First Quarter 2017 Financial Review

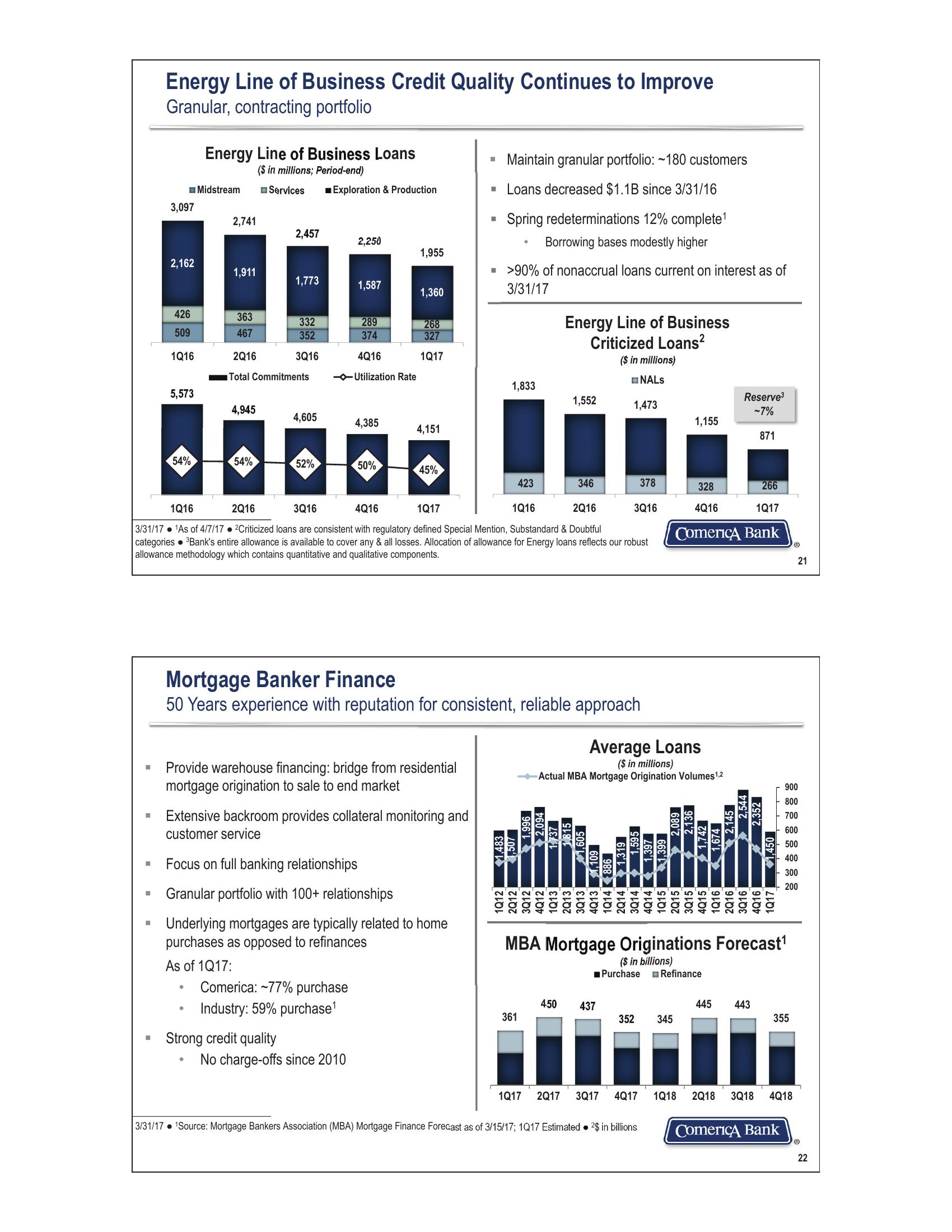

Energy Line of Business Credit Quality Continues to Improve

Granular, contracting portfolio

Energy Line of Business Loans

Midstream

3,097

($ in millions; Period-end)

Services

■ Maintain granular portfolio: ~180 customers

■Exploration & Production

2,741

2,457

2,250

1,955

2,162

1,911

1,773

1,587

1,360

426

363

332

289

268

509

467

352

374

327

1Q16

2Q16

3Q16

4Q16

1Q17

■Loans decreased $1.1B since 3/31/16

☐

Spring redeterminations 12% complete¹

Borrowing bases modestly higher

■>90% of nonaccrual loans current on interest as of

3/31/17

Energy Line of Business

Criticized Loans²

($ in millions)

Total Commitments

-Utilization Rate

NALS

1,833

5,573

1,552

Reserve³

1,473

4,945

-7%

4,605

4,385

1,155

4,151

871

00000

54%

54%

52%

50%

45%

423

346

378

328

266

1Q16

2Q16

3Q16

4Q16

1Q17

1Q16

2Q16

3Q16

4Q16

1Q17

3/31/17 1As of 4/7/17 2Criticized loans are consistent with regulatory defined Special Mention, Substandard & Doubtful

categories Bank's entire allowance is available to cover any & all losses. Allocation of allowance for Energy loans reflects our robust

allowance methodology which contains quantitative and qualitative components.

Comerica Bank

21

Mortgage Banker Finance

50 Years experience with reputation for consistent, reliable approach

Average Loans

($ in millions)

Actual MBA Mortgage Origination Volumes 1,2

Provide warehouse financing: bridge from residential

mortgage origination to sale to end market

Extensive backroom provides collateral monitoring and

customer service

Focus on full banking relationships

Granular portfolio with 100+ relationships

Underlying mortgages are typically related to home

purchases as opposed to refinances

As of 1Q17:

Comerica: ~77% purchase

Industry: 59% purchase¹

Strong credit quality

•

No charge-offs since 2010

1Q12

1,483

2Q12

,507

3Q12

1,996

4Q12

2,094

1Q13

1,737

2Q13

3Q13

815

1,605

4Q13 1,109

1Q14 886

2Q14

1,319

3Q14 1,595

4Q14

1,397

1Q15

1,399

2Q15

2,089

3Q15

2,136

4Q15

1,742

1Q16

1,674

2Q16

2,145

3Q16

2,544

4Q16

2,352

1Q17

1,450

MBA Mortgage Originations Forecast¹

($ in billions)

■Purchase

Refinance

450

437

445

443

361

352

345

355

1917

2Q17 3Q17 4Q17

1Q18 2Q18 3Q18 4Q18

3/31/17 1Source: Mortgage Bankers Association (MBA) Mortgage Finance Forecast as of 3/15/17; 1Q17 Estimated 2$ in billions

Comerica Bank

Ⓡ

22

900

800

700

600

500

400

300

200View entire presentation