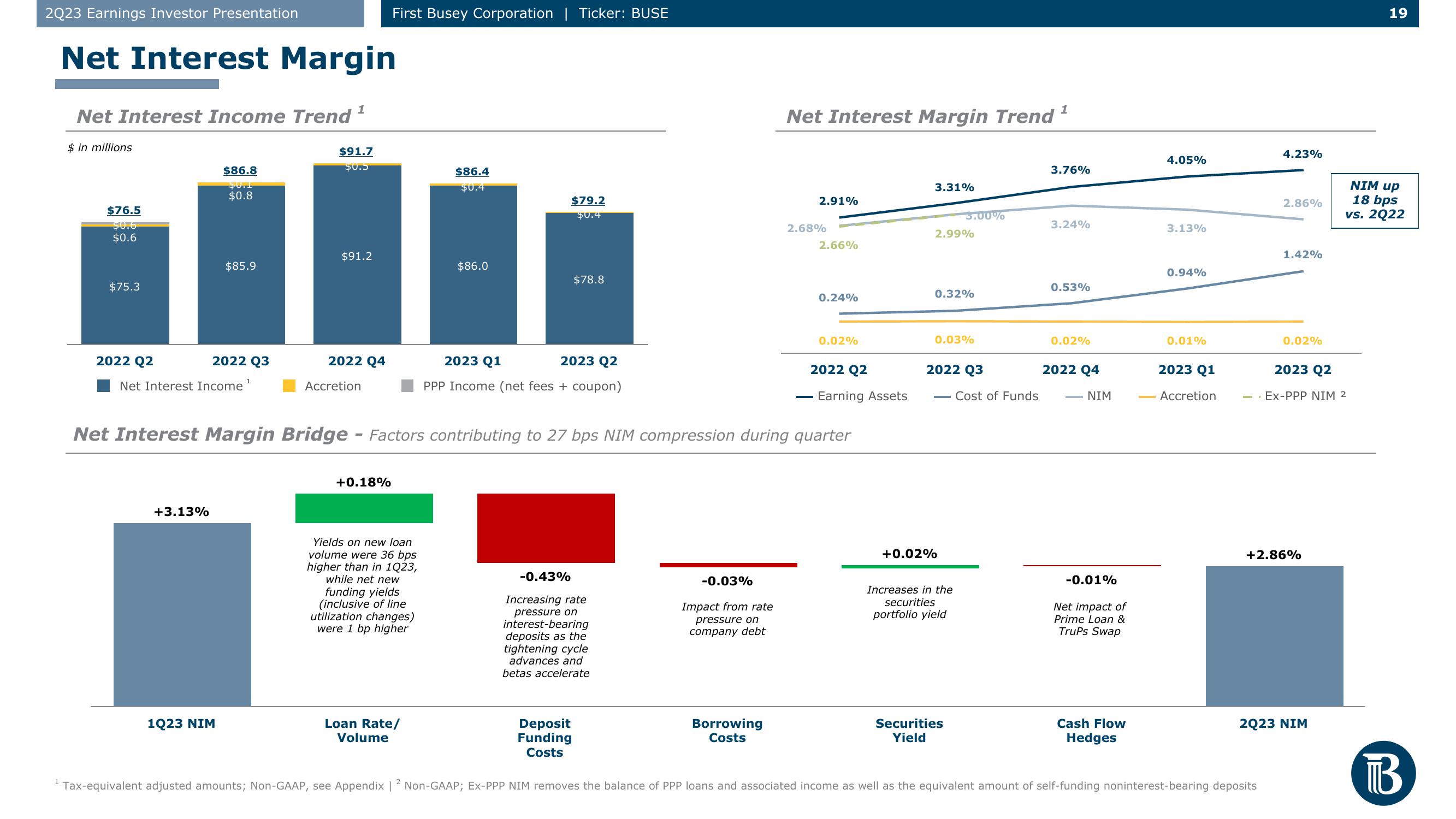

Net Interest Margin

Net Interest Income Trend ¹

$ in millions

$76.5

$0.6

$0.6

$75.3

2022 Q2

$86.8

$0.8

+3.13%

$85.9

2022 Q3

Net Interest Income

1023 NIM

1

$91.7

$0.5

$91.2

2022 Q4

Net Interest Margin Bridge

Accretion

First Busey Corporation | Ticker: BUSE

+0.18%

Yields on new loan

volume were 36 bps

higher than in 1Q23,

while net new

funding yields

(inclusive of line

utilization changes)

were 1 bp higher

$86.4

$0.4

$86.0

Loan Rate/

Volume

$79.2

$0.4

$78.8

2023 Q1

2023 Q2

PPP Income (net fees + coupon)

-0.43%

Increasing rate

pressure on

interest-bearing

deposits as the

tightening cycle

advances and

betas accelerate

-0.03%

Impact from rate

pressure on

company debt

Net Interest Margin Trend

Factors contributing to 27 bps NIM compression during quarter

2.91%

Borrowing

Costs

2.68%

2.66%

0.24%

0.02%

2022 Q2

Earning Assets

3.31%

+0.02%

2.99%

3.00%

0.32%

0.03%

2022 Q3

Increases in the

securities

portfolio yield

Securities

Yield

Cost of Funds

1

3.76%

3.24%

0.53%

0.02%

2022 Q4

NIM

-0.01%

Net impact of

Prime Loan &

Trups Swap

4.05%

Cash Flow

Hedges

3.13%

0.94%

Deposit

Funding

Costs

Tax-equivalent adjusted amounts; Non-GAAP, see Appendix | 2 Non-GAAP; EX-PPP NIM removes the balance of PPP loans and associated income as well as the equivalent amount of self-funding noninterest-bearing deposits

0.01%

2023 Q1

Accretion

4.23%

2.86%

1.42%

0.02%

+2.86%

2023 Q2

Ex-PPP NIM 2

2023 NIM

19

NIM up

18 bps

vs. 2Q22

ТВView entire presentation