Lyft Results Presentation Deck

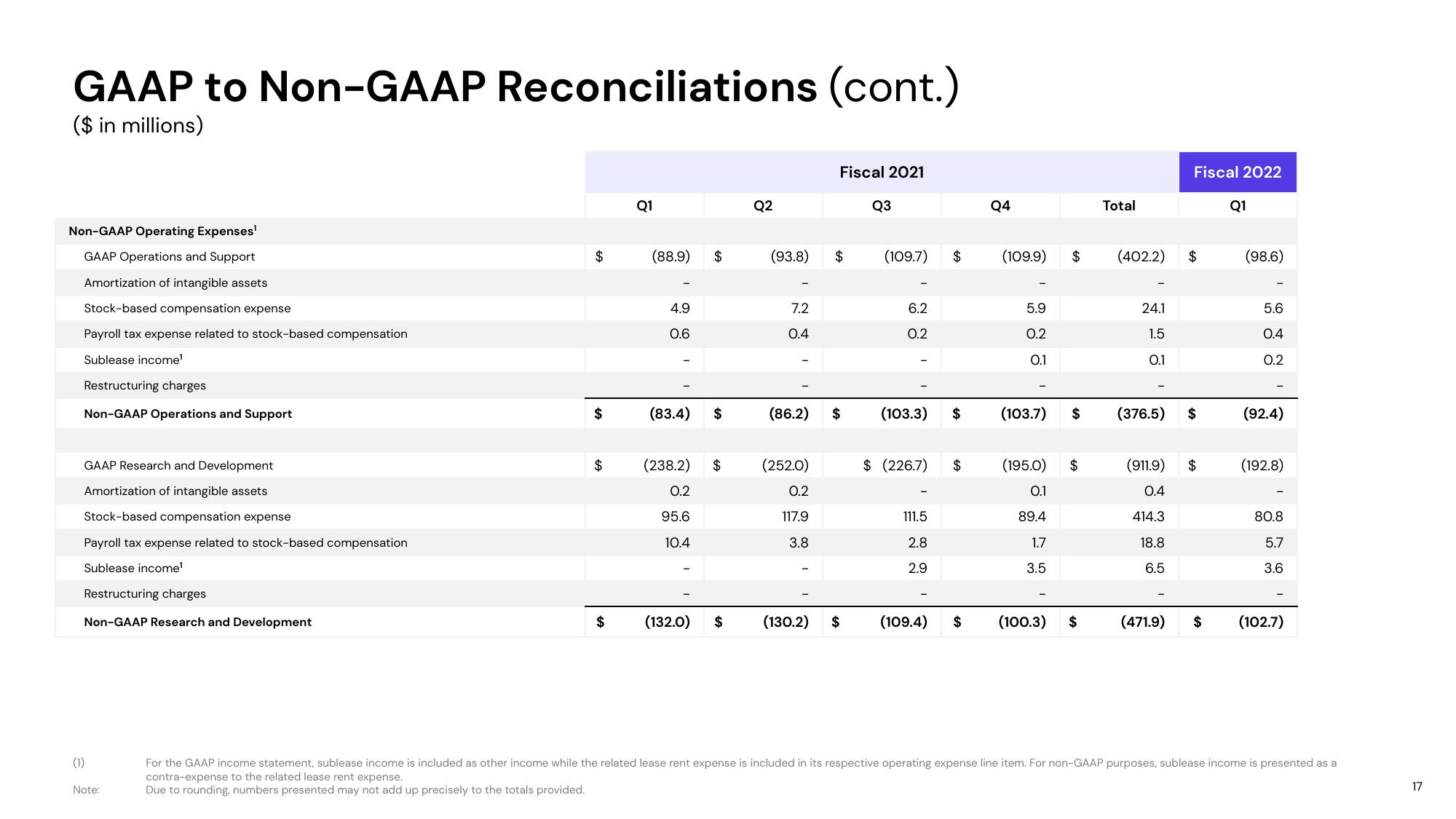

GAAP to Non-GAAP Reconciliations (cont.)

($ in millions)

Non-GAAP Operating Expenses¹

GAAP Operations and Support

Amortization of intangible assets

Stock-based compensation expense

(1)

Payroll tax expense related to stock-based compensation

Sublease income¹

Restructuring charges

Non-GAAP Operations and Support

GAAP Research and Development

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Sublease income¹

Restructuring charges

Non-GAAP Research and Development

Note:

$

$

$

Q1

(88.9)

4.9

0.6

(83.4)

$

$

(238.2) $

0.2

95.6

10.4

Q2

(93.8)

7.2

0.4

(86.2)

(252.0)

0.2

117.9

3.8

Fiscal 2021

$

(132.0) $ (130.2) $

Q3

(109.7) $ (109.9) $

6.2

0.2

(103.3)

$

$ (226.7) $

111.5

2.8

2.9

Q4

5.9

0.2

0.1

(103.7)

(195.0)

0.1

89.4

1.7

3.5

$

$

(109.4) $ (100.3) $

Total

(402.2)

24.1

1.5

0.1

(376.5)

Fiscal 2022

(471.9)

$

$

(911.9) $

0.4

414.3

18.8

6.5

$

Q1

(98.6)

5.6

0.4

0.2

(92.4)

(192.8)

80.8

5.7

3.6

(102.7)

For the GAAP income statement, sublease income is included as other income while the related lease rent expense is included in its respective operating expense line item. For non-GAAP purposes, sublease income is presented as a

contra-expense to the related lease rent expense.

Due to rounding, numbers presented may not add up precisely to the totals provided.

17View entire presentation