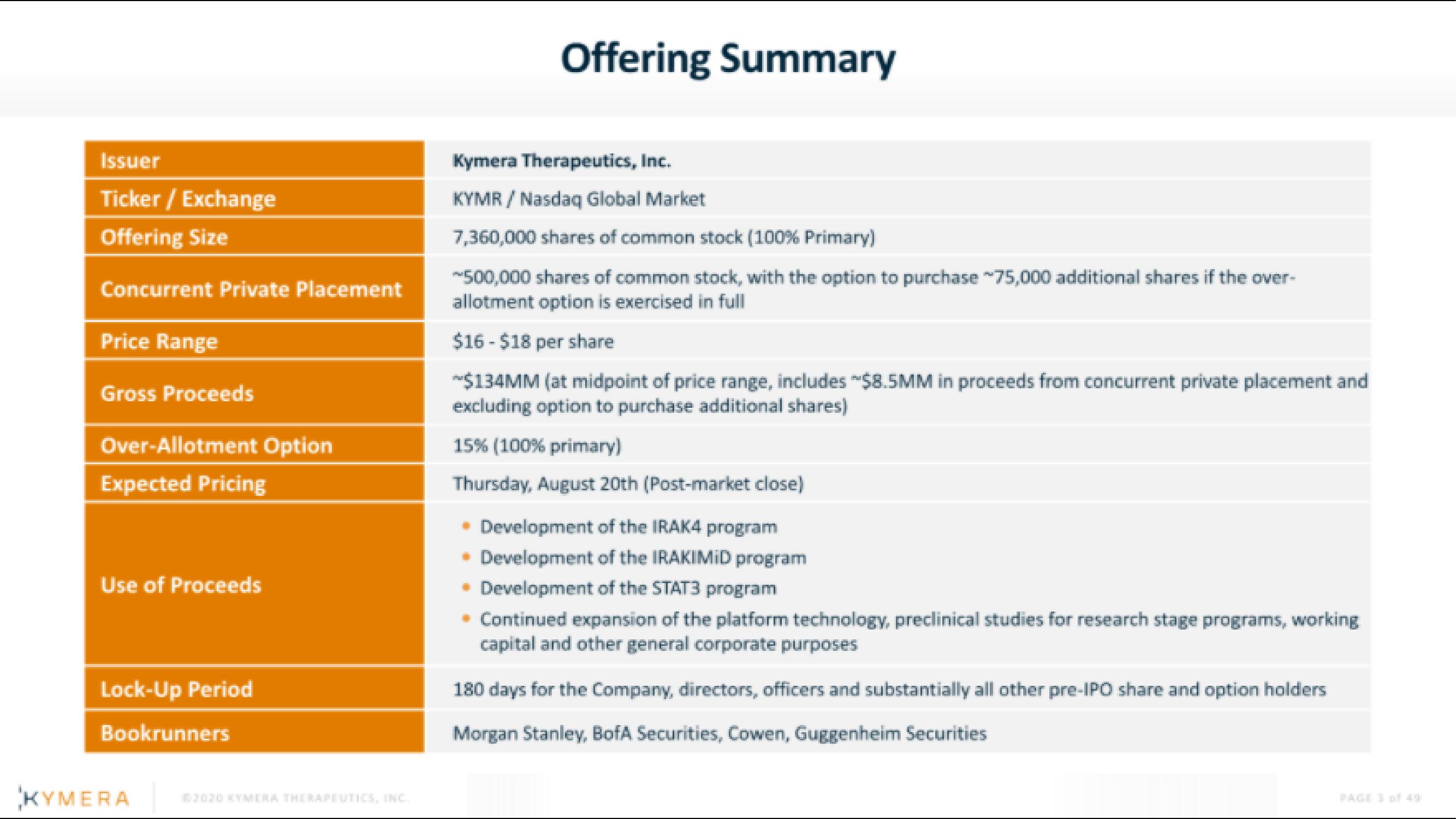

Kymera IPO Presentation Deck

Issuer

Ticker / Exchange

Offering Size

Concurrent Private Placement

Price Range

Gross Proceeds

Over-Allotment Option

Expected Pricing

Use of Proceeds

Lock-Up Period

Bookrunners

KYMERA

Offering Summary

Kymera Therapeutics, Inc.

KYMR/ Nasdaq Global Market

7,360,000 shares of common stock (100% Primary)

**500,000 shares of common stock, with the option to purchase ~75,000 additional shares if the over-

allotment option is exercised in full

$16 - $18 per share

~$134MM (at midpoint of price range, includes $8.5MM in proceeds from concurrent private placement and

excluding option to purchase additional shares)

15% (100% primary)

Thursday, August 20th (Post-market close)

* Development of the IRAK4 program

Development of the IRAKIMID program

• Development of the STAT3 program

. Continued expansion of the platform technology, preclinical studies for research stage programs, working

capital and other general corporate purposes

180 days for the Company, directors, officers and substantially all other pre-IPO share and option holders

Morgan Stanley, BofA Securities, Cowen, Guggenheim SecuritiesView entire presentation