System1 SPAC Presentation Deck

Transaction Overview

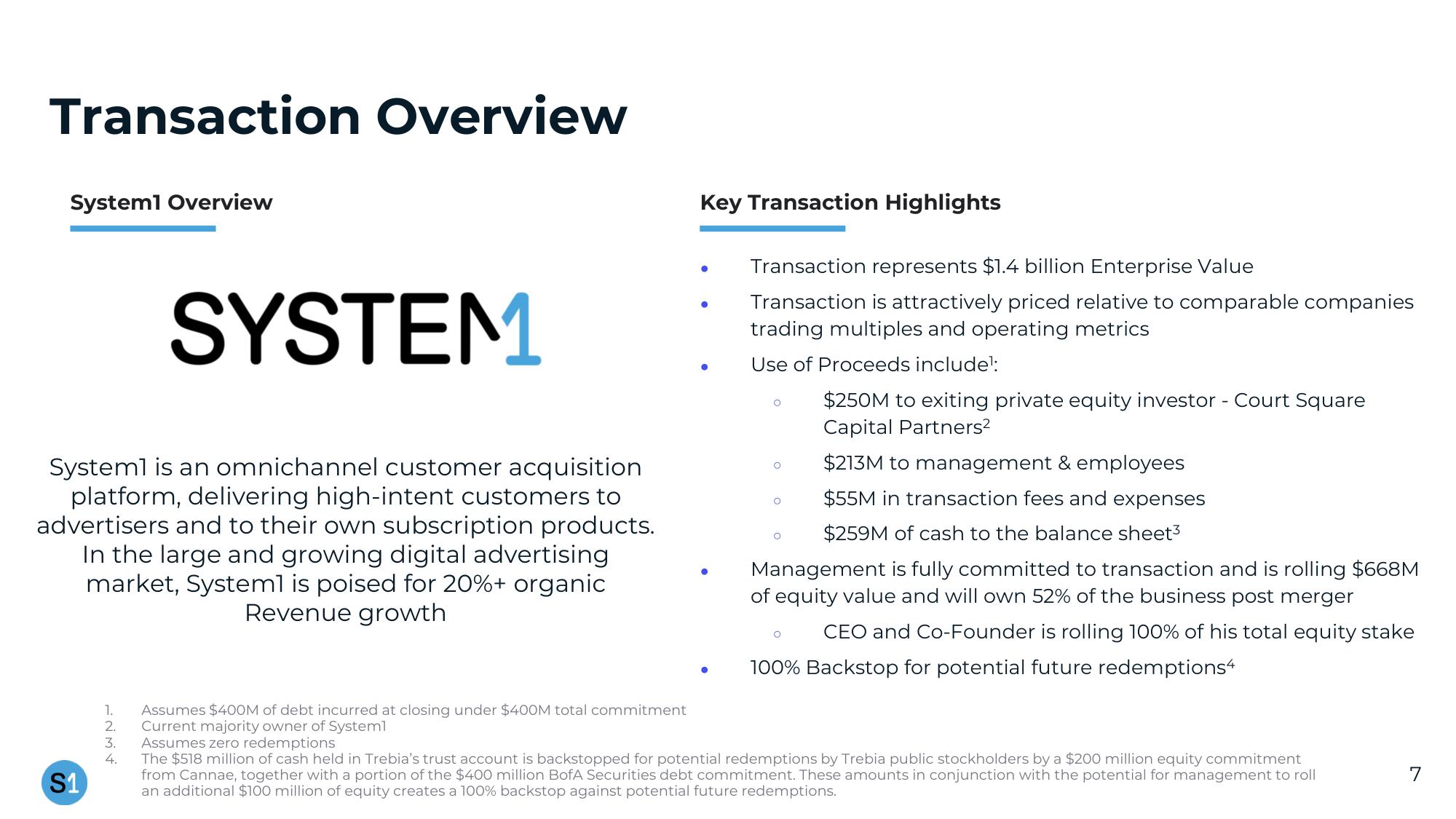

System1 Overview

SYSTEM

System1 is an omnichannel customer acquisition

platform, delivering high-intent customers to

advertisers and to their own subscription products.

In the large and growing digital advertising

market, System1 is poised for 20%+ organic

Revenue growth

S1

1.

2.

3.

4.

Assumes $400M of debt incurred at closing under $400M total commitment

Current majority owner of Systeml

Key Transaction Highlights

●

Transaction represents $1.4 billion Enterprise Value

Transaction is attractively priced relative to comparable companies

trading multiples and operating metrics

Use of Proceeds include¹:

$250M to exiting private equity investor - Court Square

Capital Partners²

$213M to management & employees

$55M in transaction fees and expenses

$259M of cash to the balance sheet³

Management is fully committed to transaction and is rolling $668M

of equity value and will own 52% of the business post merger

CEO and Co-Founder is rolling 100% of his total equity stake

100% Backstop for potential future redemptions4

O

O

O

O

O

Assumes zero redemptions

The $518 million of cash held in Trebia's trust account is backstopped for potential redemptions by Trebia public stockholders by a $200 million equity commitment

from Cannae, together with a portion of the $400 million BofA Securities debt commitment. These amounts in conjunction with the potential for management to roll

an additional $100 million of equity creates a 100% backstop against potential future redemptions.

7View entire presentation