LanzaTech SPAC Presentation Deck

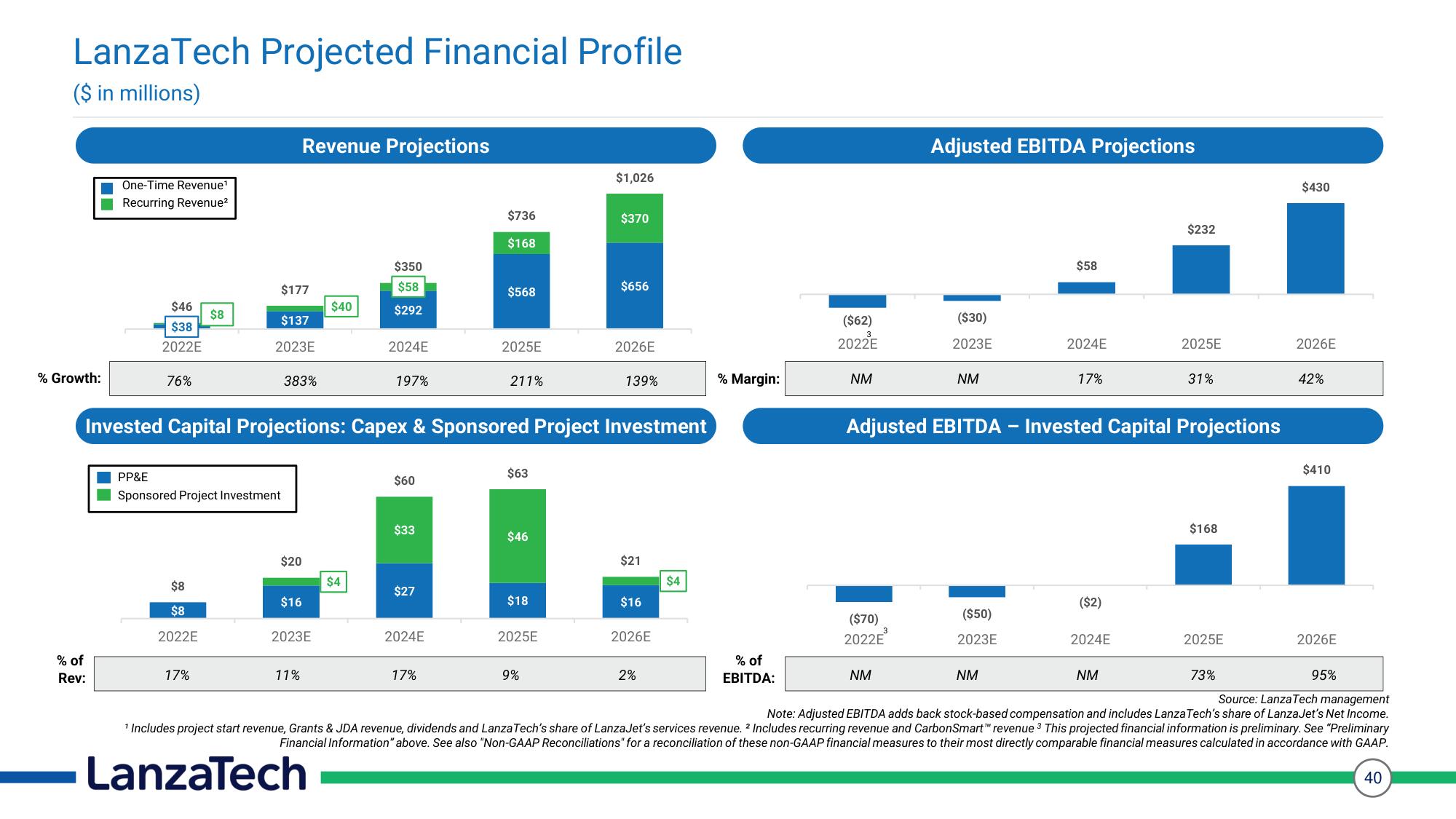

LanzaTech Projected Financial Profile

($ in millions)

% Growth:

One-Time Revenue¹

Recurring Revenue²

% of

Rev:

$46

$38

2022E

76%

$8

$8

$8

2022E

PP&E

Sponsored Project Investment

17%

$177

$137

2023E

Revenue Projections

383%

$20

$16

2023E

11%

$40

$350

$58

$292

$4

2024E

197%

Invested Capital Projections: Capex & Sponsored Project Investment

$60

$33

$27

2024E

$736

$168

17%

$568

2025E

211%

$63

$46

$18

2025E

$1,026

9%

$370

$656

2026E

139%

$21

$16

2026E

2%

$4

% Margin:

% of

EBITDA:

($62)

2022E

NM

($70)

2022E

Adjusted EBITDA Projections

NM

($30)

2023E

Adjusted EBITDA

NM

($50)

2023E

NM

-

$58

2024E

17%

($2)

2024E

$232

Invested Capital Projections

NM

2025E

31%

$168

2025E

73%

$430

2026E

42%

$410

2026E

95%

Source: LanzaTech management

Note: Adjusted EBITDA adds back stock-based compensation and includes Lanza Tech's share of LanzaJet's Net Income.

¹ Includes project start revenue, Grants & JDA revenue, dividends and Lanza Tech's share of LanzaJet's services revenue. 2 Includes recurring revenue and CarbonSmart™ revenue 3 This projected financial information is preliminary. See "Preliminary

Financial Information" above. See also "Non-GAAP Reconciliations" for a reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated in accordance with GAAP.

40

LanzaTechView entire presentation