J.P.Morgan Shareholder Engagement Presentation Deck

Executive Summary

We listened to

shareholder

feedback:

For additional information and footnotes, please see slide 15

A

B

C

D

E

JPMORGAN CHASE & CO.

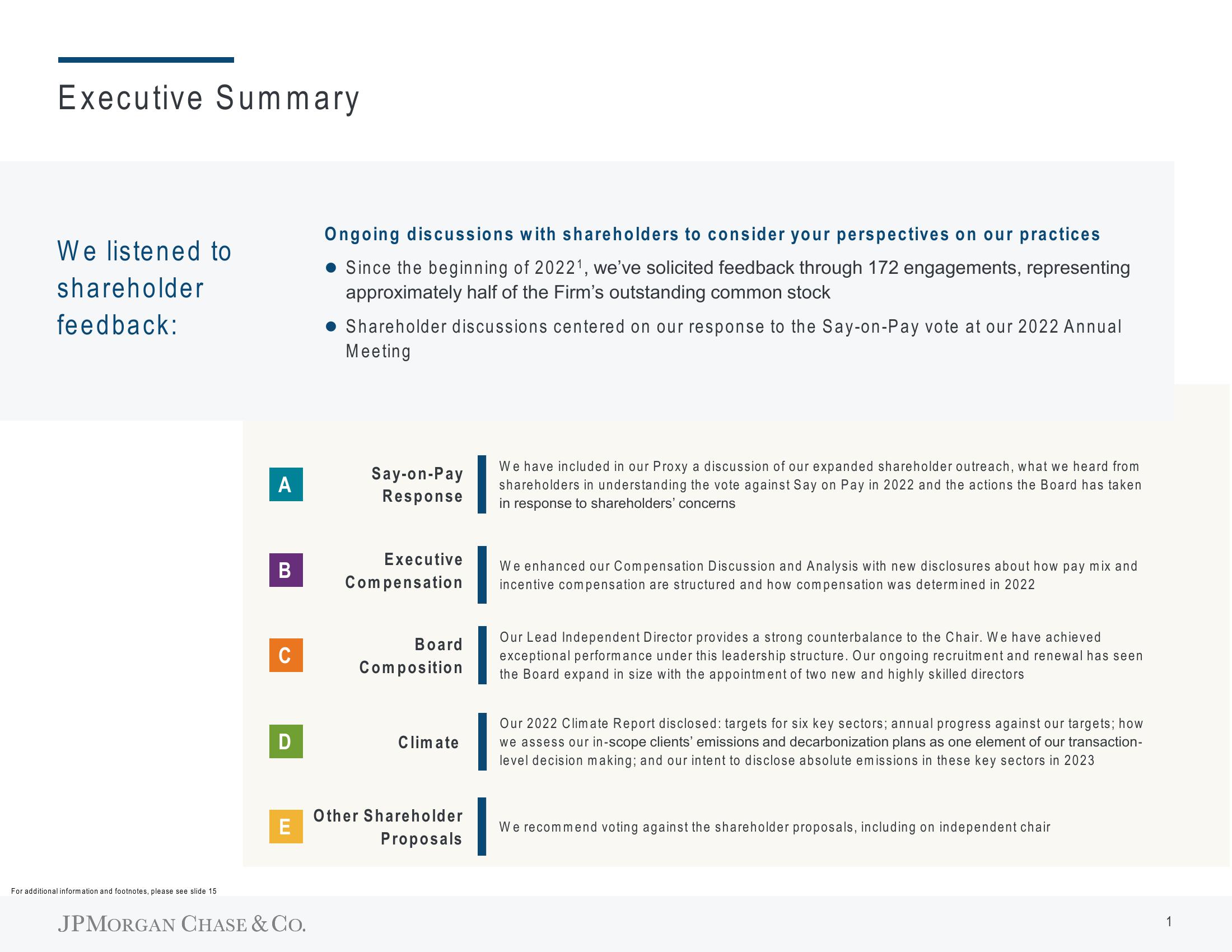

Ongoing discussions with shareholders to consider your perspectives on our practices

Since the beginning of 2022¹, we've solicited feedback through 172 engagements, representing

approximately half of the Firm's outstanding common stock

Shareholder discussions centered on our response to the Say-on-Pay vote at our 2022 Annual

Meeting

Say-on-Pay

Response

Executive

Compensation

Board

Composition

Climate

Other Shareholder

Proposals

We have included in our Proxy a discussion of our expanded shareholder outreach, what we heard from

shareholders in understanding the vote against Say on Pay in 2022 and the actions the Board has taken

in response to shareholders' concerns

We enhanced our Compensation Discussion and Analysis with new disclosures about how pay mix and

incentive compensation are structured and how compensation was determined in 2022

Our Lead Independent Director provides a strong counterbalance to the Chair. We have achieved

exceptional performance under this leadership structure. Our ongoing recruitment and renewal has seen

the Board expand in size with the appointment of two new and highly skilled directors

Our 2022 Climate Report disclosed: targets for six key sectors; annual progress against our targets; how

we assess our in-scope clients' emissions and decarbonization plans as one element of our transaction-

level decision making; and our intent to disclose absolute emissions in these key sectors in 2023

We recommend voting against the shareholder proposals, including on independent chair

1View entire presentation