Kinnevik Investor Event Presentation Deck

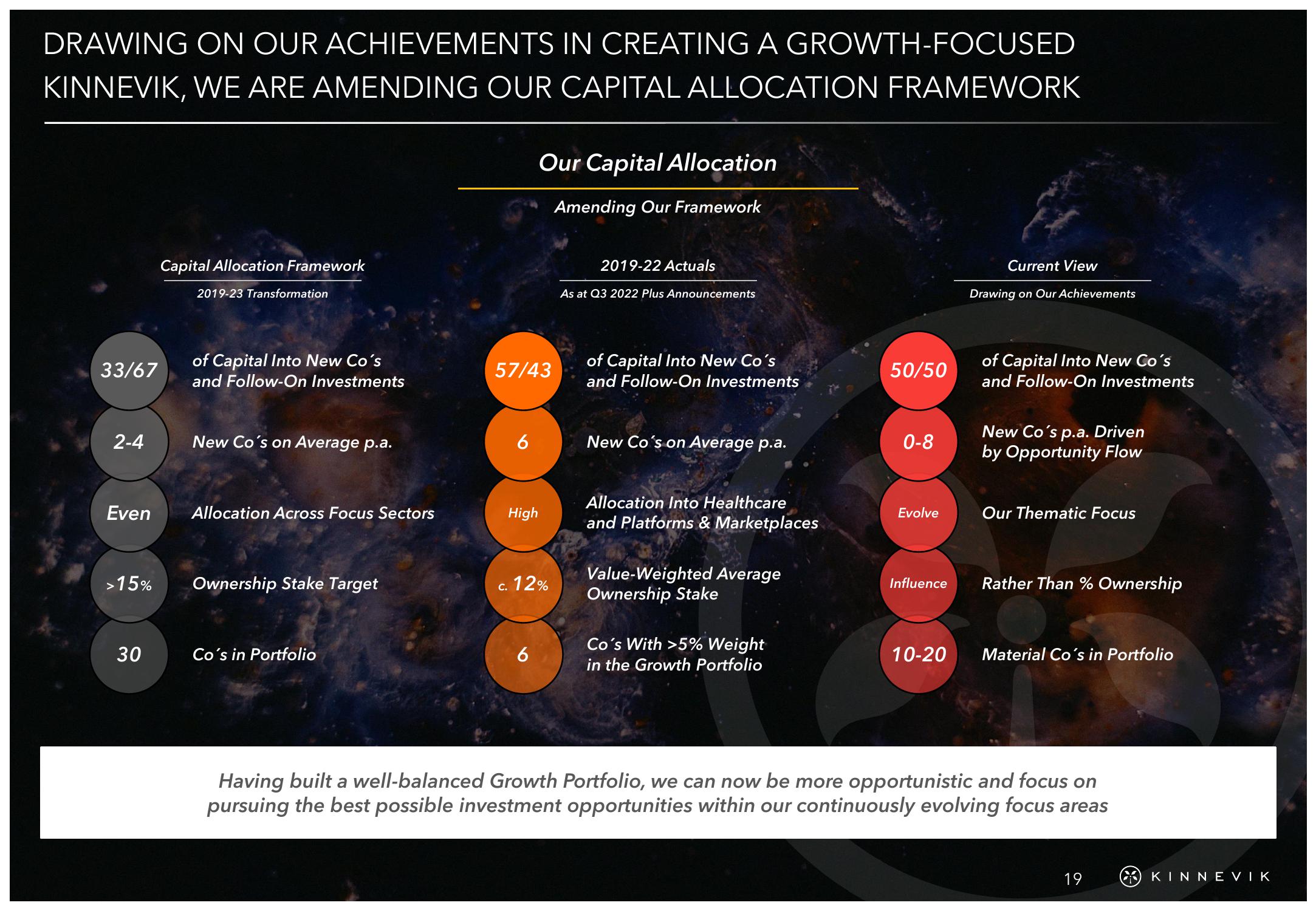

DRAWING ON OUR ACHIEVEMENTS IN CREATING A GROWTH-FOCUSED

KINNEVIK, WE ARE AMENDING OUR CAPITAL ALLOCATION FRAMEWORK

33/67

2-4

Even

>15%

30

Capital Allocation Framework

2019-23 Transformation

of Capital Into New Co's

and Follow-On Investments

New Co's on Average p.a.

Allocation Across Focus Sectors

Ownership Stake Target

Co's in Portfolio

Our Capital Allocation

Amending Our Framework

57/43

0000

High

c. 12%

6

2019-22 Actuals

As at Q3 2022 Plus Announcements

of Capital Into New Co's

and Follow-On Investments

New Co's on Average p.a.

Allocation Into Healthcare

and Platforms & Marketplaces

Value-Weighted Average

Ownership Stake

Co's With >5% Weight

in the Growth Portfolio

50/50

0-8

Evolve

Current View

Drawing on Our Achievements

10-20

of Capital Into New Co's

and Follow-On Investments

New Co's p.a. Driven

by Opportunity Flow

Our Thematic Focus

Influence Rather Than % Ownership

Material Co's in Portfolio

Having built a well-balanced Growth Portfolio, we can now be more opportunistic and focus on

pursuing the best possible investment opportunities within our continuously evolving focus areas

19

KINNEVIKView entire presentation