Barclays Global Financial Services Conference

Non-Core - 2013 'rump' make-up

£bn

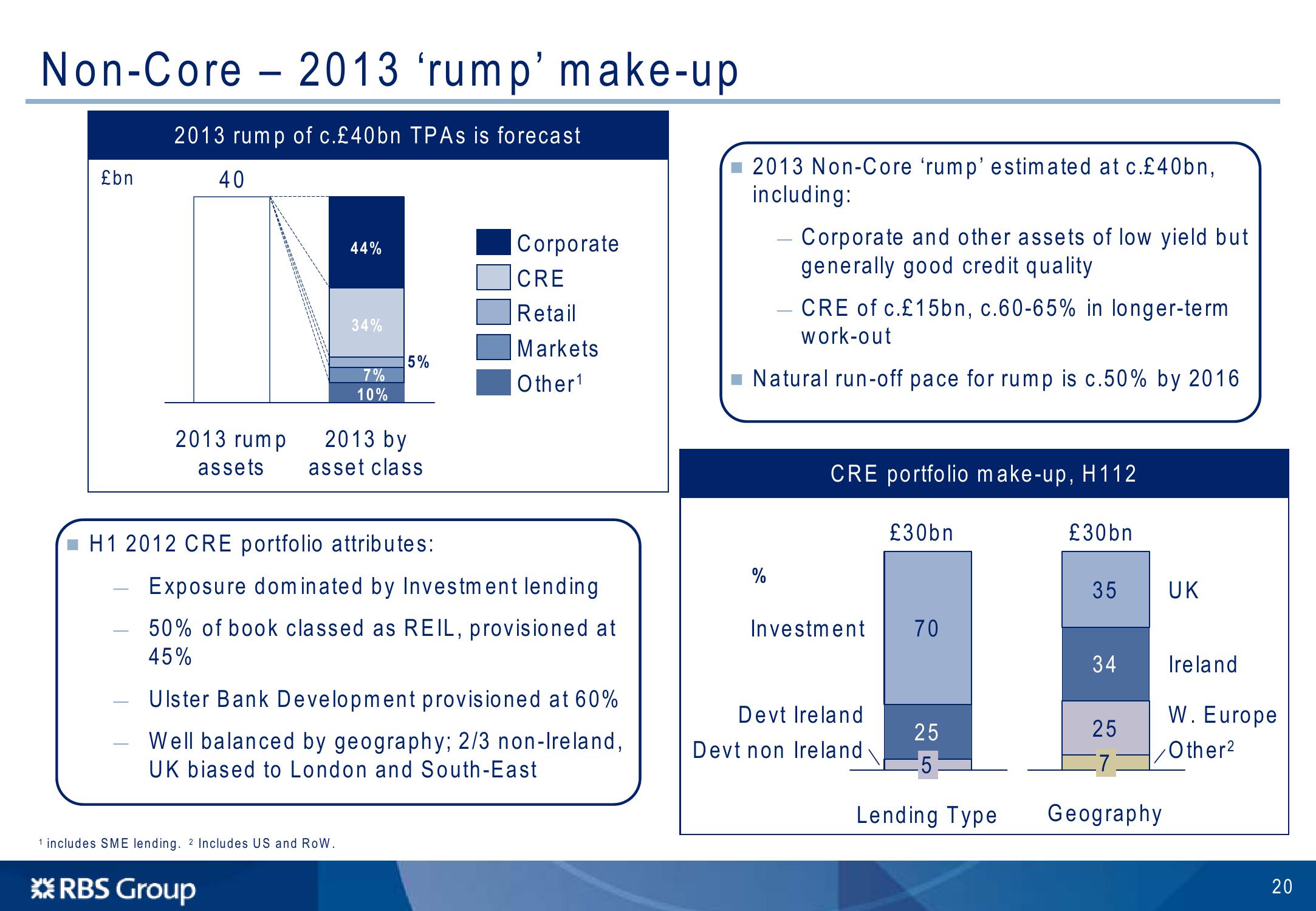

2013 rump of c.£40bn TPAs is forecast

40

2013 rump

assets

Corporate

44%

CRE

Retail

34%

5%

7%

Markets

Other1

10%

2013 by

asset class

2013 Non-Core 'rump' estimated at c.£40bn,

including:

Corporate and other assets of low yield but

generally good credit quality.

CRE of c.£15bn, c.60-65% in longer-term

work-out

Natural run-off pace for rump is c.50% by 2016

CRE portfolio make-up, H112

H1 2012 CRE portfolio attributes:

Exposure dominated by Investment lending

50% of book classed as REIL, provisioned at

45%

Ulster Bank Development provisioned at 60%

Well balanced by geography; 2/3 non-Ireland,

UK biased to London and South-East

1 includes SME lending. 2 Includes US and Row.

*RBS Group

£30bn

£30bn

%

35

UK

Investment

70

34

Ireland

Devt Ireland

Devt non Ireland

W. Europe

25

25

Other2

5

Lending Type

Geography

20

20View entire presentation