J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

CORPORATE & INVESTMENT BANK

FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except where otherwise noted)

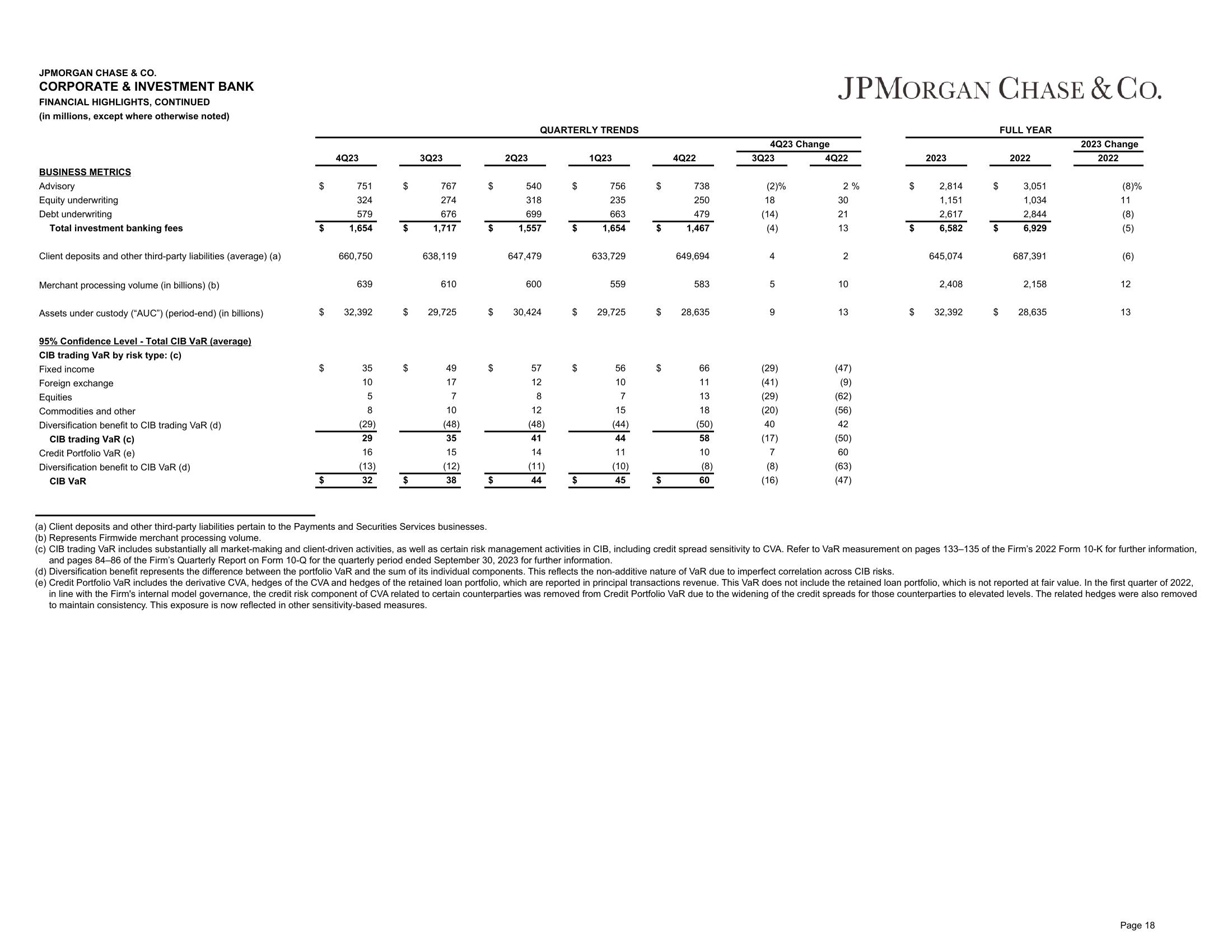

BUSINESS METRICS

Advisory

Equity underwriting

Debt underwriting

Total investment banking fees

Client deposits and other third-party liabilities (average) (a)

Merchant processing volume (in billions) (b)

Assets under custody ("AUC") (period-end) (in billions)

95% Confidence Level - Total CIB VaR (average)

CIB trading VaR by risk type: (c)

Fixed income

Foreign exchange

Equities

Commodities and other

Diversification benefit to CIB trading VaR (d)

CIB trading VaR (c)

Credit Portfolio VaR (e)

Diversification benefit to CIB VaR (d)

CIB VaR

$

$

$

$

$

4Q23

751

324

579

1,654

660,750

639

32,392

35

10

5

8

(29)

29

16

(13)

32

$

$

3Q23

$

767

274

676

1,717

638,119

610

$ 29,725

49

17

7

10

(48)

35

15

(12)

38

$

$

$

2Q23

$

QUARTERLY TRENDS

540

318

699

1,557

647,479

$ 30,424

600

57

12

8

12

(48)

41

14

(11)

44

$

$

1Q23

$

756

235

663

1,654

633,729

$ 29,725

559

56

10

7

15

(44)

44

11

(10)

45

$

$

$

4Q22

738

250

479

1,467

649,694

583

28,635

66

11

13

18

(50)

58

10

(8)

60

4Q23 Change

3Q23

(2)%

18

(14)

(4)

4

5

9

(29)

(41)

(29)

(20)

40

(17)

7

(8)

(16)

JPMORGAN CHASE & Co.

4Q22

2%

30

21

13

2

10

13

(47)

(9)

(62)

(56)

42

(50)

60

(63)

(47)

$

$

$

2023

2,814

1,151

2,617

6,582

645,074

2,408

32,392

$

$

$

FULL YEAR

2022

3,051

1,034

2,844

6,929

687,391

2,158

28,635

2023 Change

2022

(8)%

11

(8)

(5)

(6)

12

13

(a) Client deposits and other third-party liabilities pertain to the Payments and Securities Services businesses.

(b) Represents Firmwide merchant processing volume.

(c) CIB trading VaR includes substantially all market-making and client-driven activities, as well as certain risk management activities in CIB, including credit spread sensitivity to CVA. Refer to VaR measurement on pages 133-135 of the Firm's 2022 Form 10-K for further information,

and pages 84-86 of the Firm's Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023 for further information.

(d) Diversification benefit represents the difference between the portfolio VaR and the sum of its individual components. This reflects the non-additive nature of VaR due to imperfect correlation across CIB risks.

(e) Credit Portfolio VaR includes the derivative CVA, hedges of the CVA and hedges of the retained loan portfolio, which are reported in principal transactions revenue. This VaR does not include the retained loan portfolio, which is not reported at fair value. In the first quarter of 2022,

in line with the Firm's internal model governance, the credit risk component of CVA related to certain counterparties was removed from Credit Portfolio VaR due to the widening of the credit spreads for those counterparties to elevated levels. The related hedges were also removed

to maintain consistency. This exposure is now reflected in other sensitivity-based measures.

Page 18View entire presentation