ironSource Results Presentation Deck

Q2 22 INVESTOR PRESENTATION

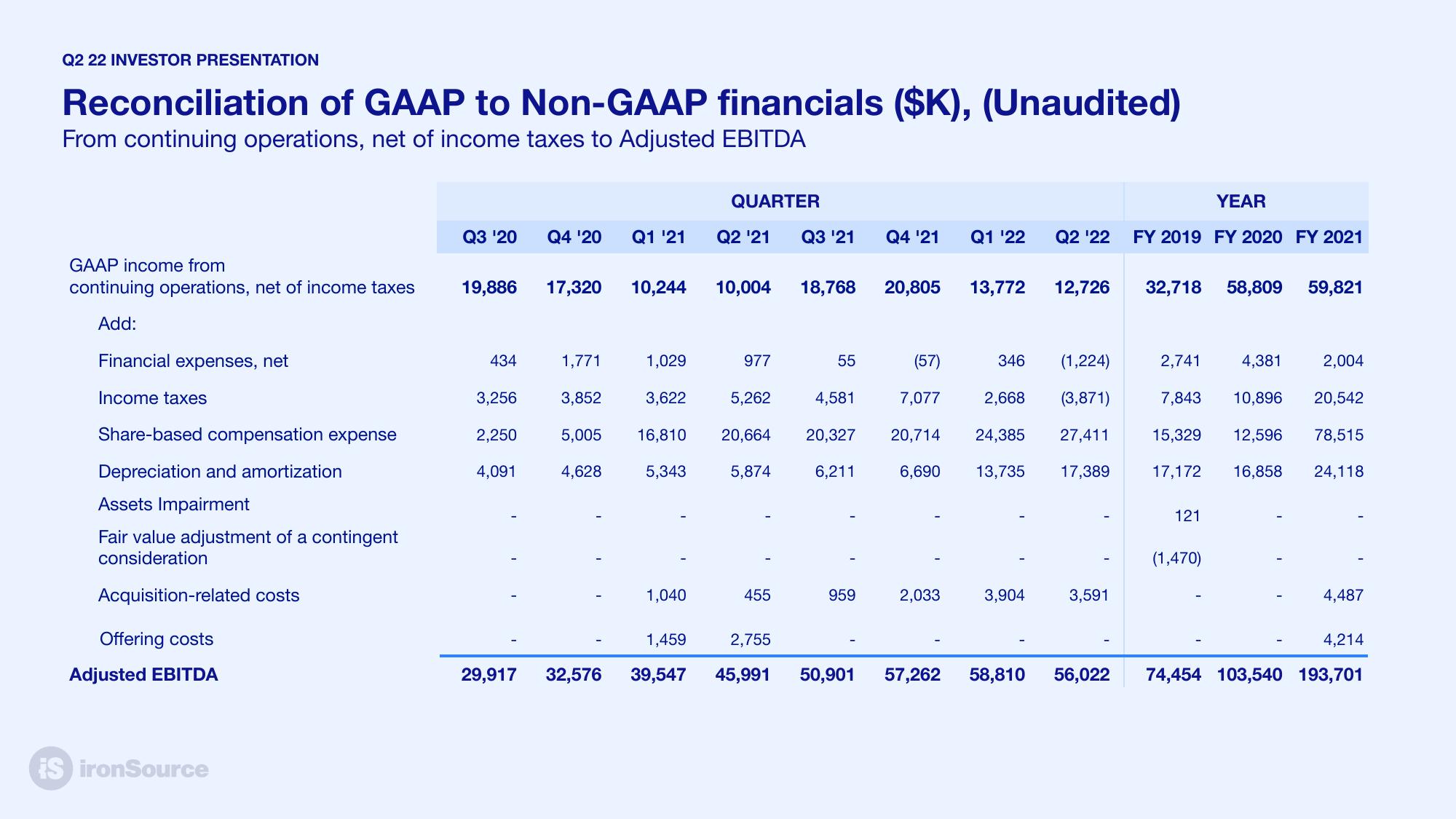

Reconciliation of GAAP to Non-GAAP financials ($K), (Unaudited)

From continuing operations, net of income taxes to Adjusted EBITDA

GAAP income from

continuing operations, net of income taxes

Add:

Financial expenses, net

Income taxes

Share-based compensation expense

Depreciation and amortization

Assets Impairment

Fair value adjustment of a contingent

consideration

Acquisition-related costs

Offering costs

Adjusted EBITDA

ES ironSource

Q3 '20 Q4 '20 Q1 '21

19,886

434

3,256

2,250

4,091

17,320 10,244

1,771

3,852

5,005

4,628

1,029

3,622

16,810

5,343

1,040

QUARTER

Q2 '21

10,004 18,768

977

Q3 '21 Q4 '21 Q1 ¹22

5,262

455

55

(57)

4,581

7,077

20,664 20,327 20,714 24,385

5,874

6,211

6,690 13,735

959

1,459

2,755

29,917 32,576 39,547 45,991 50,901

20,805 13,772 12,726

2,033

346

57,262

2,668

Q2 ¹22

3,904

(1,224)

(3,871)

27,411

17,389

3,591

YEAR

FY 2019 FY 2020 FY 2021

32,718 58,809

2,741

121

4,381

(1,470)

59,821

7,843 10,896 20,542

15,329 12,596 78,515

17,172 16,858 24,118

2,004

4,487

4,214

58,810 56,022 74,454 103,540 193,701View entire presentation