TPG Results Presentation Deck

Fee-Related Earnings

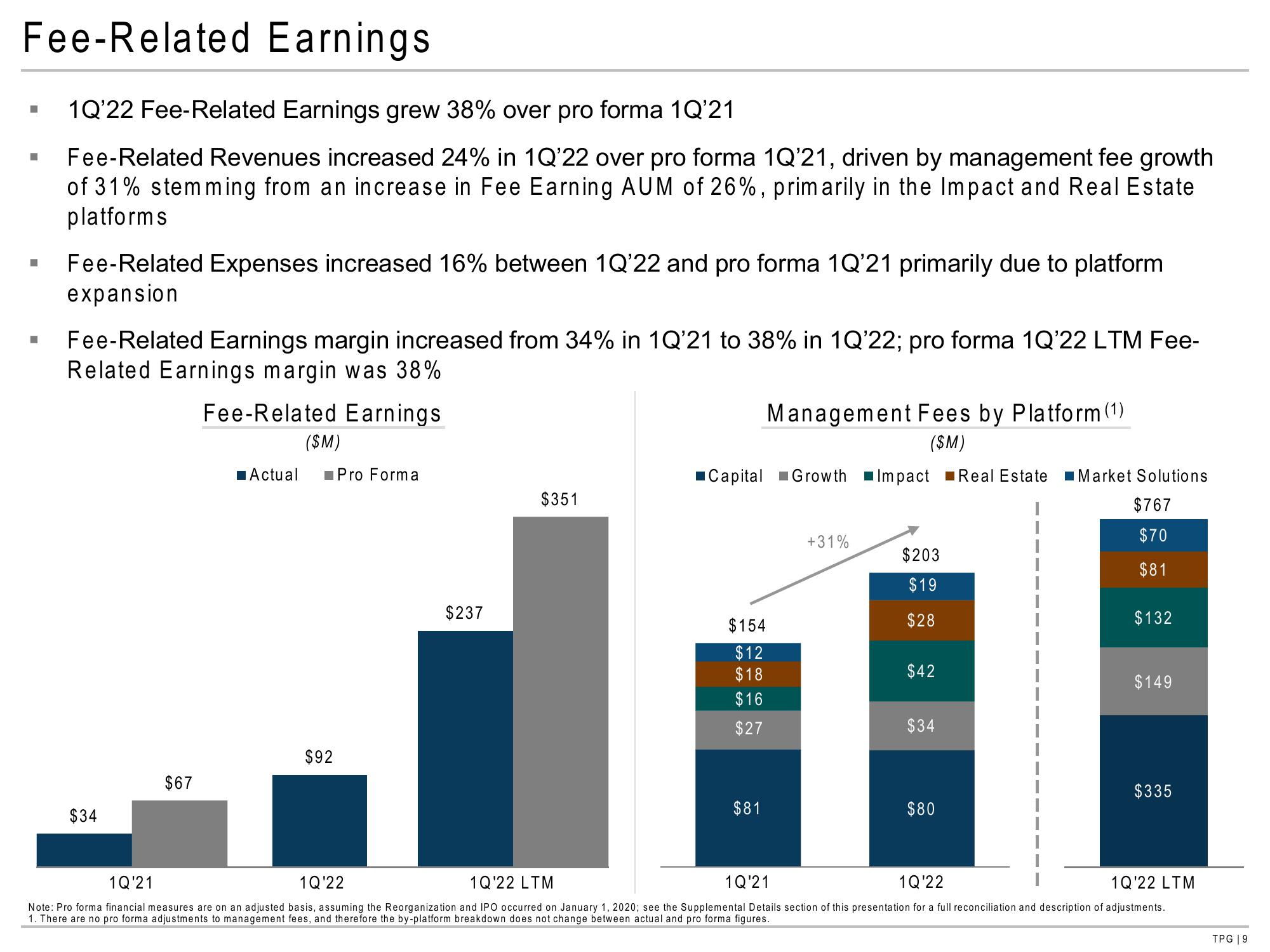

1Q'22 Fee-Related Earnings grew 38% over pro forma 1Q'21

Fee-Related Revenues increased 24% in 1Q'22 over pro forma 1Q'21, driven by management fee growth

of 31% stemming from an increase in Fee Earning AUM of 26%, primarily in the Impact and Real Estate

platforms

■

■

■

Fee-Related Expenses increased 16% between 1Q'22 and pro forma 1Q'21 primarily due to platform

expansion

Fee-Related Earnings margin increased from 34% in 1Q'21 to 38% in 1Q'22; pro forma 1Q'22 LTM Fee-

Related Earnings margin was 38%

Fee-Related Earnings.

$34

$67

■Actual

($M)

$92

Pro Forma

$237

$351

Management Fees by Platform (1)

($M)

Capital Growth Impact Real Estate ■Market Solutions

$767

$70

$81

$154

$12

$18

$16

$27

$81

+31%

$203

$19

$28

$42

$34

$80

$132

$149

$335

1Q'21

1Q'22

1Q'22 LTM

1Q'21

1Q'22

1Q'22 LTM

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO occurred on January 1, 2020; see the Supplemental Details section of this presentation for a full reconciliation and description of adjustments.

1. There are no pro forma adjustments to management fees, and therefore the by-platform breakdown does not change between actual and pro forma figures.

TPG | 9View entire presentation