Dragonfly Energy SPAC Presentation Deck

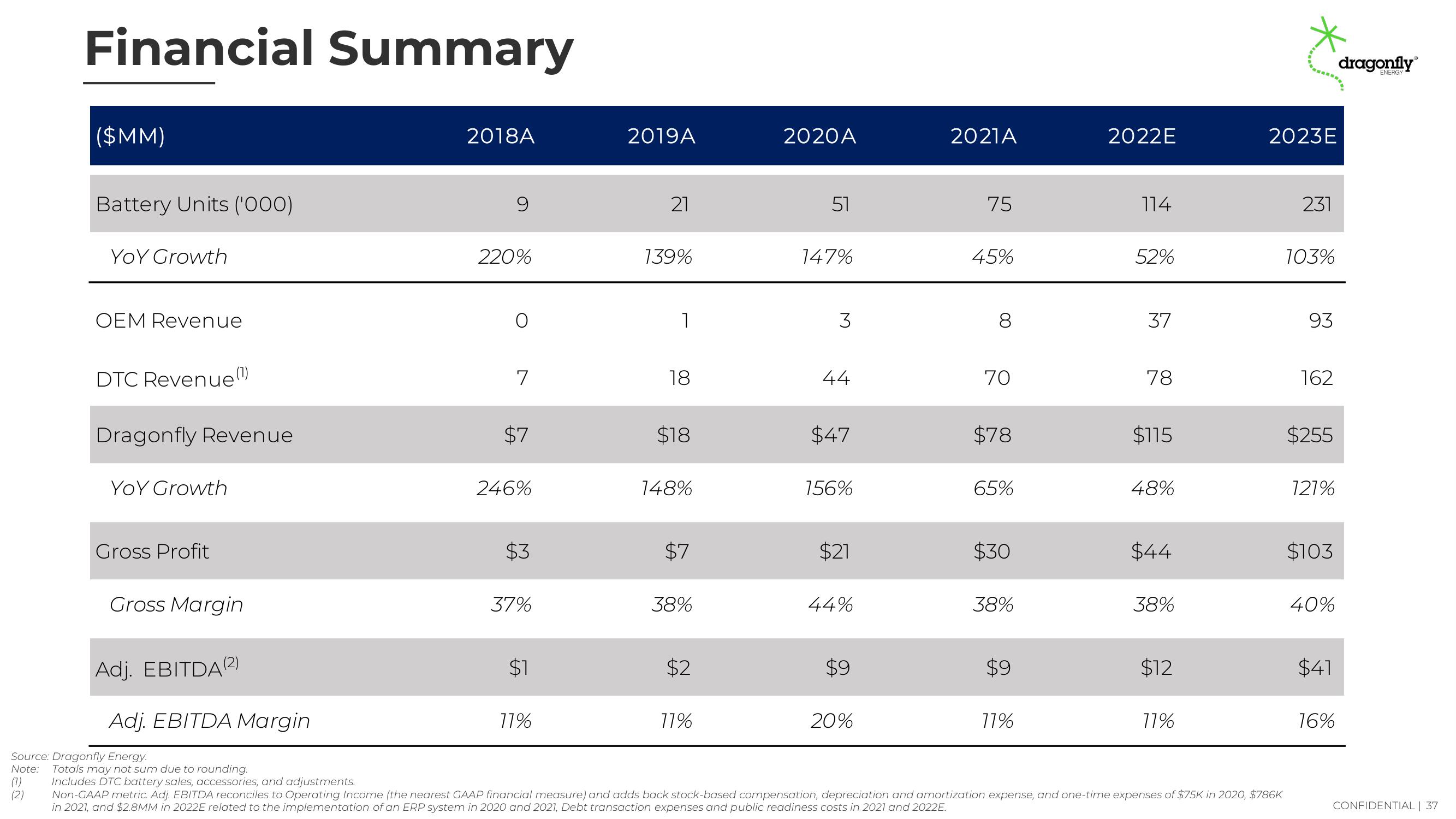

Financial Summary

(7)

(2)

($MM)

Battery Units ('000)

YOY Growth

OEM Revenue

DTC Revenue (¹)

Dragonfly Revenue

YOY Growth

Gross Profit

Gross Margin

Adj. EBITDA (2)

Adj. EBITDA Margin

2018A

9

220%

O

7

$7

246%

$3

37%

$1

77%

2019A

21

139%

1

18

$18

148%

$7

38%

$2

77%

2020A

51

147%

3

44

$47

156%

$21

44%

$9

20%

2021A

75

45%

8

70

$78

65%

$30

38%

$9

17%

2022E

114

52%

37

78

$115

48%

$44

38%

$12

11%

2023E

Source: Dragonfly Energy.

Note: Totals may not sum due to rounding.

Includes DTC battery sales, accessories, and adjustments.

Non-GAAP metric. Adj. EBITDA reconciles to Operating Income (the nearest GAAP financial measure) and adds back stock-based compensation, depreciation and amortization expense, and one-time expenses of $75K in 2020, $786K

in 2021, and $2.8MM in 2022E related to the implementation of an ERP system in 2020 and 2021, Debt transaction expenses and public readiness costs in 2021 and 2022E.

231

103%

93

162

$255

121%

$103

40%

$41

16%

dragonfly

CONFIDENTIAL | 37View entire presentation