Azerion Results Presentation Deck

Financial update

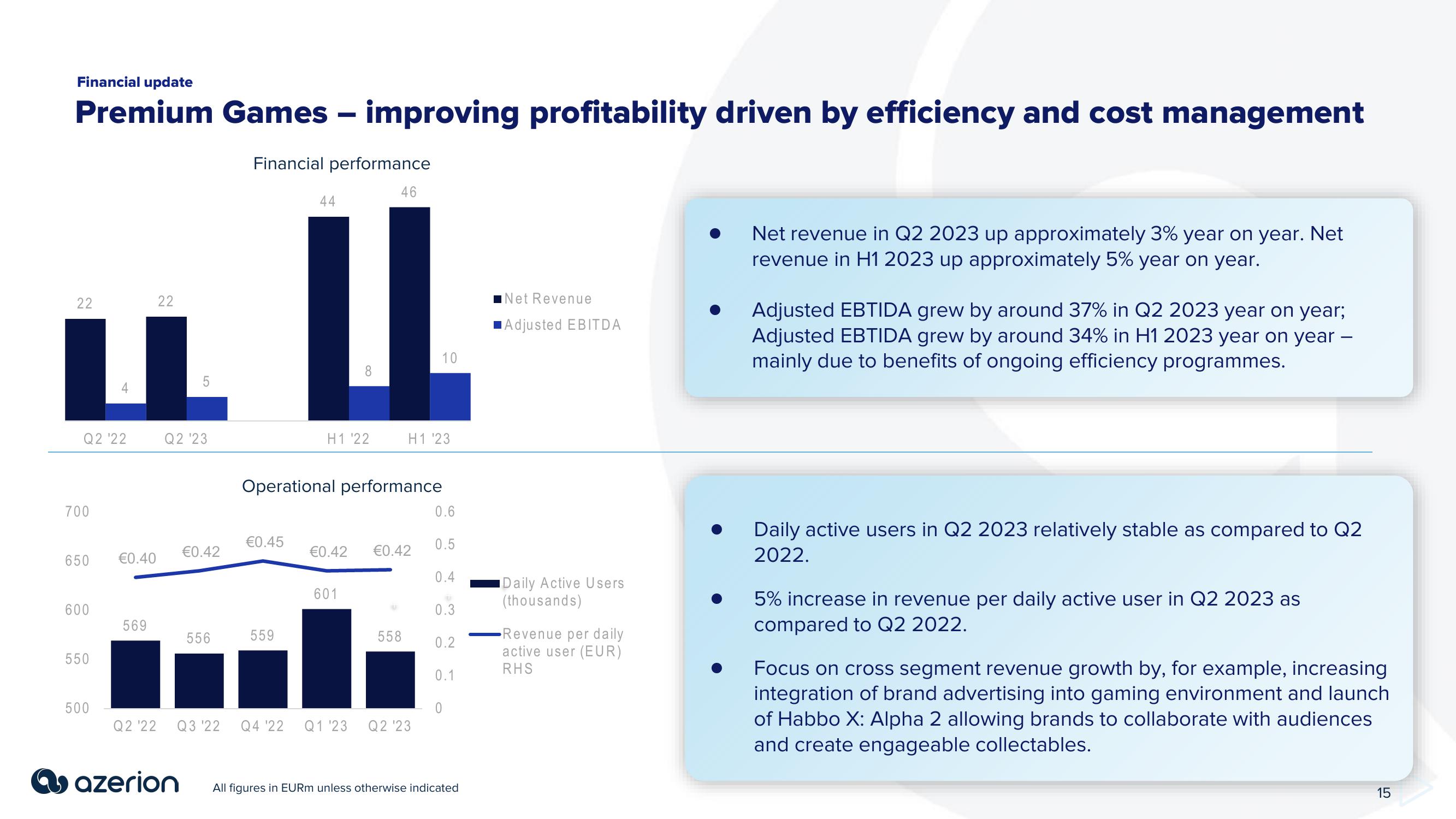

Premium Games - improving profitability driven by efficiency and cost management

Financial performance

22

LL

4

Q2 '22

700

650

600

550

500

€0.40

22

569

Q2 '22

5

Q2 '23

azerion

€0.42

556

€0.45

46

44

LL

10

8

559

H1'22

Operational performance

H1'23

€0.42 €0.42

601

558

Q3 ¹22 Q4 '22 Q1 '23 Q2 '23

0.6

0.5

0.4

0.3

0.2

0.1

0

All figures in EURm unless otherwise indicated

Net Revenue

Adjusted EBITDA

Daily Active Users

(thousands)

Revenue per daily

active user (EUR)

RHS

Net revenue in Q2 2023 up approximately 3% year on year. Net

revenue in H1 2023 up approximately 5% year on year.

Adjusted EBTIDA grew by around 37% in Q2 2023 year on year;

Adjusted EBTIDA grew by around 34% in H1 2023 year on year -

mainly due to benefits of ongoing efficiency programmes.

Daily active users in Q2 2023 relatively stable as compared to Q2

2022.

5% increase in revenue per daily active user in Q2 2023 as

compared to Q2 2022.

Focus on cross segment revenue growth by, for example, increasing

integration of brand advertising into gaming environment and launch

of Habbo X: Alpha 2 allowing brands to collaborate with audiences

and create engageable collectables.

15View entire presentation