Netstreit IPO Presentation Deck

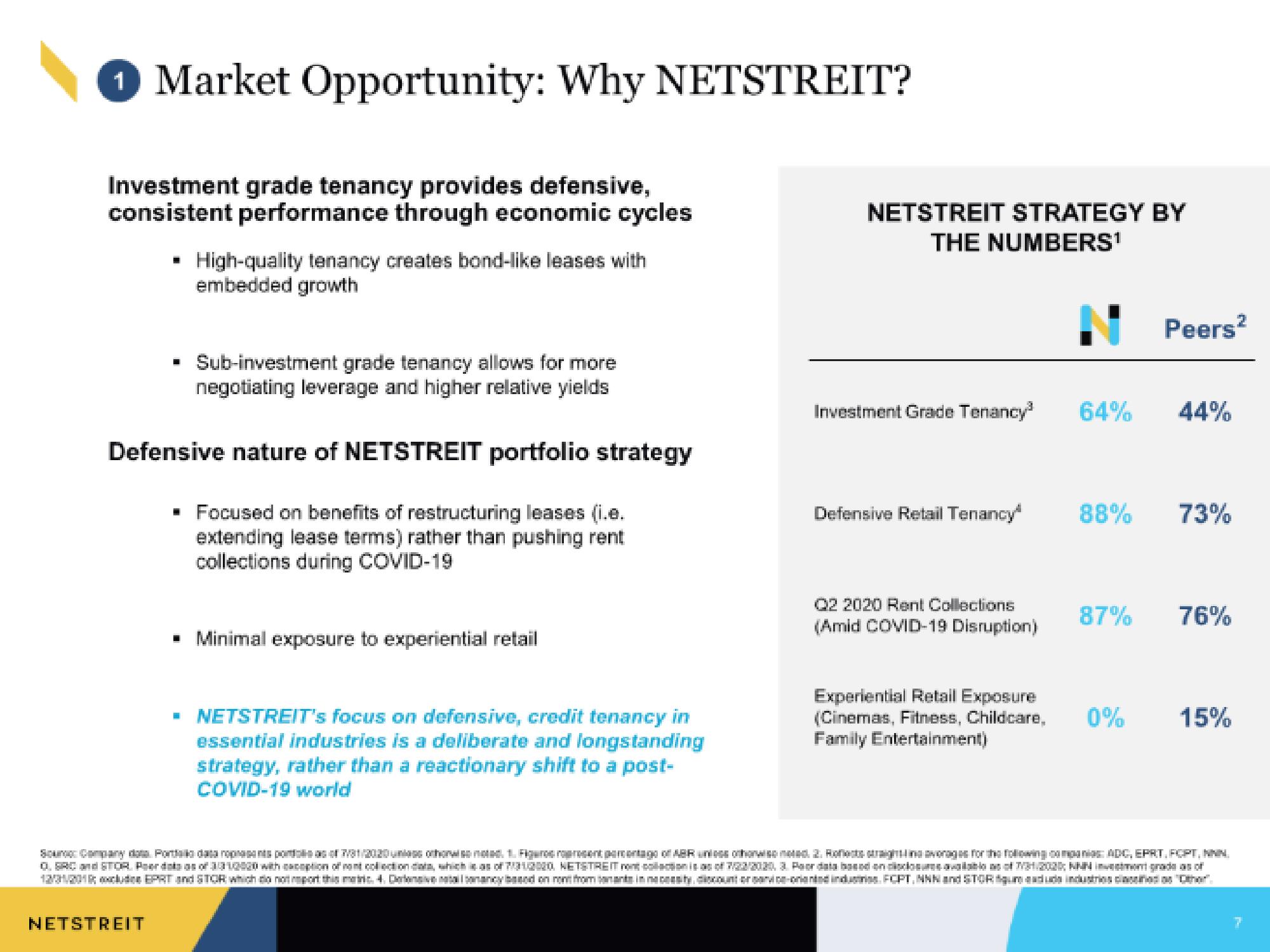

Market Opportunity: Why NETSTREIT?

Investment grade tenancy provides defensive,

consistent performance through economic cycles

■

High-quality tenancy creates bond-like leases with

embedded growth

Sub-investment grade tenancy allows for more

negotiating leverage and higher relative yields

Defensive nature of NETSTREIT portfolio strategy

▪ Focused on benefits of restructuring leases (i.e.

extending lease terms) rather than pushing rent

collections during COVID-19

NETSTREIT

▪ Minimal exposure to experiential retail

▪ NETSTREIT's focus on defensive, credit tenancy in

essential industries is a deliberate and longstanding

strategy, rather than a reactionary shift to a post-

COVID-19 world

NETSTREIT STRATEGY BY

THE NUMBERS¹

Investment Grade Tenancy³ 64%

Defensive Retail Tenancy

Q2 2020 Rent Collections

(Amid COVID-19 Disruption)

Experiential Retail Exposure

(Cinemas, Fitness, Childcare,

Family Entertainment)

Peers²

44%

88% 73%

0%

87% 76%

15%

Source Company dats. Portak data represents portlas of 781/2020 unless otherwise noted. 1. Figuros represent percentage of ABR unless otherwise noted. 2. Roñocts straightline averages for the following compania ADC,EPRT, FOPT, NNN.

O.SRC and STOR. Per disas of 3310020 with exception of rent collection data, which is asof 71312020, NETSTREIT ont collection is as of 7/22/2020, 3. Paor data based on closure available no of 7/3/2020; NAN investmont grade as of

12/31/2018: xcludes EPRT and STOR which do not report this m. 4. Dertensive tallbonancy and on rent from saman in necesity, discount or service-oria nånd industrias FCPT, NNN and STOR que duda industries as "Other"View entire presentation