SmileDirectClub Investor Presentation Deck

Summary of convertible debt terms.

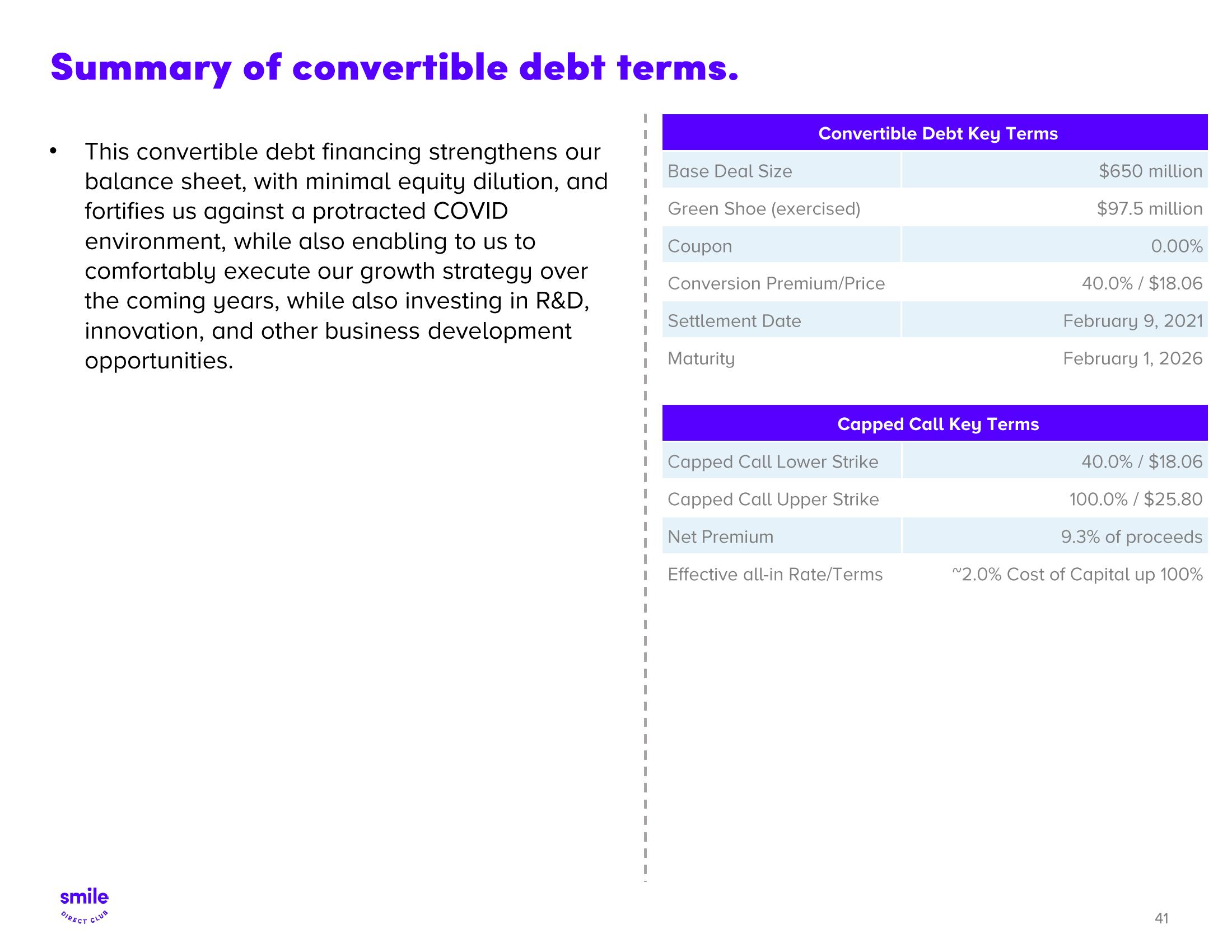

This convertible debt financing strengthens our

balance sheet, with minimal equity dilution, and

fortifies us against a protracted COVID

environment, while also enabling to us to

comfortably execute our growth strategy over

the coming years, while also investing in R&D,

innovation, and other business development

opportunities.

●

smile

DIRECT CLUB

Convertible Debt Key Terms

Base Deal Size

Green Shoe (exercised)

Coupon

Conversion Premium/Price

Settlement Date

Maturity

Net Premium

Capped Call Key Terms

Capped Call Lower Strike

Capped Call Upper Strike

Effective all-in Rate/Terms

$650 million

$97.5 million

0.00%

40.0% / $18.06

February 9, 2021

February 1, 2026

40.0% / $18.06

100.0% / $25.80

9.3% of proceeds

~2.0% Cost of Capital up 100%

41View entire presentation