The Urgent Need for Change and The Superior Path Forward

EVEN THOUGH HE'S UNQUALIFIED AND HAS FAILED

TO CREATE VALUE, THE BOARD STILL REWARDS

HIM

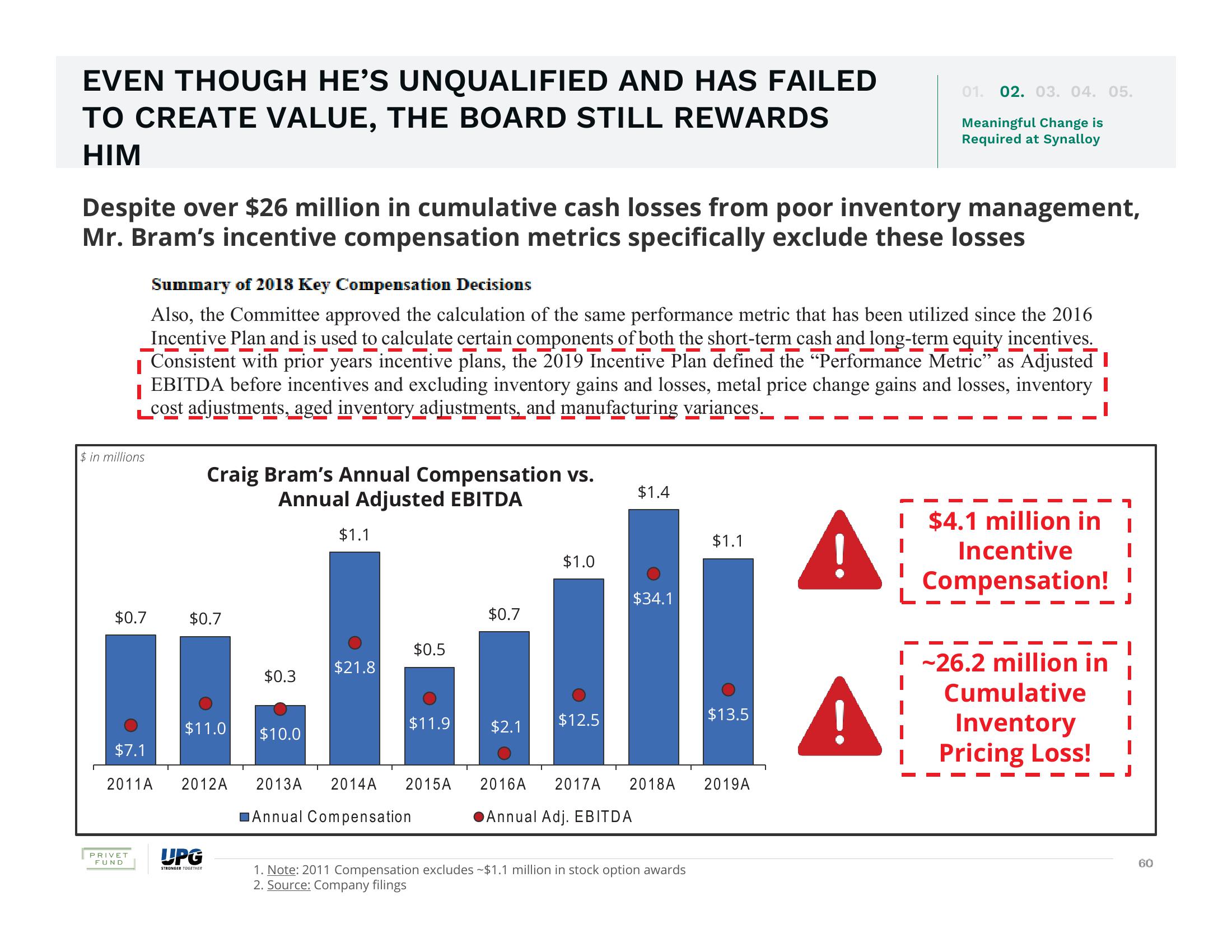

Despite over $26 million in cumulative cash losses from poor inventory management,

Mr. Bram's incentive compensation metrics specifically exclude these losses

$ in millions

Summary of 2018 Key Compensation Decisions

Also, the Committee approved the calculation of the same performance metric that has been utilized since the 2016

Incentive Plan and is used to calculate certain components of both the short-term cash and long-term equity incentives.

Consistent with prior years incentive plans, the 2019 Incentive Plan defined the "Performance Metric" as Adjusted I

I

EBITDA before incentives and excluding inventory gains and losses, metal price change gains and losses, inventory I

cost adjustments, aged inventory adjustments, and manufacturing variances.

$0.7

$1.1

$0.7

mbal

$0.5

$21.8

$0.3

$11.9

$2.1

$7.1

2011 A

PRIVET

FUND

Craig Bram's Annual Compensation vs.

Annual Adjusted EBITDA

$0.7

$11.0

2012A

UPG

STRONGER TOGETHER

$10.0

2013A 2014A 2015A

Annual Compensation

$1.0

$1.4

$12.5

$34.1

$1.1

1. Note: 2011 Compensation excludes $1.1 million in stock option awards

Source: Company filings

$13.5

2016A 2017A 2018A 2019A

Annual Adj. EBITDA

01. 02. 03. 04. 05.

Meaningful Change is

Required at Synalloy

!

I $4.1 million in

Incentive

Compensation!

-26.2 million in

Cumulative

Inventory

Pricing Loss!

60View entire presentation