Evercore Investment Banking Pitch Book

Financial Analysis

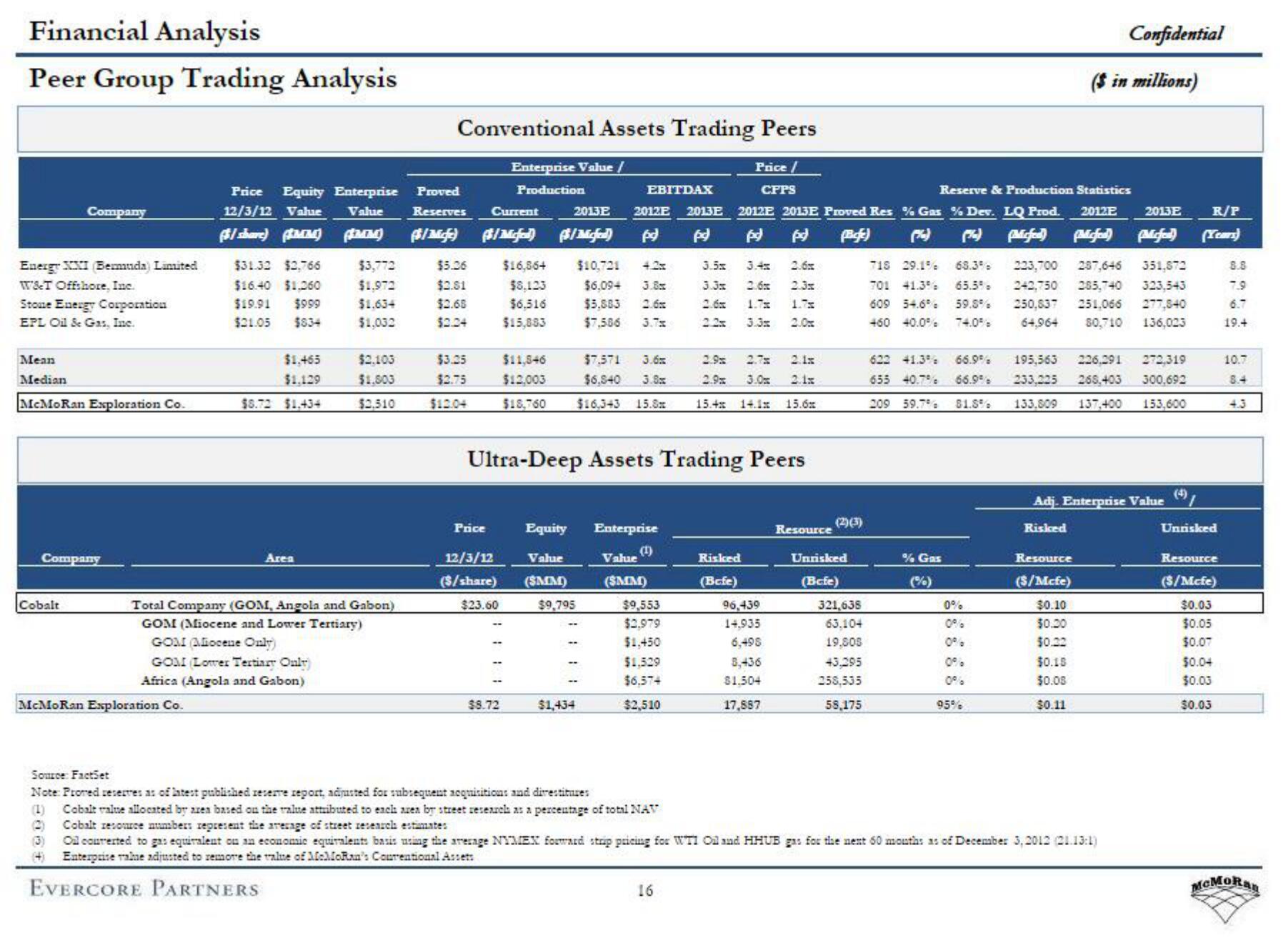

Peer Group Trading Analysis

Energy XXI (Bermuda) Limited

W&T Offshore, Inc.

Stone Energy Corporation

EPL Oil & Gas, Inc.

Company

Mean

Median

McMoRan Exploration Co.

Company

Cobalt

McMoRan Exploration Co.

(3)

(+)

Price Equity Enterprise

12/3/12 Value Value

($/share) (MM) (JMM)

$31.32 $2.766

$16.40 $1,260

$19.91 $999

$21.05 $834

$1.465

$1,129

$8.72 $1,434

Area

$3,772

$1,972

$1.634

$1,032

$2.103

$1.803

$2,510

Total Company (GOM, Angola and Gabon)

GOM (Miocene and Lower Tertiary)

GOM Aiocene Only)

GOM (Lower Tertiary Only

Africa (Angola and Gabon)

Conventional Assets Trading Peers

Enterprise Value /

Price /

CFPS

Production

Proved

Reserves

Current

2013E 2012E 2013E

($/Mcfc) $/Mefed) ($/Micfied) pd (pd)

$5.26

$2.51

$2.68

$2.24

$3.25

$2.75

$12.04

Price

$16,864

$8,123

$6.516

$15,883

$8.72

EBITDAX

Value

12/3/12

($/share) (SMM)

$23.60

$9,795

$10,721

$6,094

3.8x

$5.883 2.6x

$7,586

3.7%

Equity Enterprise

Value

(SMM)

$1,434

$11,546

$7.571 3.6

$12,003 $6,540 3.8x

$18,760 $16,343 15.8x

Ultra-Deep Assets Trading Peers

(1)

$9,553

$2.979

$1,450

$1.529

$6.574

$2,510

3.5x

3.3x

16

Reserve & Production Statistics

2012E 2013E Proved Res % Gas % Dev. LQ Prod. 2012E

pd pd (Beje)

3.4x 2.6x

2.6x 2.3x

Risked

(Befe)

2.9

2.9

2.1x

2.1x

15.4 14.1x 15.6x

2.0x

3.0

96,439

14,935

6,498

8,436

$1.504

17,887

Resource

(2)(3)

Unrisked

(Befe)

321,638

63.104

19,808

43.295

258,535

58,175

718 29.1%

701 41.3%

609 54.6%

460 40.0%

622 41.3% 66.9%

655 40.7% 66.9%

209 59.7%

81.8%

% Gas

2013E R/P

(Micfed) Mefed) (Years)

63.3% 223,700 287,646 351,872

65.5% 242,750 285,740 323,543

59.8% 250,837 251,066 277,840

74.0% 64.964 80,710 136,023

0%

0%

Confidential

($ in millions)

95%

195,563 226,291 272,319

233,225 268,403 300,692

133,809 137,400 153,600

Adj. Enterprise Value

Risked

Resource

($/Mcfe)

$0.10

$0.00

$0.22

$0.15

$0.08

$0.11

Source: FactSet

Note: Prored reserves as of latest published reserve report, adjusted for subsequent acquisitions and direstitures

(1) Cobalt value allocated by area based on the value attributed to each area by street research as a percentage of total NAV

Cobalt resource numbers represent the average of street research estimates

Oil converted to gas equivalent on an economic equivalents basis using the average NYMEX forward strip pricing for WTI Oil and HHUB gas for the next 60 months as of December 3, 2012 (21.13:1)

Enterprise rakue adjusted to remove the value of MeloRan's Courentional Assets

EVERCORE PARTNERS

(4)

Unrisked

Resource

($/Mcfe)

$0.03

$0.05

$0.07

$0.04

$0.03

$0.03

8.8

7.9

6.7

19.4

10.7

8.4

4.3

MCMoRayView entire presentation