Experienced Senior Team Overview

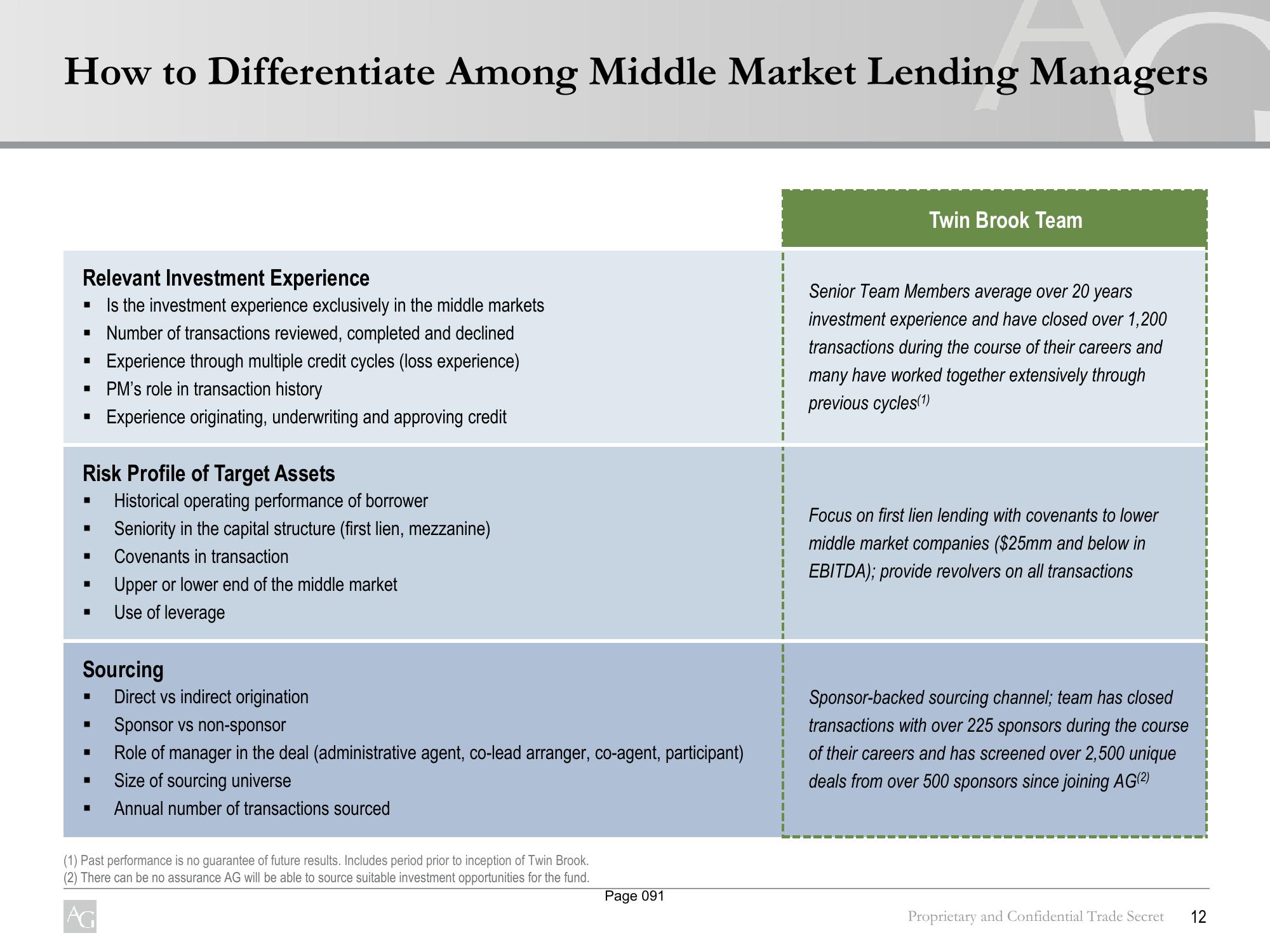

How to Differentiate Among Middle Market Lending Managers

Relevant Investment Experience

Is the investment experience exclusively in the middle markets

▪ Number of transactions reviewed, completed and declined

Experience through multiple credit cycles (loss experience)

▪ PM's role in transaction history

Experience originating, underwriting and approving credit

■

I

Risk Profile of Target Assets

Historical operating performance of borrower

Seniority in the capital structure (first lien, mezzanine)

Covenants in transaction

■

■

Sourcing

I

Upper or lower end of the middle market

Use of leverage

■

Direct vs indirect origination

Sponsor vs non-sponsor

Role of manager in the deal (administrative agent, co-lead arranger, co-agent, participant)

Size of sourcing universe

Annual number of transactions sourced

(1) Past performance is no guarantee of future results. Includes period prior to inception of Twin Brook.

(2) There can be no assurance AG will be able to source suitable investment opportunities for the fund.

AG

Page 091

Twin Brook Team

Senior Team Members average over 20 years

investment experience and have closed over 1,200

transactions during the course of their careers and

many have worked together extensively through

previous cycles(1)

Focus on first lien lending with covenants to lower

middle market companies ($25mm and below in

EBITDA); provide revolvers on all transactions

Sponsor-backed sourcing channel; team has closed

transactions with over 225 sponsors during the course

of their careers and has screened over 2,500 unique

deals from over 500 sponsors since joining AG (²)

Proprietary and Confidential Trade Secret

12View entire presentation