MP Materials SPAC Presentation Deck

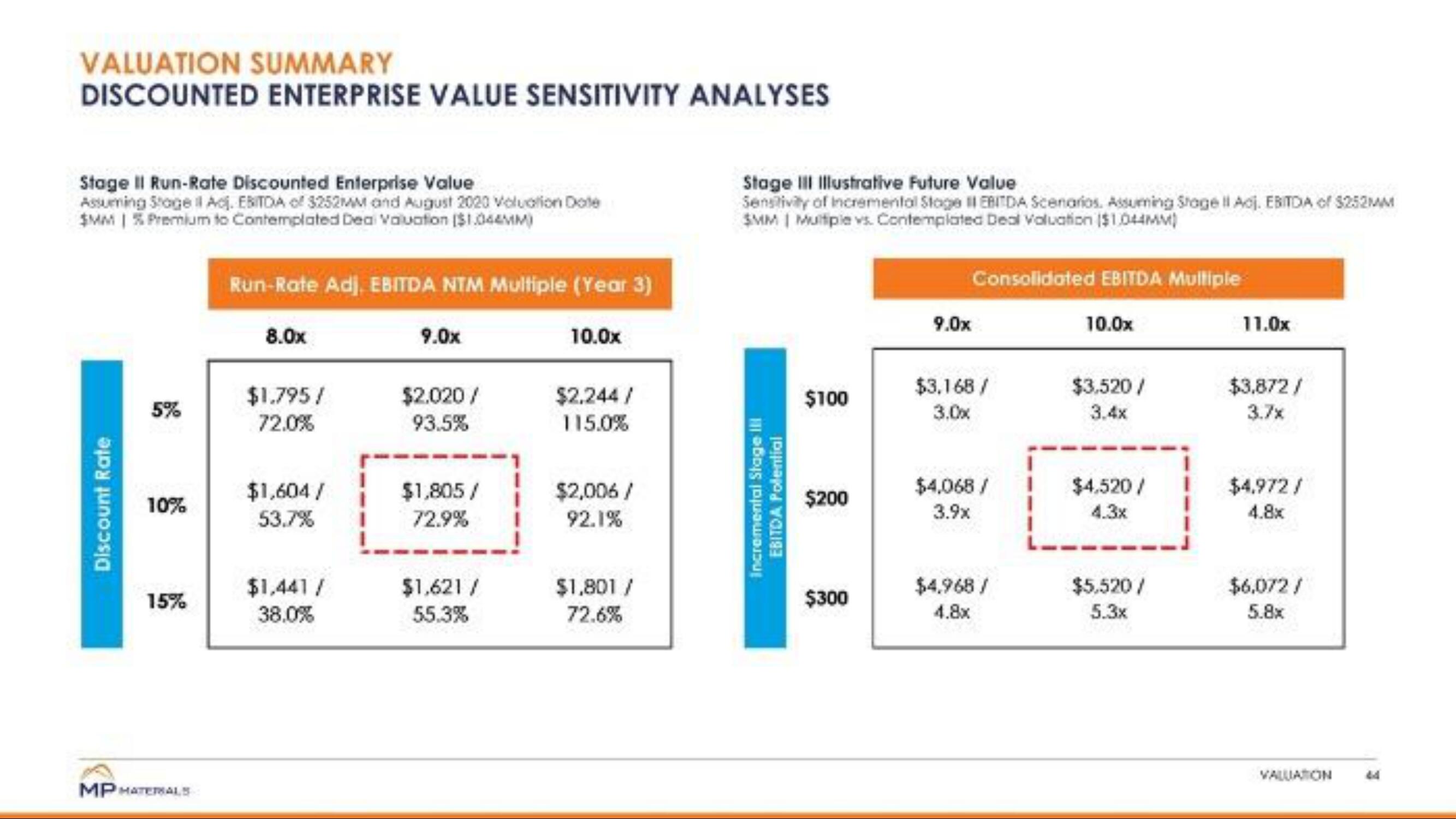

VALUATION SUMMARY

DISCOUNTED ENTERPRISE VALUE SENSITIVITY ANALYSES

Stage II Run-Rate Discounted Enterprise Value

Assuming Stage Adi. EBITDA of 3252MM and August 2020 Voluation Date

$MM | % Premium to Contemplated Deal Valuation ($1.044MM)

Discount Rate

5%

10%

15%

MP MATERIALS

Run-Rate Adj, EBITDA NTM Multiple (Year 3)

8.0x

$1.795/

72.0%

$1,604/

53.7%

$1,441/

38.0%

9.0x

$2.020/

93.5%

$1,805/

72.9%

$1,621/

55.3%

10.0x

$2,244/

115.0%

$2,006/

92.1%

$1,801/

72.6%

Stage III Illustrative Future Value

Sensitivity of Incremental Stage II EBITDA Scenarios. Assuming Slagell Aoj. EBITDA of $252MM

$MM | Multiple vs. Contemplated Deal Valuation ($1.044MM)

Incremental Stage III

EBITDA Polential

$100

$200

$300

9.0x

Consolidated EBITDA Multiple

$3,168/

3.0x

$4,068/

3.9x

$4,968/

4.8x

10.0x

$3,520/

3.4x

$4,520/

4.3x

$5,520/

5.3x

11.0x

$3,872/

3.7x

$4,972/

4.8x

$6,072/

5.8x

VALUATIONView entire presentation