Maersk Results Presentation Deck

A.P. Moller Maersk Group

- Interim Report 02 2015

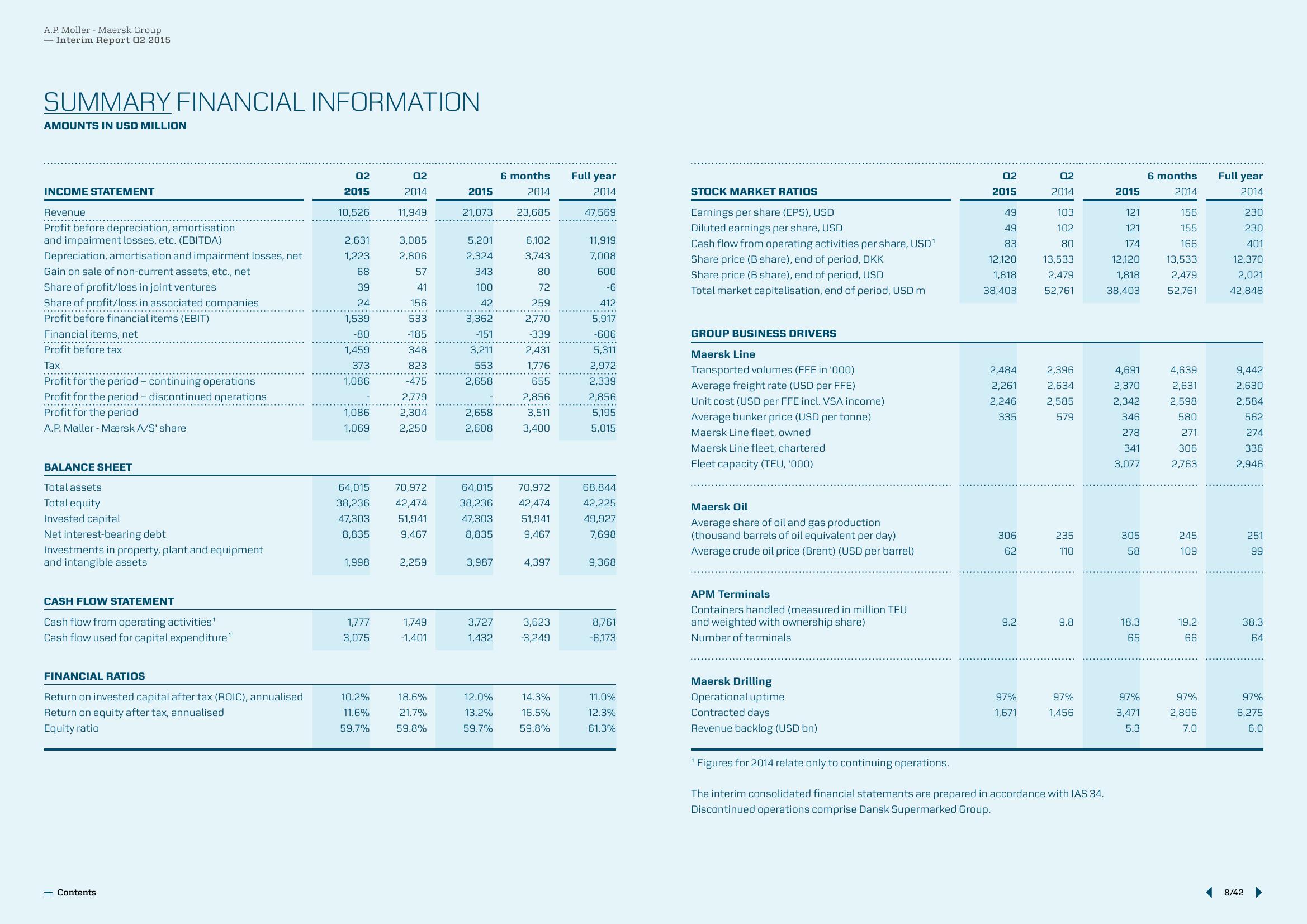

SUMMARY FINANCIAL INFORMATION

AMOUNTS IN USD MILLION

INCOME STATEMENT

Revenue

******

Profit before depreciation, amortisation

and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

Share of profit/loss in associated companies

************

Profit before financial items (EBIT)

Financial items, net

Profit before tax

Tax

Profit for the period - continuing operations

Profit for the period - discontinued operations

Profit for the period

A.P. Møller-Mærsk A/S' share

BALANCE SHEET

Total assets

Total equity

Invested capital

Net interest-bearing debt

Investments in property, plant and equipment

and intangible assets

CASH FLOW STATEMENT

Cash flow from operating activities¹

Cash flow used for capital expenditure¹

FINANCIAL RATIOS

Return on invested capital after tax (ROIC), annualised

Return on equity after tax, annualised

Equity ratio

Contents

02

2015

10,526

2,631

1,223

68

39

24

1,539

-80

1,459

373

1,086

1,086

1,069

64,015

38,236

47,303

8,835

1,998

1,777

3,075

10.2%

11.6%

59.7%

02

2014

11,949

3,085

2,806

57

41

156

533

-185

348

823

-475

2,779

2,304

2,250

70,972

42,474

51,941

9,467

2,259

1,749

-1,401

18.6%

21.7%

59.8%

2015

21,073

5,201

2,324

343

100

42

3,362

-151

3,211

553

2,658

2,658

2,608

64,015

38,236

47,303

8,835

3,987

3,727

1,432

12.0%

13.2%

59.7%

6 months

2014

23,685

6,102

3,743

80

72

259

2,770

-339

2,431

1,776

655

2,856

3,511

3,400

70,972

42,474

51,941

9,467

4,397

3,623

-3,249

14.3%

16.5%

59.8%

Full year

2014

47,569

11,919

7,008

600

-6

412

5,917

-606

5,311

2,972

2,339

2,856

5,195

5,015

68,844

42,225

49,927

7,698

9,368

8,761

-6,173

11.0%

12.3%

61.3%

STOCK MARKET RATIOS

Earnings per share (EPS), USD

Diluted earnings per share, USD

Cash flow from operating activities per share, USD¹

Share price (B share), end of period, DKK

Share price (B share), end of period, USD

Total market capitalisation, end of period, USD m

GROUP BUSINESS DRIVERS

Maersk Line

Transported volumes (FFE in '000)

Average freight rate (USD per FFE)

Unit cost (USD per FFE incl. VSA income)

Average bunker price (USD per tonne)

Maersk Line fleet, owned

Maersk Line fleet, chartered

Fleet capacity (TEU, '000)

Maersk Oil

Average share of oil and gas production

(thousand barrels of oil equivalent per day)

Average crude oil price (Brent) (USD per barrel)

APM Terminals

Containers handled (measured in million TEU

and weighted with ownership share)

Number of terminals

Maersk Drilling

Operational uptime

Contracted days

Revenue backlog (USD bn)

1 Figures for 2014 relate only to continuing operations.

02

2015

49

49

83

12,120

1,818

38,403

2,484

2,261

2,246

335

306

62

9.2

97%

1,671

02

2014

103

102

80

13,533

2,479

52,761

2,396

2,634

2,585

579

235

110

9.8

97%

1,456

The interim consolidated financial statements are prepared in accordance with IAS 34.

Discontinued operations comprise Dansk Supermarked Group.

2015

121

121

174

12,120

1,818

38,403

4,691

2,370

2,342

346

278

341

3,077

305

58

18.3

65

97%

3,471

5.3

6 months

2014

156

155

166

13,533

2,479

52,761

4,639

2,631

2,598

580

271

306

2,763

245

109

19.2

66

97%

2,896

7.0

Full year

2014

230

230

401

12,370

2,021

42,848

9,442

2,630

2,584

562

274

336

2,946

251

99

38.3

64

97%

6,275

6.0

8/42View entire presentation